[ad_1]

The which means of XIRR or the Prolonged Inside Charge of Return within the context of mutual funds is the calculation of return on investments the place quite a few transactions happen at numerous intervals. To grasp XIRR, we have to first perceive CAGR (Compound Annual Progress Charge). XIRR is nothing however the aggregation of a number of CAGRs. The share return proven within the final column of the overview part in My Investments is calculated by the XIRR technique.

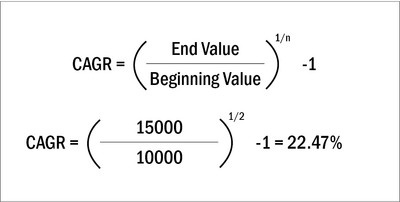

Let’s take a easy instance to grasp the CAGR. In case you make investments Rs 10,000 at present and it turns into Rs 15,000 in two years, you have made an annual compounded return of twenty-two.47 per cent. That is simple to compute since it’s one single funding and at one particular date.

However within the case of an SIP, we’d have made not one however a number of investments. It is also unfold throughout completely different time frames. To calculate a easy whole return would turn into troublesome.

So we use the XIRR components to calculate the general CAGR of all of the investments. XIRR is used to calculate the inner charge of return for a money movement for a sequence of investments executed at completely different intervals. So it’s nothing however the charge of return earned for various quantities of cash invested for various intervals.

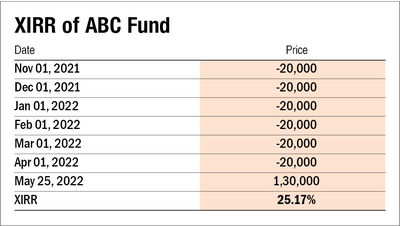

Let’s take one other instance – suppose you invested Rs 20,000 in ABC Fund through SIP each month for six months totalling to Rs 1.20 lakh. Since there are six completely different installments, it is troublesome to calculate the entire return. Utilizing the XIRR components, we will simply discover out that we earned a complete return of 25.17 per cent.

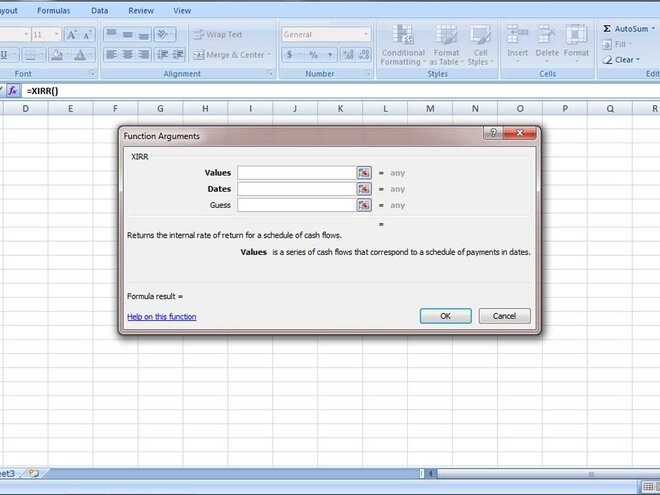

You should use MS Excel to search out out XIRR by yourself. Simply use the XIRR components and enter the ‘Values’ and ‘Dates’.

Within the values subject, add the sequence of installments with the ultimate return quantity. And within the dates subject, put the schedule of funds that match the installment.

Steered learn:

Piotroski F-score: Score an organization’s monetary well being

C-score: Dodging artistic accounting

[ad_2]

Source link