[ad_1]

A goal maturity fund (TMF) is a sort of fund that comes with a particular maturity date. The maturity rolls right down to zero because the date approaches and the fund ceases to exist. These funds normally have their maturity date written within the scheme title. For example, within the Medium to Lengthy Period class, one would spot ‘Edelweiss NIFTY PSU Bond Plus SDL Index Fund – 2026’. The quantity 2026 tells us the yr during which this fund will mature.

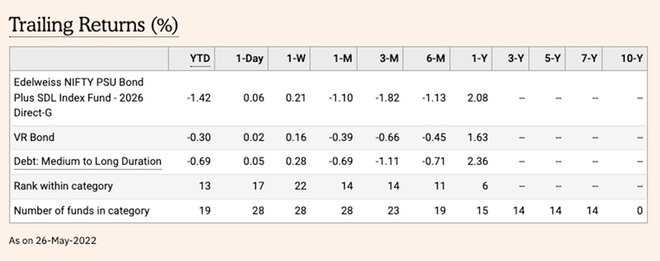

To evaluate the previous efficiency of those funds, one can seek for the respective fund within the search field on Worth Analysis On-line. On the respective fund’s web page, you possibly can scroll to the ‘Efficiency’ part. For instance, for the Edelweiss NIFTY PSU Bond Plus SDL Index Fund – 2026, you possibly can try the efficiency right here.

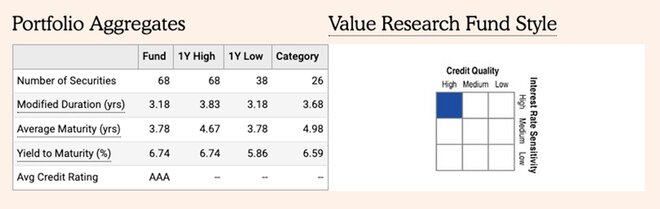

The individuality of goal maturity funds is the predictability of their returns. If buyers maintain these funds until maturity, they will anticipate to earn returns nearer to the indicative yields on the time of investing. You’ll find the Yield-to-Maturity (YTM) metric below the ‘Portfolio’ part on the fund’s web page. The YTM offers a sign of the anticipated returns from a fund, ought to the portfolio of the fund be held until maturity. For example, for the Edelweiss NIFTY PSU Bond Plus SDL Index Fund – 2026, one can observe the YTM from the portfolio part right here.

Instructed learn: The evolution of goal maturity funds

[ad_2]

Source link