[ad_1]

The three-decade period of globalisation dangers going into reverse in accordance with firm executives and buyers, as world leaders put together to fulfill within the Swiss city of Davos for the primary time for the reason that coronavirus pandemic started.

The geopolitical fallout from Russia’s struggle in Ukraine, mixed with the disruption to world provide chains attributable to the virus, current market turmoil and the quickly worsening financial outlook depart company leaders and buyers grappling with important strategic choices, a number of instructed the Monetary Instances in interviews.

“Pressure between the US and China was accelerated by the pandemic and now this invasion of Ukraine by Russia — all these tendencies are elevating critical considerations a few decoupling world,” stated José Manuel Barroso, chair of Goldman Sachs Worldwide and a former president of the European Fee.

Onshoring, renationalisation and regionalisation had turn out to be the most recent tendencies for corporations, slowing the tempo of globalisation, he added: “[Globalisation faces] friction from nationalism, protectionism, nativism, chauvinism if you want, and even generally xenophobia, and for me, it’s not clear who’s going to win.”

“Just about nobody has seen” these situations “throughout the arc of their investing profession”, in accordance with the top of one of many world’s largest non-public fairness teams. Charles ‘Chip’ Kaye, chief government of Warburg Pincus, stated geopolitics had been “on the perimeter of the best way we thought” for the reason that fall of the Berlin Wall and that this had “supplied a sure oxygen to world development”.

Nevertheless, he stated, geopolitics was now “entrance and centre” of funding choices simply because the “fairly highly effective tailwind to asset costs” supplied by years of falling inflation and low rates of interest involves an finish.

“You’re not optimising the financial consequence, you’re creating friction within the system,” he stated of rising geopolitical tensions.

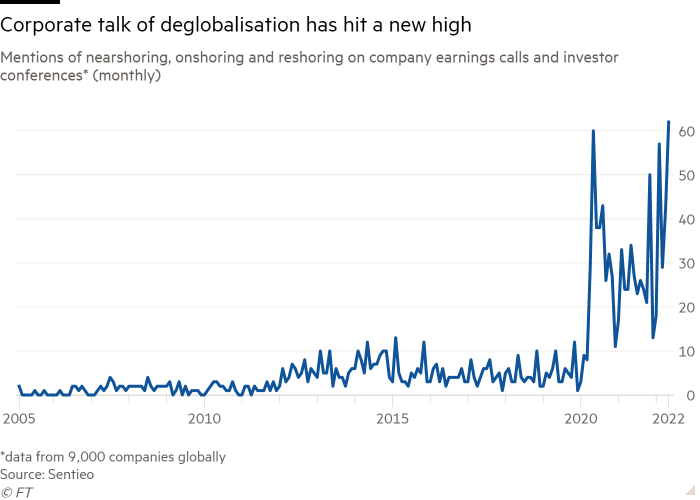

Discuss deglobalisation amongst corporations has mounted in current weeks. Mentions of nearshoring, onshoring and reshoring on company incomes calls and investor conferences are at their highest stage since no less than 2005, in accordance with information supplier Sentieo.

The topic will probably be excessive on the agenda for attendees on the World Financial Discussion board in Davos this week. Since its final assembly in January 2020 world occasions have scrambled the provision chains that underpin the globalisation that the WEF champions.

“Corporations are saying I would like my manufacturing nearer to my prospects,” stated Jonathan Grey, president of Blackstone Group.

The top of Asia’s largest pharmaceutical firm stated the period of globalisation based mostly on outsourcing capabilities to chop prices was over.

Christophe Weber, chief government of Takeda, which is headquartered in Tokyo, Japan, stated drugmakers would proceed to hunt development in worldwide markets, significantly China due to its excessive potential. However company focus had shifted to a extra sustainable type of globalisation, he stated: “It’s a query of de-risking your provide chain.”

“It will be a short-cut to say that globalisation is over however the globalisation that folks take note of just isn’t true any extra,” Weber stated. “The globalisation which existed just a few years in the past, commerce with out constraints, and the ‘world is flat’ concept, is completed.”

Takeda has applied a twin sourcing coverage to construct extra redundancy into its provide chains, Weber added: “I by no means thought [outsourcing] would work long-term however I feel that is clear for everybody now.”

Shopper industries are additionally experiencing a shift away from globalisation, in accordance with Rachid Mohamed Rachid, chair of Valentino and Balmain.

Some luxurious corporations are rethinking their technique, which tended to rely closely on world branding, promoting to vacationers and transport items around the globe, he stated: “The enterprise has gone native . . . Shops at present in London or Paris or Milan are actually catering for his or her native residents greater than they used to earlier than.”

Previously two years corporations have begun to “look native and begin performing regionally as an alternative of performing globally”, he instructed the FT’s Enterprise of Luxurious convention earlier this week. “In several markets just like the US, Europe, Asia, even smaller markets like Latin America and Africa, persons are trying regionally now and I’m certain there’ll be plenty of native offers happening.”

Dominik Asam, chief monetary officer at Airbus, warned this might have extreme financial penalties.

“If a significant a part of many years of productiveness features pushed by globalisation was reversed in a brief time frame, this could drive inflation up and lead to a significant, protracted recession,” he stated. “That is precisely why I imagine that main financial powers will come to the conclusion that they should do every part they’ll to avert such a devastating state of affairs.”

Barroso blamed a much less co-operative spirit at a political stage inside the G20 now compared with the monetary disaster in 2008. Political leaders ought to distinguish between critical geopolitical variations and the need to deal with challenges corresponding to public well being and local weather change, he stated.

Germany’s central financial institution chief Joachim Nagel listed deglobalisation as one of many “three Ds” that may “add to inflationary pressures” alongside decarbonisation and demographics.

The shift away from globalisation was being “fuelled by geopolitical tensions and the need to scale back financial dependencies”, the Bundesbank president stated after a gathering of G7 finance ministers and central financial institution governors in Königswinter, Germany, earlier this week.

Extra reporting by Brooke Masters and Sylvia Pfeifer in London and Martin Arnold in Frankfurt

[ad_2]

Source link