[ad_1]

Even because the latest sharp surge in inflation is because of provide aspect elements, principally warfare associated which are past central financial institution’s management, the Reserve Financial institution’s MPC nonetheless selected to lift coverage charges by 40 bps to 4.4% in early Might exterior of schedule as a charge motion was essential to handle inflation expectations as inflation is getting extra generalised, the newest MPC minutes point out.

The MPC unanimously selected worth stability over progress because it sees India’s macroeconomic fundamentals intact barring meals and gas inflation. Inflation dangers have accentuated because the MPC’s April assertion and the expansion issues have receded.

Enhancing contact-intensive providers amidst revival in city demand is driving private consumption. The outlook for agriculture stays constructive within the wake of regular southwest monsoon forecast for 2022, which might assist rural consumption.

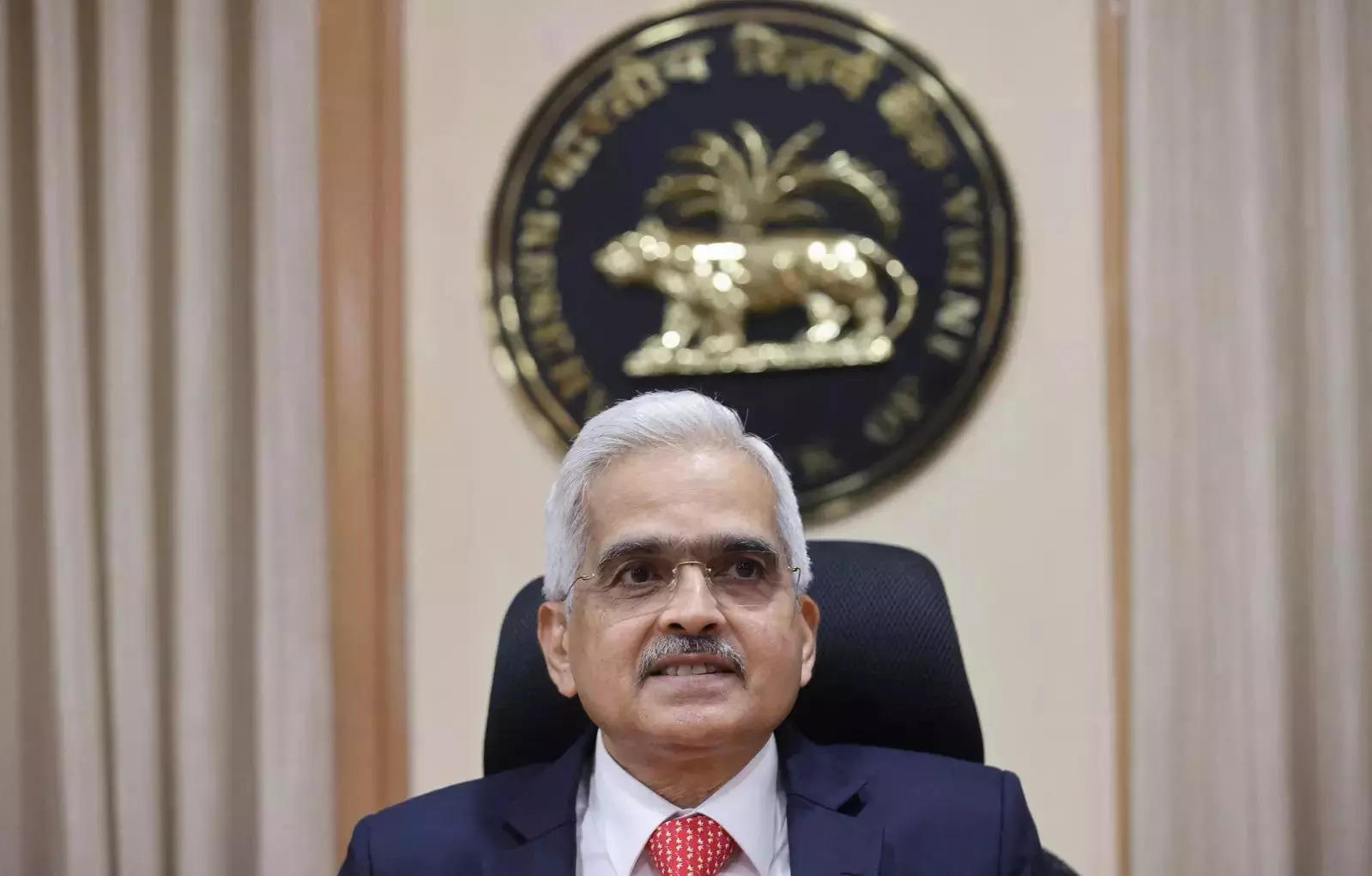

“The rebound in home financial exercise is step by step getting generalised” stated governor Shaktikanta Das in his minutes launched on Wednesday. “The worsening outlook of inflation warrants well timed motion to forestall second spherical results which might result in unanchoring of inflation expectations. Heightened uncertainty and risky monetary markets might additionally add to such unhinging of expectations. Accordingly, decisive and measured financial coverage response is important to keep away from any unintended shocks to the financial system”

A better inflation print additionally provides to the danger of unfavourable actual charge. “In view of an inexpensive restoration and the sharp rise in inflation, frontloading of charge hikes is required to stop the actual charge changing into too unfavourable” stated Ashima Goyal, professor at Indira Gandhi Institute of Improvement Analysis. “Amongst dangers from unfavourable actual rates of interest embrace households shopping for gold thus aggravating the present account deficit and hurting monetary intermediation”.

Justifying the timing of RBI’s charge motion, the governor stated that the warfare in Europe is now anticipated to final for much longer than earlier anticipated. The April inflation was anticipated to be additional elevated which got here at a eight yr excessive of seven.79 %, means above the goal band of 2-6 %.” Therefore it was essential to act by an off-cycle coverage assembly. Ready for one month until the June MPC would imply dropping that a lot time whereas warfare associated inflationary pressures accentuated. Additional, it might necessitate a a lot stronger motion within the June MPC which is avoidable”

Exterior member Jayanth Varma, professor at IIM, Ahmedabad, hinted at sharper charge hikes quickly saying that there’s a lot of catching as much as do because the MPC prioritised financial restoration on the peak of the pandemic till early 2021. and delayed normalisation. ” It seems to me that greater than 100 foundation factors of charge will increase must be carried out very quickly” Varma stated.

The configurations that exist immediately – hardening US yields; ever strengthening US greenback; fairness sell-offs; rising foreign money depreciations and capital outflows; rising debt misery – are harking back to 1993-1994 after which adopted a cascade of rising market crises. “At the least, all of the signs of a generalised monetary deleveraging are in place” stated deputy governor MD Patra.

[ad_2]

Source link