[ad_1]

Because it goes for any service that you simply take, as an example, a lawyer on your authorized issues, a chartered accountant for submitting your revenue tax returns, or an architect for your own home, mutual fund managers cost a payment for constructing and managing your funding portfolio. This payment is known as the ‘expense ratio’ of the fund.

The expense ratio is a single basket that features all the fees that traders have to pay mutual funds corporations to handle their cash. These embrace fund administration charges, agent commissions, promoting and promotional bills and different expenses incurred by the fund.

Calculation of expense ratio

The expense ratio is expressed as an annualised proportion of the fund’s property underneath administration (AUM). Thus, as an investor, you pay a payment in proportion to your funding worth within the fund. Nevertheless, you do not have to pay it individually because it will get adjusted from the returns generated by the mutual fund itself. Sounds a bit advanced? Don’t fret. Right here is an instance.

For example, you invested in a fund at present with an expense ratio of two per cent. After a 12 months, the fund earns 15 per cent returns from its portfolio. Now, as an investor, your returns on the finish of the 12 months could be 13 per cent, i.e.,15 per cent returns generated by the fund decreased by 2 per cent of the expense ratio. Fund’s every day NAVs (internet asset values) are reported internet of such charges and bills. Completely different funds have totally different expense ratios however SEBI has stipulated an higher restrict of two.25 per cent and a pair of per cent on these ratios for fairness and debt funds respectively. This payment is charged regardless of the fund’s efficiency, be it constructive or unfavorable.

The right way to discover out the expense ratio of a fund?

To search out out the expense ratio of a fund, you’ll be able to examine its disclosures on the web site of the given asset administration firm (AMC). Or you’ll be able to simply entry the identical on the respective fund’s web page on the Worth Analysis web site through the use of the search bar on the high.

How a lot expense ratio is appropriate?

A excessive expense ratio over the long-term might considerably eat into your returns. For instance, the worth of Rs 1 lakh after 10 years with 15 per cent charge of return might be about Rs 4 lakh. But when we embrace the price of, for instance 1.5 per cent, expense ratio, your returns would scale back to Rs 3.5 lakh, almost 13 per cent lower than what it might have been with none bills. So, it is higher for traders to decide on a fund that has a low expense ratio.

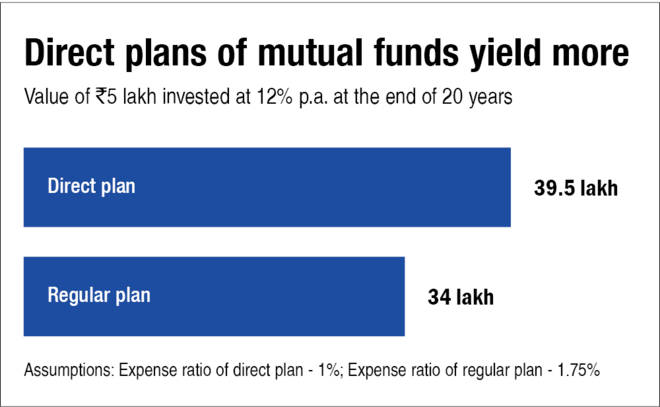

Additional, in case you are able to managing your personal investments, chances are you’ll considerably decrease your expense ratio and obtain increased returns over time by staying away from common plans. Common plans have the next expense ratio as in comparison with direct plans. That is because of the further price of paying commissions to the distributors within the former case. Although the distinction between the expense ratio of direct and common plans may not look substantial in proportion phrases, the affect on the general corpus turns into significant over a time frame.

Thus, earlier than venturing into any fund, it is best to examine its expense ratio. However keep in mind {that a} decrease expense ratio doesn’t essentially make the fund higher. A fund that delivers good returns with minimal bills is the way in which to go.

[ad_2]

Source link