[ad_1]

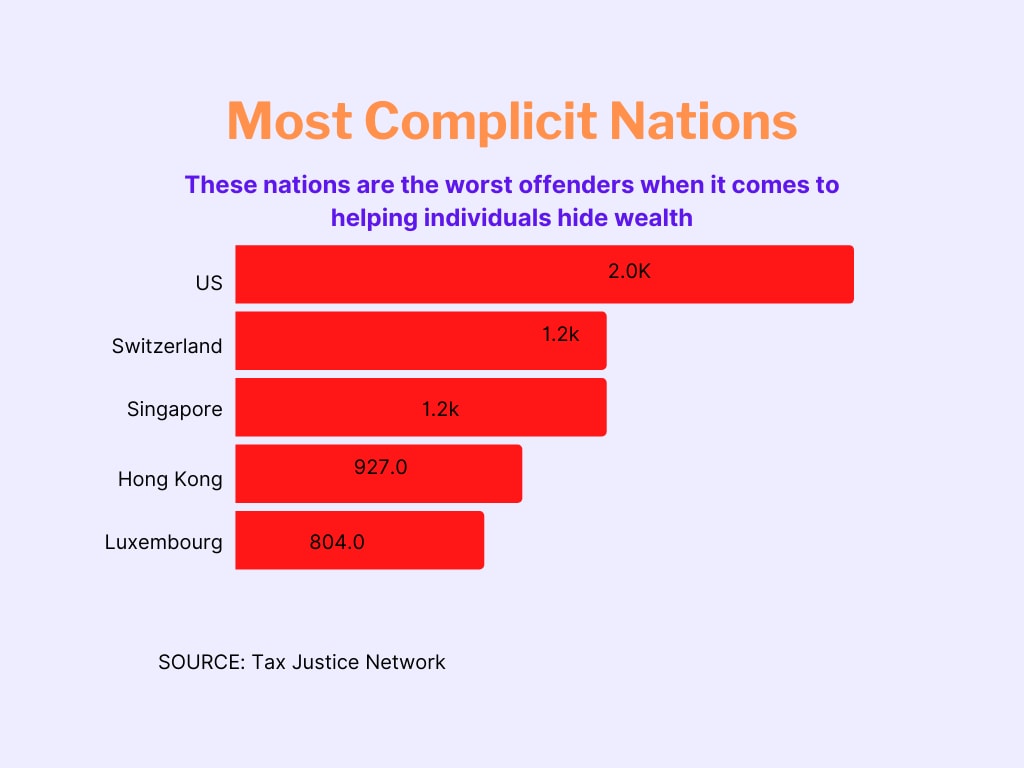

A analysis by the Tax Justice Community revealed that the US is essentially the most useful for people who wish to conceal their wealth.

The Tax Justice Community ranked nations by extent of how a lot their monetary and authorized programs assist people conceal their possession of belongings.

The analysis reveals that the US has elevated provide of economic secrecy to such people by an enormous margin since 2020 incomes it the worst ranking within the Monetary Secrecy Index.

Ian Gary, government director on the US-based Monetary Accountability & Company Transparency Coalition whereas chatting with information company Bloomberg identified that the rankings spotlight how these nations are serving to corrupt people in weaponizing their monetary programs in opposition to democracy.

“The US should assist extra reciprocal automated data trade between nations,” Gary was quoted as saying by information company Bloomberg.

The Tax Justice Community makes use of metrics like FSI Worth, International Scale Weight, Secrecy Rating and FSI Share. The FSI Worth measures how a lot ‘monetary secrecy the jurisdiction provides’ and the US scored 1,951.

The US scored 67 out of 100 in Secrecy Rating – increased secrecy rating means the nation’s authorized and monetary programs enable enormous scope for monetary secrecy. The International Scale Weight of the US was 25.8% – it’s a share of all monetary providers globally supplied by all jurisdictions to non-residents.

The FSI Share – the place the US’ share is 5.74% – reveals how a lot a rustic contributes to international monetary secrecy.

The US ranks excessive in all these metrics, adopted by Switzerland, Singapore, Hong Kong, Luxembourg, Japan, Germany, the UAE, British Virgin Islands, Guernsey and China.

