[ad_1]

In December 2018, a leaked letter from the Kenyan auditor-general’s workplace sparked a hearsay that Kenya had staked its bustling Mombasa Port as collateral for the Chinese language-financed Commonplace Gauge Railway. Our new analysis exhibits why the collateral hearsay is improper.

The previous auditor-general, Edward Ouko, was finishing the 2017/18 audit of the nationwide ports authority. He warned that the port authority’s belongings – of which Mombasa Port is probably the most beneficial – risked being taken over by China Eximbank if Kenya defaulted on the US$3.6 billion railway loans.

The worthwhile Mombasa Port is East Africa’s predominant worldwide commerce gateway. Launched in 2017, the railway was supposed to seamlessly hyperlink the port to Kenya’s capital, Nairobi, and landlocked international locations past.

The Kenyan fears mirrored one other story broadly circulated earlier in 2018. In that story, China was mentioned to have “seized” Hambantota Port in Sri Lanka when the island nation had hassle repaying Chinese language loans. This “debt entice diplomacy” allegation was later proven to be a fable, however not earlier than it sparked fears about different massive Chinese language initiatives.

The Chinese language and Kenyan governments each denied that Mombasa Port was collateral however provided no rationalization. Perplexed by the leaked letter, our workforce of students and practitioners of worldwide industrial regulation and challenge finance spent months gathering main paperwork and mapping the challenge’s contractual construction.

To our shock, we discovered that the collateral hearsay stemmed from a seemingly tiny however vital misreading by the auditor-general. The chief auditor mistakenly labelled the ports authority as a borrower, liable for repaying the Chinese language railway loans. He charged that by waiving sovereign immunity, Kenya’s authorities had “expressly assured” that the ports authority’s belongings might be used to repay the Chinese language mortgage. The auditor-general was mistaken in each fees.

For the auditor-general, and plenty of others, the talk over the railway and Mombasa Port was difficult by technical phrases and practices. These are used routinely within the regulation and enterprise of worldwide challenge finance however are unfamiliar outdoors this enviornment.

Though some public schooling would have been essential, releasing the contracts (which Kenya’s Excessive Courtroom ordered the federal government to just do final week) may need prevented the auditor-general’s mistake, and would have allowed debate on the details, relatively than rumours.

Mapping the challenge

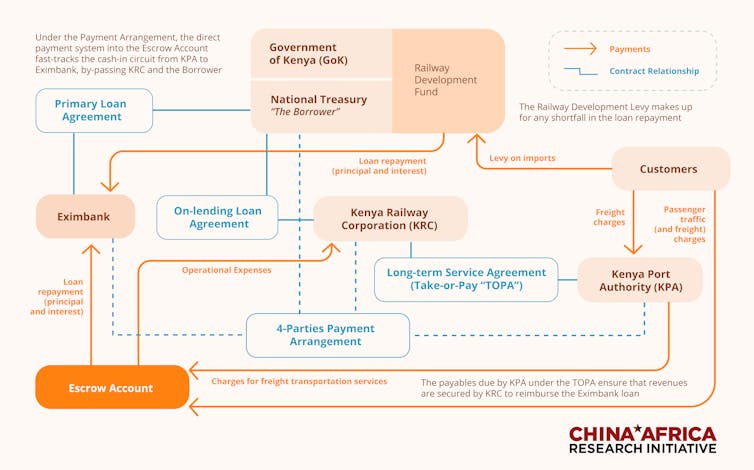

The 4 key stakeholders within the financing of the Commonplace Gauge Railway have been Kenya’s Nationwide Treasury (the borrower), the Kenya Railway Company (the challenge firm), the Kenya Ports Authority and China Eximbank (the lender). The determine beneath maps the difficult contractual and fee preparations.

Kenya’s treasury defined the railway’s financing preparations and credit score enhancements in some element in a 2013 briefing to Kenya’s parliament. The federal government had organized a number of credit score enhancements to spice up the monetary attractiveness of the expensive challenge, rendering it “bankable”.

Amongst these was a “take or pay” settlement signed between the nationwide railway company and the ports authority. Underneath this 15 12 months settlement, the ports authority undertook to ship (or “take”) a minimal quantity of cargo on the brand new railway yearly. If cargo shipments dropped beneath the agreed annual stage, Kenya Ports Authority would draw by itself revenues to cowl (“pay”) the shortfall.

The ports authority is thus the Commonplace Gauge Railway’s main consumer, not its collateral. The treasury additionally pledged that the railway improvement levy, a 1.5% tax on Kenya’s imports, would help the challenge.

The errors

Certainly one of our most necessary findings is that the federal government’s chief auditor was mistaken to name Kenya Ports Authority a borrower. If the ports authority was a borrower, it will imply that it had co-signed the Chinese language loans and was equally liable for compensation. However the ports authority is just not in any sense a borrower.

Clause 17.5 of the 4 get together settlement quoted by the auditor-general in its report spelled out the relationships: “Every of the Borrower, Kenya Rail Firm and Kenya Port Authority agrees…”

Our authorized skilled instantly famous that this refers to a few entities: Kenya’s treasury (the borrower), the rail firm and the port authority.

But this distinction was missed by the auditor-general, who wrongly paraphrased the clause as referring to 2 entities: “every of the debtors, on this case Kenya Railways Company and Kenya Ports Authority…”

The auditor-general then pointed to Clause 17.5 to say that the ports authority was a borrower and due to this fact its belongings have been in danger. The auditor accused the ports authority of failing to reveal this in the course of the audit. The auditor-general was working from incorrect assumptions that influenced its opinion on the ports authority’s obligations.

What does the waiver of sovereign immunity imply?

The Treasury, Kenya Ports Authority and Kenya Railways Company all signed “waivers of sovereign immunity”. It’s because all three have been events to numerous contracts within the general package deal. Underneath worldwide regulation, sovereign states and entities they management have sovereign immunity. This implies they’re usually immune from lawsuits and can’t be compelled to look earlier than a international courtroom or arbitration venue, or to implement a judgement rendered outdoors their borders. But few worldwide banks will supply a mortgage if there isn’t a risk of arbitration ought to a dispute happen and no authorized path to get better their cash ought to the borrower default.

A printed cache of mortgage contracts signed by Cameroon with banks and export credit score businesses from Austria, India, Germany, Spain, Turkey, and the UK exhibits that every one required these clauses. As one American lawyer famous,

leaving out a sovereign immunity waiver in a world industrial mortgage contract could be skilled malpractice.

Nonetheless, there’s fairly a big gulf between a normal sovereign immunity waiver and specifying a specific asset like a port as collateral.

Our findings make clear comparable rumours that borrowing governments have pledged strategic belongings like land or ports in trade for Chinese language finance. These contain Zambia (Kenneth Kaunda Airport), Uganda (Entebbe Airport) and Montenegro (Port of Bar).

The debt entice diplomacy concern that debtors’ strategic belongings are immediately (and intentionally) in danger from Chinese language banks continues to fail the take a look at of proof.![]()

Deborah Brautigam, Bernard L Schwartz Professor of Worldwide Political Economic system, Johns Hopkins College

This text is republished from The Dialog beneath a Artistic Commons license. Learn the unique article.

We’re a voice to you; you might have been a help to us. Collectively we construct journalism that’s impartial, credible and fearless. You’ll be able to additional assist us by making a donation. This may imply rather a lot for our means to carry you information, views and evaluation from the bottom in order that we will make change collectively.

[ad_2]

Source link