[ad_1]

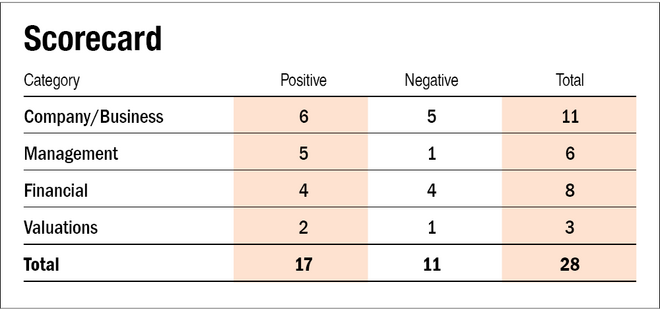

In our earlier a part of Paradeep Phosphates IPO story, we examine the important thing particulars of the IPO together with essential details about the complicated fertilisers producer. Right here we’ll reply some questions on Paradeep Phosphates and consider it on parameters like administration, financials, valuations, and so on.

IPO questions

The corporate/enterprise

1) Are the corporate’s earnings earlier than tax greater than Rs 50 crore within the final 12 months?

Sure. The corporate’s revenue earlier than tax for FY21 was Rs 367 crore.

2) Will Paradeep Phospates have the ability to scale up its enterprise?

Sure. With the acquisition of its Goa facility from ZACL, the corporate’s manufacturing capability will improve by 0.8 MT and it’ll additionally get entry to new markets.

3) Does Paradeep Phosphates have recognisable manufacturers actually valued by its clients?

Sure. The corporate’s manufacturers ‘Jai Kisaan – Navratna’ and ‘Navratna’ are effectively recognised among the many farmers.

4) Does Paradeep Phospates have excessive repeat buyer utilization?

Sure. Farmers buy fertiliser annually and even a number of occasions relying upon want. For the reason that firm is a pacesetter in non-urea fertilisers, it’s secure to say that it has a excessive repeat buyer utilization.

5) Does the corporate have a reputable moat?

No. Though Paradeep Phosphates is a pacesetter in non-urea fertiliser section, it doesn’t have a stable moat.

6) Is the corporate sufficiently sturdy to main regulatory or geopolitical dangers?

No. The corporate extremely relies upon upon import of uncooked supplies. In FY21, imported uncooked supplies accounted for 97.7 per cent of the overall uncooked supplies consumed. Thus any geopolitical stress can have an effect on the corporate.

7) Is the enterprise of the corporate proof against straightforward replication by new gamers?

Sure. Aside from establishing a dependable community, the fertiliser trade is a bit capital intensive and extremely regulated one which is troublesome for a brand new participant to adapt.

8) Is the corporate’s product in a position to stand up to being simply substituted or outdated?

No. Though all farmers want fertilisers, there are a lot of different choices obtainable available in the market for them.

9) Are the purchasers of Paradeep Phosphates devoid of great bargaining energy?

Sure. For the reason that clients are particular person farmers, they don’t have important bargaining energy. Additionally as per NBS coverage, producers are free to repair retail costs for phosphoric fertilisers.

10) Are the suppliers of Paradeep Phospates devoid of great bargaining energy?

No. The corporate extremely relies upon upon few suppliers and one in all them is OCP, an oblique promoter. They could command important bargaining energy.

11) Is the extent of competitors the corporate faces comparatively low?

No. There are a lot of different fertliser producers in India.

Administration

12) Do any of the corporate’s founders nonetheless maintain not less than a 5 per cent stake within the firm? Or do promoters maintain greater than a 25 per cent stake within the firm?

Sure, the corporate’s promoter firm Zuari Maroc Phosphates Non-public Restricted (ZMMPL) will proceed to carry 56.1 per cent stake post-issue.

13) Do the highest three managers have greater than 15 years of mixed management on the firm?

Sure. The corporate’s chairman Saroj Kumar Poddar and Managing director Narayanan Suresh Krishnan have a mixed expertise of greater than 15 years.

14) Is the administration reliable? Is it clear in its disclosures, that are in step with SEBI pointers?

Sure. We now have no motive to imagine in any other case.

