[ad_1]

On-line scams are on an increase in India for the final 5-6 yrs because the UPI and on-line transactions have elevated over time.

Not too long ago a man I do know instructed me that he unintentionally misplaced Rs 56,000 in on-line fraud. He wished to go on a tour and when he searched on-line, he got here throughout a web site that had a tour operator quantity the place he known as and enquired. The whole lot seemed real and after some primary checks, he did a UPI switch of the entire quantity of Rs 56k.

The web site hyperlink the place he obtained the quantity was https://www.bharatibiz.com/en/gurdwara-sri-hemkunt-sahib-093392-58256 and the cellphone quantity was 9339258256

It was an enormous mistake

As quickly as he transferred, he quickly realized that he was taken for a experience and realized his mistake. Generally, this man may be very cautious and doesn’t belief these sorts of on-line contacts, however on this case, there was some aspect of RUSH and overtrust as within the current previous he had some on-line bookings in the same method it labored.

I really feel that whereas all of us are conscious of those frauds and attempt to be cautious, sometime even all of us might fall for these methods as the opposite aspect can outsmart us.

10 precautions to take earlier than sending cash to somebody on-line

Allow us to see among the primary checks and precautions we should take with a purpose to stop any on-line fraud whereas we’re transferring any cash on-line to somebody for reserving any excursions, journeys, inns, or for purchasing functions. Let’s take a look at them one after the other

1. Seek for the quantity/firm identify on google as soon as

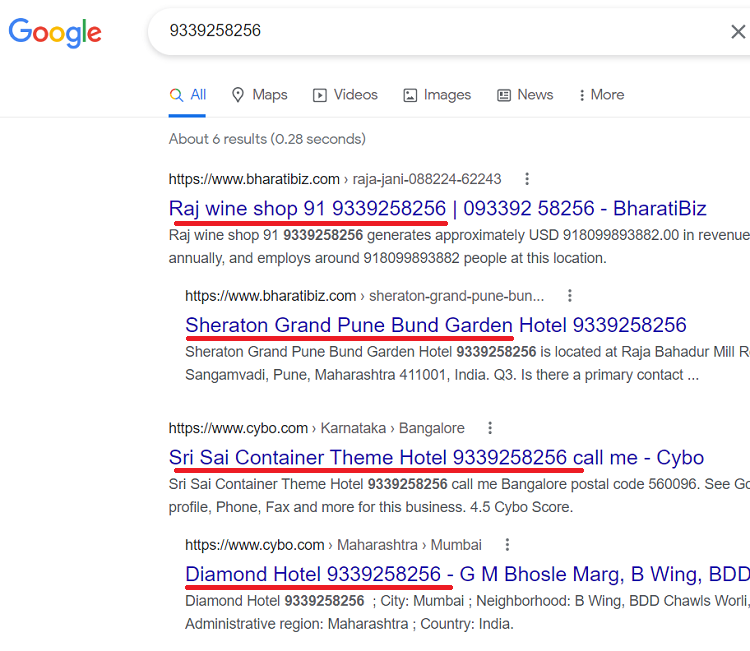

One small search on the cellphone quantity or electronic mail of the particular person might reveal plenty of particulars at occasions. If the identical particular person has cheated others, there’s a good likelihood that you’ll get some pointers for it. Once I looked for that quantity 9339258256 on-line, I noticed that the identical quantity was listed for numerous companies, which clearly exhibits that’s a cheater.

2. Use NEFT/IMPS switch as a substitute of UPI

UPI is quick and safe, however solely priceless in case you are transferring cash to the precise and real particular person. The issue of UPI is that it MASKS the main points of the particular person and simply provides you a scan code or easy particulars which doesn’t inform a lot in regards to the particular person. In case you are unsure, at all times ask for the financial institution particulars to switch cash by means of NEFT or IMPS.

This may at the very least provide you with particulars like a checking account, Identify of the account holder, department and many others. You should utilize this to confirm or complain later on the financial institution simply. Additionally, the checking account identify shall be of the identical particular person.

