[ad_1]

NEW DELHI: The finance ministry has determined to permit authorities departments to roll over unspent funds from one quarter to a different in a bid to push public spending.

Revising its earlier pointers, the ministry has mentioned that this may be accomplished after an approval by the expenditure secretary. The finances division has, nonetheless, retained the cap on spending through the fourth quarter of the total 12 months allocation, whereas limiting the spending throughout March at 15% of the annual spend.

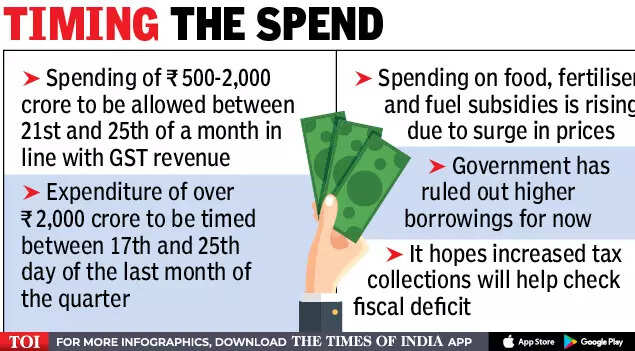

The revised norms have additionally advised higher money circulate administration. Monetary advisers in ministries to permit spending of Rs 500-2,000 crore between the twenty first and twenty fifth of a month as GST income comes round this time.

Equally, expenditure of over Rs 2,000 crore is sought to be “timed” in the direction of the tip of the quarter — between seventeenth and twenty fifth day of June, September, December and March.

In addition to, the monetary advisers have been requested to intently monitor the discharge of funds to autonomous our bodies and different organisation in order that they don’t sit on funds.

Additional, dividend receipts from public sector entities are proposed to be pushed through the first half of the 12 months with an identical deal with non-tax receipts.

With the federal government spend on meals, fertiliser and gasoline subsidies rising as a result of current improve in costs, together with responsibility concessions, analysts have advised that the Centre might must go for added borrowings or curtail among the spending. For the second, larger borrowings have been dominated out as the federal government is hoping that larger tax col- lections will assist it hold the fiscal deficit beneath examine. Clearly, higher administration of money is a spotlight.

The rules come at a time when the federal government is searching for to make sure that the capex plan for the 12 months just isn’t impacted as it’s eager to revive financial exercise, which can take a beating as a result of current spike in inflation. Larger rates of interest, specialists concern, will decelerate among the demand for loans. The Centre has maintained that it’s going forward with its capital-spending plan to spice up asset creation together with demand for metal and cement and likewise create extra employment.

A senior authorities official mentioned that the thrust on asset creation during the last 12 months or so has received the federal government businesses prepared to fulfill the problem and spending will circulate through the of the 12 months.

[ad_2]

Source link