[ad_1]

Small and medium-scale farmers and agri-businesses in east and southern Africa are getting a uncooked deal. To succeed they want honest and built-in regional markets. Analysis by the Centre for Competitors, Regulation and Financial Improvement has highlighted the necessity for higher integration of regional economies as a step in the direction of meals safety within the area.

Highly effective business pursuits, excessive transport prices and poor entry to amenities similar to for storage imply that small and medium-scale farmers are sometimes not getting honest costs for the meals they develop. Honest costs are those who meet demand and canopy affordable prices of provide together with transport throughout borders.

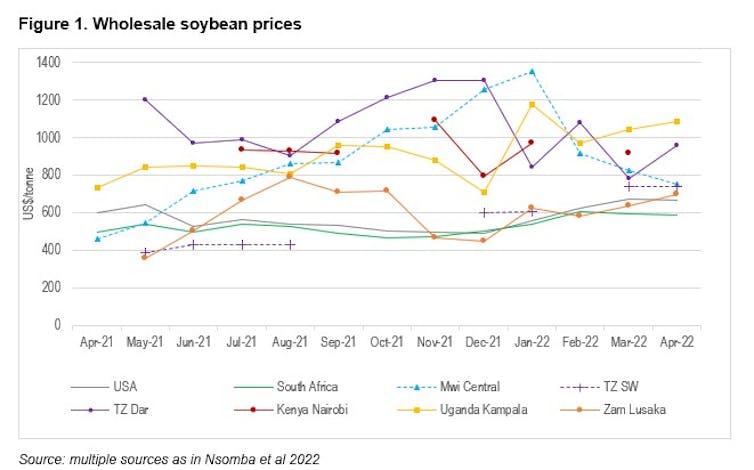

Through the course of our analysis we got here throughout examples of how the percentages are stacked in opposition to most small and medium-scale farmers. Take the expertise of Endrina Maxwell, a small producer in Malawi. In April 2021, she bought her soybean crop in central Malawi and realised the returns from investing in business agriculture as a feminine agribusiness proprietor and farmer. She acquired costs round Malawi kwacha 350/kg, about $450/t (see Determine 1). On the similar time, the costs in the principle markets in Dar es Salaam and Nairobi have been over a $1000/t.

Plenty of hurdles stood in Endrina’s approach to reap the benefits of the excessive costs in neighbouring nations. First, particular value info was not available for somebody in Endrina’s place to concentrate on the features from exporting. Second, transport prices are very excessive for smaller producers. Third, to hold-off from promoting on the harvest and to cut price for higher gives, producers like Endrina must have storage choices.

This example does profit some. These embrace the principle merchants and processors in Malawi and throughout the area. These firms purchased up a lot of the crop on the time of harvest at low costs, for native use and for export, profiting from their storage amenities and personal info. Costs in Malawi then elevated to peak at $1350/t in January 2022, as if there was a extreme shortage.

The trebling of soybean costs affected one other cohort of small-scale farmers. Soybeans are a key element of poultry feed. Small-scale poultry farmers noticed their animal feed costs enhance by related quantities, squeezing them severely.

Our analysis identifies an absence of efficient regional competitors and signifies the necessity to inquire into transport, storage and logistics points. The variations in costs between areas on transport corridors translate into rents to transporters and arbitrage margins being made by giant merchants. It additionally factors to provides being bought-up by intermediaries at low costs on the harvest and held again to drive costs up.

The delicate meals techniques within the area, mixed with growing focus at a number of ranges of key worth chains, requires a regional competitors coverage for resilient and sustainable regional worth chains.

A stronger regional market referee to watch and implement competitors guidelines would degree the taking part in area for fairer meals markets.

The Frequent Marketplace for Japanese and Southern Africa Competitors Fee working along with nationwide competitors authorities, has the central position to play.

What’s lacking

The African Market Observatory was created to fill the hole of dependable market info for key meals merchandise on the wholesale and producer ranges. The observatory tracks and compiles costs month-to-month. The primary 12 months of information gathering by the observatory underlined the advantages to smaller market members of market information.

This 12 months, with the African Market Observatory, it has been doable to trace markets by way of crowd-sourcing costs from smaller market members. Entry to this information has allowed Endrina to anticipate what she ought to get for her soybean harvest. It has additionally enabled her to plan her different enterprise – oil manufacturing – extra effectively.

