[ad_1]

Inside a number of varieties of debt mutual fund schemes, liquid funds are an acceptable avenue to park your cash to your quick wants which might be due over the subsequent few weeks or months. They’ve the potential to return barely larger than the financial savings checking account. We frequently come throughout the query that whether or not retail traders ought to use their financial savings checking account or liquid funds for that objective to realize extra returns. Allow us to examine each.

Liquid funds are debt funds that put money into devices having a maturity interval of lower than 91 days. Because the identify suggests, these funds put money into extremely liquid devices. They’re appropriate to park your cash for the quick wants which might be over the subsequent few weeks to months. However they’ve an exit load if redeemed inside seven days and so they vary from 0.0070 per cent on day one to 0.0045 per cent on day seven.

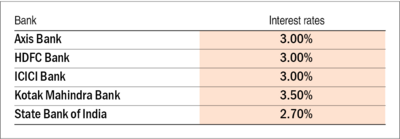

Then again, a financial savings account acts as storage for our cash. This isn’t an funding. However, simply conserving money within the account may help us to make some curiosity. Among the high banks present an rate of interest of round 2.70 to three.50 per cent.

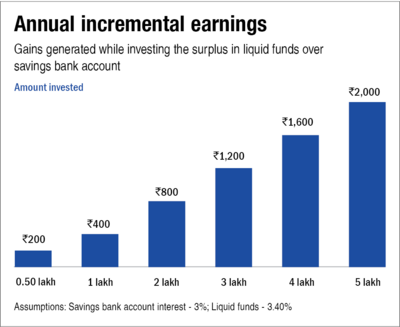

If we take an funding horizon of 1 yr and examine the returns, liquid funds returned 3.41 per cent during the last one yr as of Might 31, 2022, and the curiosity from the financial savings financial institution accounts was 3 per cent. We are able to see that there is not a lot of a distinction.

If we check out the taxation of each, the curiosity revenue from a financial savings checking account is added to your revenue and taxed as per the relevant slab. Nevertheless, part 80TTA permits claiming a deduction of as much as Rs 10,000 which appears fairly an affordable quantity for a retail investor.

Then again, positive factors from liquid funds (if bought inside three years) are added to the revenue and taxed as per the relevant slab. So financial savings financial institution accounts have an higher hand right here. Nevertheless, should you maintain your cash in liquid funds for greater than three years, you might be eligible to assert the good thing about indexation and the positive factors are taxed at 20 per cent. So, for a retail investor, until you will have an enormous quantity, it does not make a distinction. However when you have obtained an enormous windfall for any purpose, they may make somewhat sense.

Recommended watch: How secure are liquid funds as an funding possibility?

[ad_2]

Source link