3. Don’t Rush

What’s the frenzy?

By no means take fast selections whereas sending large quantities. At occasions, while you do issues on the final minute, you’re in hurry and sometimes don’t take note of small purple flags. Additionally, your thoughts might not go into particulars which may have prevented a fraud. All the time begin a dialog with the particular person, speak to them as soon as, await hours/days after which make any transfers after correct analysis.

4. All the time switch Advance cash, not full

More often than not, folks pay the complete quantity if issues look real and so they don’t wish to get right into a headache of paying the stability later. They overtrust others. So far as potential, at all times pay an advance first and pay the stability later. This offers you plenty of time and in case you’re unfortunate, you don’t lose all the cash in fraud.

5. Continous callbacks are a red-flag

A lot of the fraudsters/scamsters tend to spam you with calls and messages time and again. I’ve personally seen this in “NGO Rip-off” the place somebody calls you or WhatsApp you to donate cash for an in poor health youngster in hospital, Should you present any small curiosity, you’ll be bombarded with WhatsApp messages and callbacks to donate the cash NOW.

It is a large purple flag. At occasions you get a name from some senior or higher-up following with you. If that is taking place in your case, be very cautious about it.

6. Validate the quantity or contact particular person with on-line teams/websites

Most real companies have a robust on-line presence. They’ve their very own web site, Fb web page, Instagram web page or another social media identification. You possibly can learn others’ opinions, their cellphone numbers are revealed there and different particulars like deal with, and enterprise particulars are talked about.

I’m not saying that fraud folks cant create these items, but it surely’s a quite simple checkpoint. Should you obtained in touch with somebody who’s lacking these items, you’ve gotten a robust cause to doubt them.

7. Search on Truecaller

One other nice trick is to easily test the cellphone quantity on truecaller App. Others who might have come throughout that fraudster or identical cellphone quantity should have tagged them as “fraud”, “rip-off”, “Spam” or comparable phrases. It offers you some trace on their genuineness

8. Ask for compliance like GST / Cheque/ References

One factor you are able to do moreover asks for a CHEQUE copy and point out to them an excuse that you’ll make fee out of your company account and that is the necessary requirement by the corporate. This fashion you’ll get all the main points of the account holder, department, and account quantity. Quite a lot of issues you possibly can cross-check if the account belongs to the identical particular person or not. Quite a lot of fraudsters don’t use their very own account. This will change into a foundation for extra questioning and it’s possible you’ll catch a fraudster.

Additionally if it’s a enterprise entity, do ask for a GST quantity, and many others too as added safety.

9. Don’t belief the random low key web sites commercials

By no means belief folks or cellphone numbers which might be listed on low-key web sites, in spite of everything, they listing their enterprise on useless websites which don’t have any credibility. It merely seems within the search engine for somebody who’s looking on google.

10. Take heed to the Intestine feeling

Lastly, I might say, that you simply shall hearken to your intestine feeling and in case your interior voice says that issues should not proper, higher don’t do the transaction. Do speak to the particular person to whom you’re transferring the quantity, and do watch their language, their tone, and plenty of small issues. However do belief your interior voice and don’t do the transaction or at the very least await extra time.

Extra precautions to take

- By no means share OTP, or PIN with anybody ever it doesn’t matter what

- Don’t reply to calls that say that they’re from RBI, IRDA, or Tax division which ask in your private particulars

- You by no means must pay your UPI pin to revise the cash on any UPI App. Quite a lot of fraudsters say they’re sending the cash to you however have despatched you a “Cost request”

- By no means give entry to anybody for sharing your display screen for help functions. Don’t use software program like Teamviewer or Anydesk

Steps to take in case you misplaced cash to any on-line fraud

- Do criticism to Cyber Cell instantly

- Do file an FIR additionally if the quantity is critical for you.

- Do share in regards to the incident on Twitter and different social media channels you’re a part of

[ad_2]

Source link