[ad_1]

The inherent nature of the market is volatility. The previous few weeks have been unnerving for a number of buyers because the markets have witnessed a turmoil owing to macroeconomic circumstances resembling rising inflation, tightening financial coverage and Russia-Ukraine warfare. Consequently, the returns of equity-oriented mutual funds have come down throughout classes inflicting jitters in buyers.

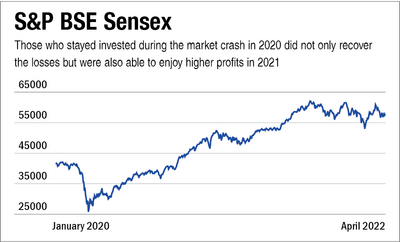

Nevertheless, it might not be a good suggestion to redeem your investments at this time limit. It will solely make your losses everlasting. Many buyers had exited equities out of panic when the markets crashed in 2020 as a result of COVID, making their losses everlasting. However those that stayed invested didn’t solely get well the losses but additionally made increased income in 2021 when the markets recovered and went on a steady bull-run.

It’s best to look to redeem your funding solely below sure circumstances. Firstly, when you might have achieved your objective. Secondly, in case your fund has been underperforming as in comparison with class friends. In case you do not want your cash at present then keep put. Keep in mind why you began investing within the first place. Perceive your funding objective and the time horizon of funding. The fairness market may be actually unstable if checked out for a brief time frame. Therefore, you need to put money into fairness solely when you’ve got a minimal of 5 years of funding horizon.

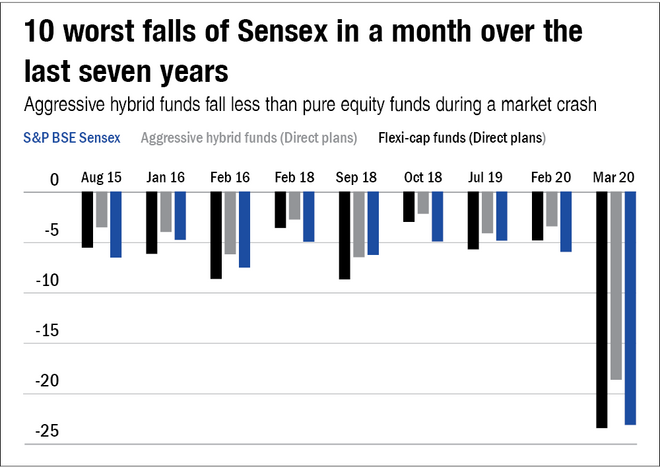

In case you are an investor who is well apprehensive by the ups and downs of the market, then it could be advisable that you simply put money into aggressive hybrid funds. These funds are mandated to take a position about 65-80 per cent of their belongings in fairness whereas relaxation in debt. The fairness portion of those funds helps in producing increased returns for buyers whereas the debt element offers a cushion in case the market falls offering phycological consolation to buyers.

Furthermore, keep in mind to not put all of your eggs in a single basket. Diversify your portfolio throughout funds and asset courses. Decide an asset allocation plan for your self primarily based in your danger urge for food and targets and rebalance your portfolio at common intervals to stay to it. As an illustration, you may determine to maintain 80 per cent of your portfolio in fairness and relaxation in debt. Rebalance your portfolio yearly to stay to this allocation plan.

Prompt watch:

What ought to an investor do because the market turns unstable?

What’s the significance of asset allocation in a unstable market?

Risky markets and jittery you

[ad_2]

Source link