[ad_1]

Lemon_tm/iStock through Getty Photos

With earnings being the key theme once more this week, Ritchie Bros. led the gainers, whereas Kornit’s inventory misplaced over 30% of its value.

Regardless of beneficial properties early on Could 13 buying and selling, the S&P 500 (SP500) stays near bear market territory for 2022. For the week ending Could 13, The SPDR S&P 500 Belief ETF (SPY) -2.34% has been within the purple for six weeks a row now. YTD, the ETF is -15.42%. The Industrial Choose Sector SPDR (XLI) -2.53% was within the purple after a uncommon week in inexperienced final week, which had adopted 5 weeks of decline. YTD, XLI -12.01%.

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +10% every.

Ritchie Bros. Auctioneers (NYSE:RBA) +18.23%. The Canadian industrial gear vendor noticed its inventory rise probably the most on Could 10 (+11.98%) a day after its Q1 earnings beat analysts’ estimates. The corporate’s income additionally grew +18.8% Y/Y. YTD, the inventory has risen +1.06%.

Trex (TREX) +13.21%. Winchester, Va.-based decking merchandise maker reported double-digit quantity progress “from “sturdy secular developments” on Could 9. Trex’s Q1 GAAP EPS and income beat estimates and the corporate reaffirmed its FY22 outlook. YTD, the inventory has misplaced greater than half its worth (-53.49%). The Wall Road Analysts’ Ranking is Purchase with Common Worth Goal $76.82.

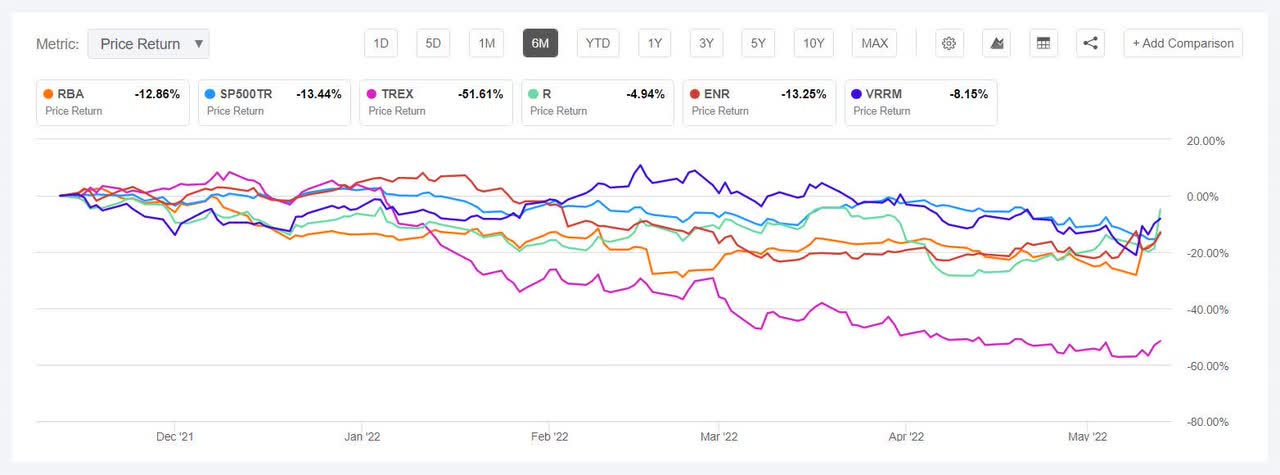

The chart under reveals 6-month price-return efficiency of the highest 5 gainers and SP500TR:

Ryder System (R) +12.55% soared on Could 13 (+17.03%) as a submitting mirrored a takeover bid for the Miami-based logistics options supplier by a shareholder, HG Vora Capital Administration, for a purchase order value of ~$4.4B. YTD, the shares have risen +1.48%, the one different inventory within the high 5 apart from Ritchie Bros. to be within the inexperienced YTD.

Energizer (ENR) +10.97% Q1 non-GAAP EPS and income beat estimates making the inventory soar +11.81% on Could 9. The St. Louis-based battery maker credited a 5% improve in battery and auto care costs pivotal for the constructive outcomes. YTD, the inventory has declined -17.03%.

Verra Mobility (VRRM) +10.30% wrapped up the highest 5, with its inventory rising probably the most on Could 10 (+13.15%) a day after the Mesa, Ariz.-based firm stated its Q1 income grew +89.6% Y/Y. The Wall Road Analysts’ Ranking is Purchase with an Common Worth Goal of $19.57. YTD, the inventory is -3.56%.