The pricing patterns have highlighted the essential position that entry to aggressive transport companies in addition to storage amenities play in accessing markets and fairer costs. This has knowledgeable Endrina’s resolution to put money into storage amenities on her farm because of discovering that there’s worth in spreading her grain gross sales all year long versus promoting solely on the harvest.

To strengthen the area’s fragile meals safety – made worse by local weather change –it’s important that produce might be sourced from throughout the area, which is probably the most value efficient approach to meet the wants of consumers and to reward producers for increasing provide.

That is most evident in Kenya the place meals costs have risen exponentially. The nation is experiencing probably the most extreme drought in 40 years. As well as, the struggle in Ukraine is compounding worldwide pricing pressures.

Because of this Kenya must supply imports from the area the place climate has been good at honest aggressive costs. But, regardless of rising manufacturing in nations similar to Malawi and Zambia, cross-border commerce shouldn’t be taking place successfully.

Unfair commerce

By contemplating the market clearing sources of provide for the principle centres of demand in Dar es Salaam and Nairobi we will see that soybean costs have been means above the honest import costs. This means that producers acquired too little and finish customers paid means an excessive amount of, with intermediaries capturing the distinction.

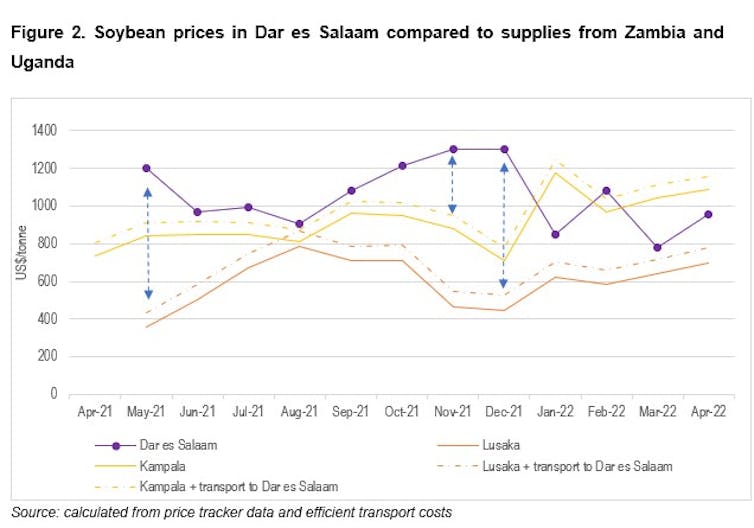

Dar es Salaam might have sourced soybeans from Malawi, Zambia or Uganda – all neighbouring nations – so as to add to home provides. Costs at over US$1200/t in some months, similar to October to December 2021, have been US$200-400/t above what it ought to have value to land items from Uganda and US$400-750/t above what it ought to have value to land from Zambia. This contains an environment friendly transport fee, calculated at US$0.04/t/km from varied sources.

Regional commerce and aggressive markets are additionally impeded by governments. Zambia had an export restriction on soybeans from August to November 2021. Eradicating the restriction introduced decrease costs to patrons in Dar and better costs to sellers in Zambia, benefiting either side by way of commerce.

The place the area is unable to reap the benefits of good provide in some areas to satisfy demand in others at aggressive costs, this locations nice strain on downstream industries. For instance, animal feed producers in Kenya who’re patrons have been hit arduous.

A bundle of interventions to make sure regional markets work higher is urgently required.

Making regional markets work

We suggest the strengthening of three precedence areas:

- coverage and advocacy,

- enforcement, together with in opposition to cartels; and

- regional merger analysis.

Competitors advocacy and coverage is important, as most of the components undermining efficient regional aggressive markets embrace coverage points. Regulatory obstacles, for instance, undermine commerce and reinforce the market energy of firms inside nations.

The Comesa Competitors Fee and nationwide authorities within the area must urgently act collectively in these areas to deal with poorly working regional meals markets.

The African Market Observatory is a place to begin for information assortment the place analyses might be deepened, collaboration might be strengthened, and entry to pricing info improved for market members.![]()

Grace Nsomba, Researcher at Centre for Competitors, Regulation and Financial Improvement, College of Johannesburg and Simon Roberts, Professor of Economics and Lead Researcher, Centre for Competitors, Regulation and Financial Improvement, UJ, College of Johannesburg

This text is republished from The Dialog underneath a Artistic Commons license. Learn the unique article.

[ad_2]

Source link