[ad_1]

Might you please recommend a number of mutual funds or ETFs for Chinese language funding?

– A Rajan

It’s at all times a good suggestion to increase the diversification of your fairness portfolio geographically. Nevertheless it shouldn’t be restricted to any particular area or a fund with a slim mandate. Many traders typically look to put money into region-specific funds, e.g., the funds that make investments solely in Chinese language firms or within the firms of the US. Nonetheless, doing so will increase the focus threat.

Whereas investing abroad, the thought ought to be to search for true-diversified-global publicity. And for that matter, one ought to search for funds that aren’t concentrated in any particular area. As an alternative, a fund investing throughout firms of a number of nations ought to be an choice.

Nonetheless, the sort of firms which might be domiciled within the nation or through which the fund invests in, additionally performs an amazing function. For instance, a US-specific fund might put money into firms domiciled solely in the USA. However in case you look intently, most firms which might be domiciled within the US, particularly the tech giants, have a world shopper base and that shopper base is just not restricted to simply the individuals residing in the USA, e.g., Alphabet (Google), Apple and so forth. So whereas a US-based fund could also be a region-specific fund, due to the sort of firms it invests in, it gives international publicity.

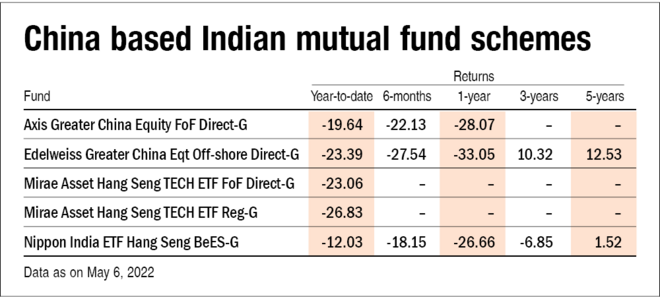

A retail investor ought to ideally keep away from taking a place in funds that make investments particularly in China for the above-mentioned causes. Nonetheless, if somebody nonetheless desires to, the allocation to them mustn’t exceed a small portion of the portfolio, say 5-10 per cent. Right here is the record of Indian funds with a Chinese language theme. Whereas two of those funds are concentrated to Mainland China, the others put money into Grasp Seng, a inventory market index of Hong Kong.

Many of the worldwide funds have stopped accepting recent investments because the mutual fund trade has exhausted the general restrict of abroad funding. Although some funds are nonetheless persevering with with the prevailing SIPs. The mutual fund trade is collectively allowed to not make investments greater than USD 7 billion. Hopefully, the restrict could be revised quickly and the funds will once more begin accepting recent inflows.

Nonetheless, worldwide mutual funds aren’t the one approach to make investments abroad. Liberalised Remittance Scheme (LRS) permits each particular person to take a position as much as USD 2.5 lakh abroad, each monetary 12 months. That is over Rs 1.93 crore – greater than adequate for a retail investor. One simply must open a buying and selling account with a dealer who facilitates buying and selling in overseas shares and so they can then make investments instantly in overseas shares of their selection. In addition to, one may also select to put money into overseas exchange-traded funds (ETFs) monitoring a specific index.

[ad_2]

Source link