[ad_1]

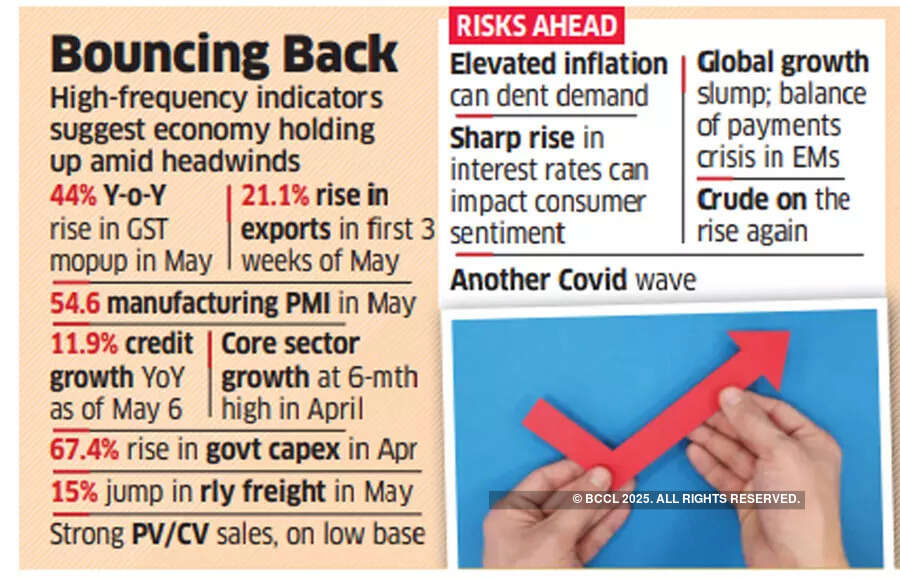

India’s economic system is off to a powerful begin within the new monetary yr with a number of high-frequency indicators holding agency regardless of a number of headwinds, bouncing again from the tepid fourth quarter of FY22.

Knowledge launched June 1 confirmed items and providers tax (GST) collections topped ₹1.4 lakh crore for the third month operating in Might, whereas the manufacturing buying managers’ index (PMI) remained firmly within the development zone at 54.6 in that month.

Automakers reported strong passenger automobile and business automobile gross sales for Might regardless of components shortages and provide points. Railway freight loading rose 15% in the identical month to 131.7 million tonnes in opposition to 114.9 million tonnes within the yr earlier. The nation’s merchandise exports rose 21.1% year-on-year to $23.7 billion within the first three weeks of Might.

Core sector development hit a six-month excessive of 8.4% in April, knowledge launched on Tuesday confirmed, whereas credit score development was up 11.9% year-on-year as of Might 6.

“The high-frequency indicators for April and Might present that there’s a pickup in exercise,” mentioned Sakshi Gupta, principal economist at HDFC Financial institution.

India’s economic system grew 4.1% within the March quarter, pulled down by the Omicron wave of the pandemic and excessive commodity and crude costs.

Geopolitical Challenges

Economists anticipate double-digit development within the June quarter, propelled by the low base of final yr. FY23 development is seen at a wholesome 7-8% in contrast with 8.7% in FY22, helped by the low base of 6.6% contraction in FY21.

“As of right now, the symptoms present development of the economic system and no scope for a downgrade, however inflation can are available the way in which of spending at a later stage,” mentioned Madan Sabnavis, chief economist at Financial institution of Baroda.

The economic system might, nevertheless, hit a tough patch given the assorted threats it faces.

Inflation is elevated and financial tightening is underway to regulate the value rise. Crude costs are advancing once more with Brent at $118 a barrel and commodity costs stay elevated.

World development is slowing in response to financial tightening and lots of nations are going through a capital exodus or stability of funds disaster.

Easing of Covid restrictions in China ought to ease provide points going forward.

“We’re cautiously optimistic primarily based on the out there high-frequency indicators. Nonetheless, there’s a niggling concern, as we might not have the whole image on the patron facet as a result of there isn’t a well timed indicator for client non-durables,” mentioned ICRA chief economist Aditi Nayar.

The ranking company expects India’s GDP to develop 12-13% within the June quarter of FY23 and seven.2% within the full fiscal.

“We mark down our estimate for India’s FY23 GDP development to 7% from 7.3%, with draw back threat, earlier,” QuantEco Analysis mentioned, citing exterior dangers within the type of geopolitical uncertainty and the accompanying phrases of commerce shock which have worsened up to now month.

In keeping with HDFC Financial institution’s Gupta, rising price pressures can curb bullishness.

[ad_2]

Source link