[ad_1]

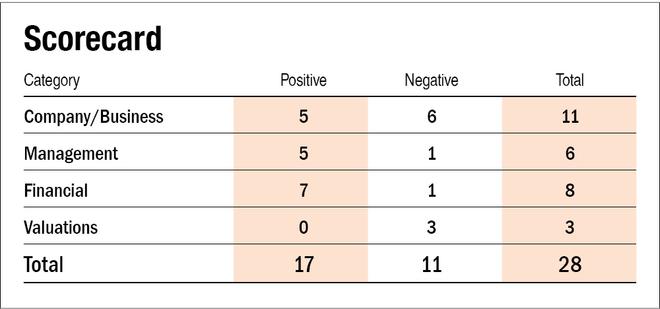

In our earlier a part of Prudent Company IPO story, we examine the important thing particulars of the IPO. Right here we’ll reply some questions on Prudent Company and consider it on parameters like administration, financials, valuations, and many others.

IPO questions

The corporate/enterprise

1) Are the corporate’s earnings earlier than tax greater than Rs 50 crore within the final 12 months?

Sure. The corporate’s earnings earlier than revenue had been Rs 60.5 crore in FY21.

2) Will Prudent Company be capable to scale up its enterprise?

Sure. Given the numerous beneath penetration in mutual funds, the rising share of nationwide distributors in mutual funds distribution and the big presence of the corporate, it is going to be capable of scale up its enterprise.

3) Does the corporate have recognisable manufacturers really valued by its prospects?

Sure. Prudent Company leverages its ‘Prudent’ model to supply technologically pushed options by means of its platforms ‘FundzBazar’, ‘PrudentConnect’, ‘Policyworld’, ‘WiseBasket’, ‘Prubazar’ and ‘CreditBasket’.

4) Does Prudent Company have excessive repeat buyer utilization?

Sure. The corporate receives common SIP inflows from retail traders and furthermore, the MFDs carry many purchasers to the corporate’s platform.

5) Does the corporate have a reputable moat?

No. Though the corporate has sturdy model recognition, a number of different well-recognised distributors supply comparable merchandise and revel in a much bigger slice of the pie.

6) Is the corporate sufficiently sturdy to main regulatory or geopolitical dangers?

No. The corporate is prone to regulatory rulings that scale back the whole trade ratio of mutual funds, which in flip, might scale back the corporate’s income.

7) Is the corporate’s enterprise proof against simple replication by new gamers?

No. New gamers can and have entered the market. These with technologically superior choices can damage the corporate’s operations.

8) Can the corporate’s product face up to being simply substituted or outdated?

No. With the rising use of expertise and the convenience of investing it brings, retail traders (present and potential purchasers) might select to take a position instantly in mutual funds. This could render the corporate’s platform redundant.

9) Are the shoppers of Prudent Company devoid of great bargaining energy?

Sure. As the corporate is a nationwide distributor with a pan-India presence, it enjoys the next bargaining energy with AMCs. This results in the next fee payout to the corporate, and subsequently, the fee payout to the MFDs (prospects of the corporate) is both in-line or barely increased than the fee earned by them whereas working as a standalone entity. Thus, being related to Prudent Company is helpful to the MFDs.

10) Are the suppliers of Prudent Company devoid of great bargaining energy?

No. Whereas being a pan-India nationwide distributor does present the next bargaining energy, the chance of regulatory actions caps the fee revenue that may be earned by the corporate.

11) Is the extent of competitors the corporate faces comparatively low?

No. The corporate operates in a extremely aggressive house with varied home gamers.

Administration

12) Do any of the corporate’s founders nonetheless maintain a minimum of a 5 per cent stake within the firm? Or do promoters maintain greater than a 25 per cent stake within the firm?

Sure. Submit-IPO, the promoter and promoter group will maintain a few 56.8 per cent stake within the firm.

13) Do the highest three managers have greater than 15 years of mixed management on the firm?