The Tax Justice Community identified that the US scored worst as a result of it refuses to trade data with different nations’ tax authorities. The report stated that if the US modified its rule it could then reduce its provide of economic secrecy to the world by 40%

The Biden administration earlier final 12 months accepted that the US is ‘the perfect place to cover and launder ill-gotten beneficial properties’ and US president Biden made transparency reforms one among essential points of US overseas coverage. He vowed to deal with tax evasion and cash laundering however the report reveals that quite a bit must be finished.

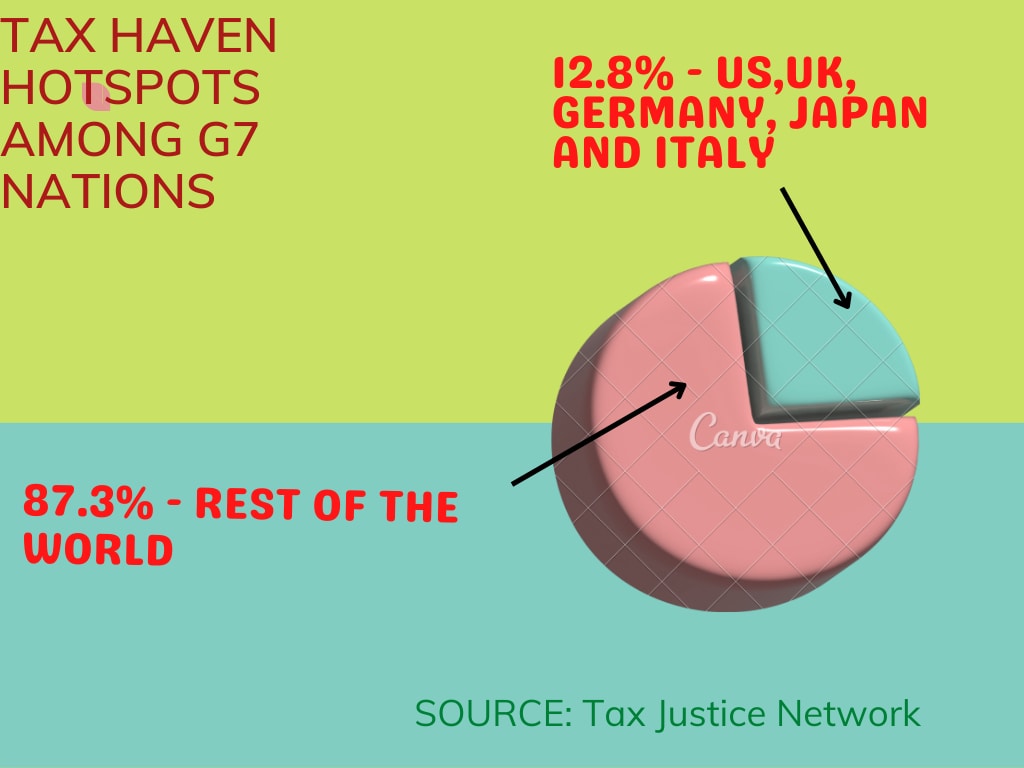

“Wealthy G-7 nations courted billionaires, oligarchs and company giants with secrecy loopholes and eyes-wide-shut-regulations for many years,” Moran Harari, the lead researcher on the Tax Justice Community, informed information company Bloomberg whereas pointing that this small membership of wealthy nations are setting international monetary and tax guidelines whereas facilitating tax abuse and monetary secrecy.

The report additionally reveals the UK and Italy in poor mild as nicely. The report held these two nations together with Japan and Germany chargeable for reducing international progress in opposition to monetary secrecy. This additionally seems to be dangerous for Germany which is able to host the G-7 finance minister’s assembly in a while Monday. It ranks seventh within the record.

The UK additionally faces a damning evaluation if abroad territories and crown dependencies, just like the British Virgin Islands and Jersey, are taken under consideration since they’re chargeable for 8.9% of all monetary secrecy on the planet, the analysis reveals.

The Tax Justice Community revealed that an estimated $10 trillion of wealth is held offshore.

Learn all of the Newest Information , Breaking Information and IPL 2022 Dwell Updates right here.

[ad_2]

Source link