15) Is the corporate freed from litigation in courtroom or with the regulator that casts doubts on the administration’s intention?

No. There are a complete of 174 circumstances involving the corporate with 71 felony proceedings. Complete quantity concerned of all circumstances is Rs 561 crore. One such case is by authorities of Maharashtra towards the corporate for not manufacturing and promoting fertilisers adhering to requirements.

16) Is the corporate’s accounting coverage steady?

Sure. We now have no motive to imagine in any other case.

17) Is the corporate freed from promoter pledging of its shares?

Sure. The corporate’s shares are freed from any pledge.

Financials

18) Did the corporate generate a present and three-year common return on fairness of greater than 15 per cent and a return on capital employed of greater than 18 per cent?

No. The corporate’s three yr common ROE and ROCE is 11.7 and 11.4 per cent respectively. In FY21, the corporate’s ROE and ROCE had been 12.2 and 13.7 per cent respectively.

19) Was the corporate’s working money circulation constructive over the past three years?

No. The corporate reported adverse working money circulation in FY19 as a result of improve in inventories and commerce receivables.

20) Did Paradeep Phospates improve its income by 10 per cent CAGR within the final three years?

No. The corporate’s income elevated by 9 per cent from FY19 to FY21. Though we should point out that for two.75-year interval from FY19 to 9 months ended FY22, the revenues have grown at 12 per cent.

21) Is the corporate’s web debt-to-equity ratio lower than one, or is its interest-coverage ratio greater than two?

Sure. the corporate’s web debt to fairness ratio, as of December 2021, is one time and curiosity protection ratio for FY21 is 4.3 occasions.

22) Is the corporate free from reliance on large working capital for day-to-day affairs?

No. Though the corporate is working capital constructive, its common working capital cycle days throughout final three years is 167 days. Combining this with dependence on subsidy from the federal government, there could also be some working capital considerations in future.

23) Can the corporate run its enterprise with out counting on exterior funding within the subsequent three years?

Sure. The corporate is already worthwhile and generates constructive working money circulation. After buying Goa facility, the corporate’s capability would improve too.

24) Have the corporate’s short-term borrowings remained steady or declined (not elevated by better than 15 per cent)?

Sure. The corporate’s quick time period borrowings have diminished by 60.1 per cent from FY19 to FY21. However we wish to point out that from FY21 to 9 months ended FY22, the short-term debt has elevated by 54 per cent.

25) Is the corporate free from significant contingent liabilities?

Sure. The corporate is free from any significant contingent liabilities.

Inventory/valuations

26) Does the inventory supply an operating-earnings yield of greater than 8 per cent on its enterprise worth?

Sure. The inventory will supply 8.6 per cent working earnings yield on its enterprise worth based mostly on its higher value band of subject value.

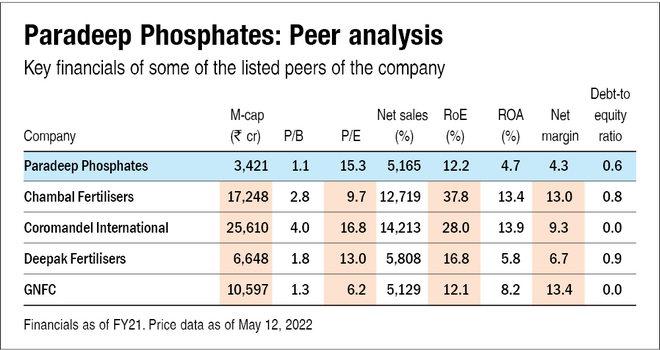

27) Is the inventory’s price-to-earnings lower than its friends’ median stage?

No. The corporate will commerce at a value to earnings ratio of 15.3 occasions in comparison with friends’ median stage of 11.4 occasions.

28) Is the inventory’s price-to-book worth lower than its friends’ common stage?

Sure. The corporate will commerce at a value to guide worth of 1.1 occasions in comparison with friends’ median stage of two.3 occasions.

Additionally, learn our earlier story on Paradeep Phosphates IPO to study key IPO particulars and essential firm data.

Disclaimer: The creator could also be an applicant on this Preliminary Public Providing.

[ad_2]

Source link