[ad_1]

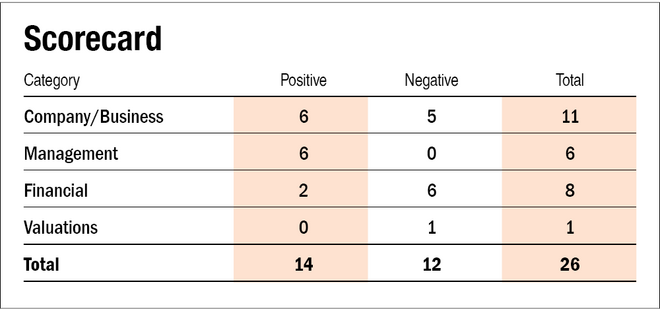

In our earlier a part of Ethos IPO story, we examine the important thing particulars of the IPO. Right here we’ll reply some questions on Ethos and consider it on parameters like administration, financials, valuations, and so forth.

IPO questions

The corporate/enterprise

1) Are the corporate’s earnings earlier than tax greater than Rs 50 crore within the final 12 months?

No. The corporate’s earnings earlier than tax have been Rs 8.1 crore in FY21.

2) Will Ethos be capable of scale up its enterprise?

Sure. The corporate will use part of the IPO proceeds to open 13 new shops. Furthermore, elements like rising discretionary spending on watches, rising penetration of smartwatches and the event of omnichannel markets will assist the corporate scale up its enterprise.

3) Does the corporate have recognisable manufacturers really valued by its prospects?

Sure. The model ‘Ethos’ is effectively recognised and trusted by prospects.

4) Does Ethos have excessive repeat buyer utilization?

Sure. The corporate’s loyalty programme, Membership Echo, brings in about 35 per cent of annual enterprise from repeat prospects.

5) Does the corporate have a reputable moat?

No. Although the corporate is a frontrunner in its trade, it does not have any credible moat.

6) Is the corporate sufficiently sturdy to main regulatory or geopolitical dangers?

No. The corporate is vulnerable to modifications in import duties on watches.

7) Is the corporate’s enterprise resistant to straightforward replication by new gamers?

No. New gamers can and have entered the market.

8) Can the corporate’s product stand up to being simply substituted or outdated?

Sure. Firstly, there are not any substitutes for watches. Second, retailing of watches can happen both via bodily shops or via e-commerce channels. The corporate has a presence in each.

9) Are the shoppers of Ethos devoid of serious bargaining energy?

Sure. The corporate has primarily excessive net-worth prospects, and this can be a fragmented group with luxurious being their main driver of buy.

10) Are the suppliers of Ethos devoid of serious bargaining energy?

No. The corporate’s suppliers are primarily worldwide luxurious watch manufacturers, they usually dictate the phrases and circumstances.

11) Is the extent of competitors the corporate faces comparatively low?

Sure. The principle rivals for the corporate are different watch retailers. Nevertheless, most luxurious and premium watch retailers have few shops in a single or two cities. Furthermore, there isn’t any competitor with a comparable digital presence as Ethos.

Administration

12) Do any of the corporate’s founders nonetheless maintain a minimum of a 5 per cent stake within the firm? Or do promoters maintain greater than a 25 per cent stake within the firm?

Sure. Submit-IPO, the promoter and promoter group will maintain a few 61.7 per cent stake within the firm.

13) Do the highest three managers have greater than 15 years of mixed management on the firm?

Sure. Managing Director Yashovardhan Saboo (additionally one of many promoters) has been the managing director since 2007, and CEO Pranav Saboo has held the place since 2018.

14) Is the administration reliable? Is it clear in its disclosures, that are per SEBI pointers?

Sure, now we have no purpose to consider in any other case.

15) Is the corporate freed from litigation in court docket or with the regulator that casts doubts on the administration’s intention?

Sure. Nevertheless, there are 13 tax-related litigations towards the corporate amounting to about Rs 37 crore.

16) Is the corporate’s accounting coverage secure?

Sure, the corporate’s accounting coverage is secure.

17) Is the corporate freed from promoter pledging of its shares?

Sure. The corporate’s shares are freed from any pledge.

Financials

18) Did Ethos generate a present and three-year common return on fairness of greater than 15 per cent and a return on capital employed of greater than 18 per cent?

No, the corporate managed to generate a three-year (FY19-21) common return on fairness of 5.2 per cent and a return on capital employed of 14.2 per cent. For FY21, the corporate generated a return on fairness of three.8 per cent and a return on capital employed of 12.9 per cent.

19) Was the corporate’s working money circulate optimistic over the last three years?

No, the corporate has reported working money circulate of Rs -1 crore in FY19, Rs 37 crore in FY20 and Rs 63 crore in FY21.

20) Did Ethos enhance its income by 10 per cent CAGR within the final three years?

No. The corporate’s revenues decreased from Rs 443.5 crore in FY19 to Rs 386.6 crore in FY21.

21) Is the corporate’s internet debt-to-equity ratio lower than one, or is its interest-coverage ratio greater than two?

No. The corporate’s internet debt-to-equity ratio stood at 0.91 as of December 2021. Nevertheless, the curiosity protection was low at 1.29 occasions for FY21. Ethos would use Rs 30 crore of IPO proceeds to repay part of the debt.

22) Is the corporate free from reliance on big working capital for day-to-day affairs?

No. The corporate wants big working capital for its day by day operations. Nevertheless, round R 235 crore of IPO proceeds shall be used to fund these necessities.

23) Can the corporate run its enterprise with out counting on exterior funding within the subsequent three years?

No. The corporate expects its borrowings, present money and IPO proceeds to satisfy its current and anticipated necessities over the subsequent 12 months solely. Thus, the corporate would flip to exterior sources for funding in some unspecified time in the future sooner or later.

24) Have the corporate’s short-term borrowings remained secure or declined (not elevated by larger than 15 per cent)?

Sure. The corporate’s short-term borrowings have just about remained the identical. It was at Rs 61 crore in FY21 and was at Rs 63 crore as of December 2021.

25) Is the corporate free from significant contingent liabilities?

Sure, the corporate is free from significant contingent liabilities. Nevertheless, there are particular claims beneath dispute relating to tax and customs with an mixture quantity of Rs 37 crore.

Inventory/valuations

26) Does the inventory provide an operating-earnings yield of greater than 8 per cent on its enterprise worth?

No, the inventory will solely provide an operating-earnings yield of 0.4 per cent on its enterprise worth.

27) Is the inventory’s price-to-earnings lower than its friends’ median stage?

Not relevant. The corporate does not have a listed peer. Submit-IPO, the corporate’s inventory will commerce at a P/E of round 354.4.

28) Is the inventory’s price-to-book worth lower than its friends’ common stage?

Not relevant. The corporate does not have a listed peer. Submit-IPO, the corporate’s inventory will commerce at a P/B of round 3.6.

Additionally learn our earlier story on Ethos IPO to find out about essential IPO particulars and necessary firm data.

Disclaimer: The creator could also be an applicant on this Preliminary Public Providing.

[ad_2]

Source link