[ad_1]

Optimism could also be briefly provide for fairness buyers caught within the downdraft of unstable world markets, however pockets of shelter are rising.

From banks benefiting from interest-rate hikes to shares providing excessive dividend yields and low cost valuations, portfolio managers and strategists are discovering areas of resilience. These prepared to abdomen excessive volatility are betting on China’s eventual reopening.

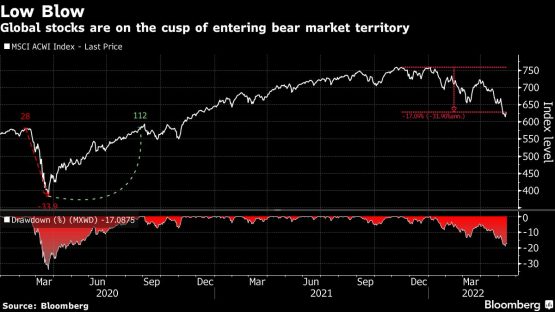

The seek for relative havens comes as riskier property have been roiled by worries over surging rates of interest, inflation and slowing financial development. The speculative fervor that drove meme shares, blank-check corporations and cryptocurrencies has waned. Down 17% from a report excessive hit six months in the past, the MSCI All Nation World Index is nearing a bear market.

“Buyers are caught between fears that earnings and valuations might be beneath strain within the quick time period from these headwinds, but in addition notice that the fairness valuations have declined to ranges which have develop into engaging for long run buyers,” stated David Sekera, chief US market strategist at Morningstar.

Dividend Champions

As corporations navigate a world of rising borrowing prices and enter costs, shares providing buyers earnings through increased dividend yields are being rewarded by the market. The MSCI World Excessive Dividend Yield gauge, which is estimated to supply a yield of three.8% over the subsequent 12 months, has outperformed its broader peer by greater than 10 share factors this 12 months.

“The quick length nature of the high-yielding shares also needs to present safety in opposition to increased rates of interest,” Goldman Sachs Group Inc. strategists led by Timothy Moe wrote in an Asia-focused be aware on Wednesday.

Worth names

Whereas worth shares have outshone development friends amid the tech rout, sectors reminiscent of commodities and financials nonetheless provide room for upside as earnings are set to enhance within the high-inflation, rising-rates setting, strategists say. Earnings forecasts for the S&P Pure Worth Index have risen at a time when outlooks for development friends are worsening quickly, based on Bloomberg Intelligence.

Oil and fuel shares provide a pure hedge in opposition to inflation — significantly vitality inflation — and have outperformed broader indexes by a large margin by means of 2021 and to this point in 2022. The S&P 500 Vitality Index is up 45% to this point this 12 months, outperforming the broader S&P 500, which is down 16%.

Vitality has additionally dominated the record of top-performing world shares on the MSCI World Index this 12 months. Texas-focused Occidental Petroleum Corp. sits on the high after rising 121% to this point this 12 months.

Even after that run, Wells Fargo analysts Nitin Kumar and Joseph McKay wrote “the outlook for the sector stays robust” and the “world market stays structurally under-supplied” for oil and fuel due partly to Russia’s invasion of Ukraine making a tightness in commodities provides.

“Vitality, whereas a consensus lengthy, nonetheless is smart” as an chubby funding class, JP Morgan analysts wrote in a analysis be aware after U.S. inflation information confirmed a higher than anticipated enhance in client costs on Wednesday at 8.3%.

For vitality shares, “the truth that oil costs have stopped going up makes the sector not as engaging as earlier than, nevertheless it stays a sector that may extract fairly an enormous chunk of margins over the others,” stated Andrea Cicione, head of analysis at TS Lombard.

Allocating to corporations with steady earnings development and ample pricing energy “is smart given assist for commodity costs,” stated Marcella Chow, world market strategist at JPMorgan Asset Administration.

China, Southeast Asia

China may at the moment appear to be a contrarian wager, however Credit score Suisse Group AG and Invesco are amongst people who level to an impending rebound as soon as lockdowns ease in main cities reminiscent of Shanghai and Beijing.

Whereas mired in a bear market, China’s benchmark CSI 300 Index gained 2% final week, led by industrial shares, posting its greatest weekly outperformance versus world friends since 2020.

Elsewhere in Asia, reopening Southeast Asian economies are additionally seen providing some alternatives together with in vitality and monetary shares, with the latter holding a virtually 40% weight within the area’s benchmark MSCI index.

“Top quality Asean banks with robust deposit franchises look comparatively nicely positioned,” reminiscent of Indonesia’s Financial institution Central Asia Tbk, stated Ross Cameron, a Tokyo-based fund supervisor of Northcape Capital Ltd.

Utilities, Japan

Defensive shares — whose earnings are much less depending on financial cycles — are additionally seen providing some solace. In Europe the Stoxx 600 Optimised Defensives Index is sort of flat for the 12 months, in comparison with a 15.3% drop within the equal cyclicals index.

Buyers ought to keep “comparatively constructive” on sectors reminiscent of US well being care and European utilities and telecom, Morgan Stanley strategists led by Mike Wilson wrote in a mid-year outlook report.

Total, Morgan Stanley prefers Japanese equities over US shares because of the differing monetary-policy backdrops, cheaper valuations and lightweight investor positioning.

© 2022 Bloomberg

[ad_2]

Source link