This week’s high 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -12% every. YTD, all these 5 shares are within the purple.

Kornit Digital (NASDAQ:KRNT) -31.64%. The Israeli digital printing options supplier’s inventory misplaced a 3rd of its worth (-33.29%) on Could 11 regardless of reporting higher than anticipated Q1 adjusted earnings and revenues however swinging to a GAAP internet loss and guiding Q2 revenues under consensus. The Wall Road Analysts’ Ranking is nonetheless is Robust Purchase with an Common Worth Goal of $89. YTD, the inventory has fallen -71.18%.

Plug Energy (PLUG) -22.57%. The Latham, New York-based firm discovered itself again among the many decliners after three weeks. Plug shares prolonged two-year lows after reporting a bigger than anticipated Q1 GAAP loss and at the same time as revenues practically doubled Y/Y however missed estimates. YTD, PLUG has declined -46.76%.

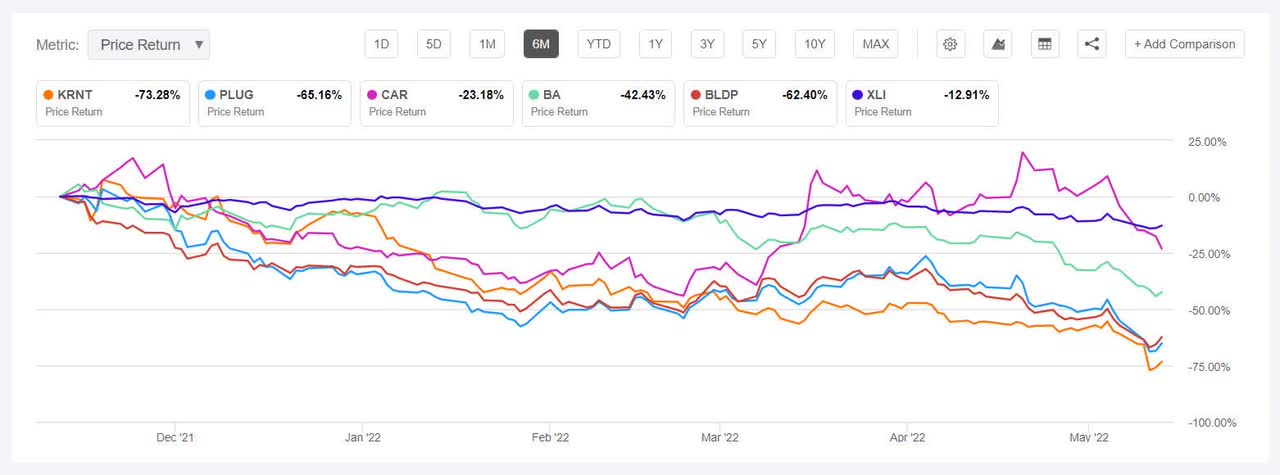

The chart under reveals 6-month price-return efficiency of the worst 5 decliners and XLI:

Avis Finances (CAR) -19.83%. 2021’s finest industrial inventory +455.95% (on this section) had seen higher weeks in and March and April. The automobile/truck rental firm inventory fell all through the week, probably the most on Could 9 (-11.18%) regardless of a report by JP Morgan that the primary indicators of stabilization in used automobile costs has promising implications for rental firms and automakers themselves. YTD, the inventory is marginally down -1.08%.

Boeing (BA) -14.57% inventory misplaced probably the most in the beginning of the week (Could 9 -10.47%) after Air Lease government chairman Steven Udvar-Hazy stated the way forward for the delayed 777X jetliner mission could possibly be in danger. Midweek, Boeing famous that the availability chain disruptions slowed manufacturing and deliveries of its 737 MAX airplane in latest weeks, but it surely didn’t anticipate any change to its general plan for the 12 months. And on the finish of the week, it was reported that the FAA knowledgeable the corporate that paperwork submitted for the resumption of 787 Dreamliner deliveries had been incomplete. YTD, the inventory has misplaced over a 3rd of its worth (-36.82%).

Ballard Energy Programs (BLDP) -12.26%. The Canadian gasoline cell methods developer was again within the losers’ record after a month, this time pushed by its Q1 outcomes, which missed estimates. Q1 internet loss widened Y/Y and whereas revenues grew 19% Y/Y to $21M, it nonetheless fell in need of analyst consensus estimates. SA contributor Henrik Alex wrote, Ballard Energy – No Mild At The Finish Of The Tunnel. YTD, BLDP has declined -45.30%.

[ad_2]

Source link