Sure. Chairman and Managing Director Sanjay Shah (additionally the promoter) has been related to the corporate since its incorporation in 2003.

14) Is the administration reliable? Is it clear in its disclosures, that are in line with SEBI pointers?

Sure, we’ve no purpose to imagine in any other case.

15) Is the corporate freed from litigation in court docket or with the regulator that casts doubts on the administration’s intention?

No. The corporate’s erstwhile subsidiary, Prudent Comder (now merged with Prudent Broking Providers), is beneath the lens of SEBI for not sustaining correct requirements concerning buying and selling in ‘paired contracts’ whereas the corporate was a member of the Nationwide Spot Trade of India. The corporate has denied the allegation, nevertheless, SEBI has advisable cancelling the certificates of registration of the corporate as a commodity derivatives dealer. The matter is presently pending adjudication.

16) Is the corporate’s accounting coverage steady?

Sure, the corporate’s accounting coverage is steady.

17) Is the corporate freed from promoter pledging of its shares?

Sure. The corporate’s shares are freed from any pledge.

Financials

18) Did Prudent Company generate a present and three-year common return on fairness of greater than 15 per cent and a return on capital employed of greater than 18 per cent?

Sure, the corporate managed to generate a three-year (FY19-21) common return on fairness of 29.1 per cent and a return on capital employed of 36.6 per cent. For FY21, the corporate generated a return on fairness of 33.5 per cent and a return on capital employed of 44.3 per cent.

19) Was the corporate’s working money circulate optimistic over the past three years?

Sure, the corporate has reported optimistic working money circulate over the past three years.

20) Did Prudent Company enhance its income by 10 per cent CAGR within the final three years?

Sure. The corporate’s revenues elevated from Rs 222 crore in FY19 to Rs 286.5 crore in FY21 at a CAGR of 13.6 per cent.

21) Is the corporate’s internet debt-to-equity ratio lower than one, or is its interest-coverage ratio greater than two?

Sure. The corporate was debt-free on a net-debt foundation. Curiosity protection stood at 37.6 occasions for FY21.

22) Is the corporate free from reliance on large working capital for day-to-day affairs?

Sure. Prudent Company funds its operations primarily by means of working money flows.

23) Can the corporate run its enterprise with out counting on exterior funding within the subsequent three years?

Sure. The corporate’s enterprise is asset-light in nature and does not require excessive capital expenditures. Additionally, it generates adequate working money flows.

24) Have the corporate’s short-term borrowings remained steady or declined (not elevated by higher than 15 per cent)?

No. The corporate’s short-term borrowings have elevated from Rs 2.6 crore in FY21 to Rs 33 crore as of December 2021.

25) Is the corporate free from significant contingent liabilities?

Sure, the corporate is free from significant contingent liabilities.

Inventory/valuations

26) Does the inventory supply an operating-earnings yield of greater than 8 per cent on its enterprise worth?

No, the inventory will solely supply an operating-earnings yield of two.4 per cent on its enterprise worth.

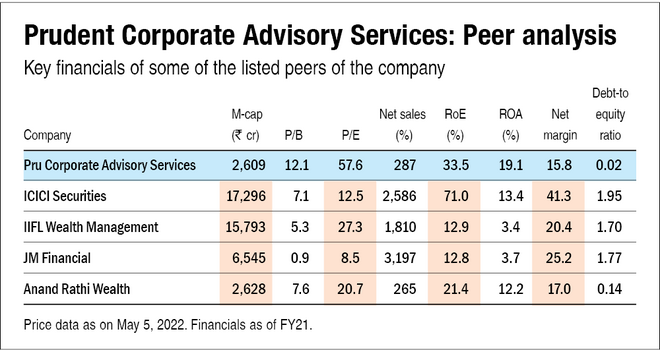

27) Is the inventory’s price-to-earnings lower than its friends’ median degree?

No. Submit-IPO, the corporate’s inventory will commerce at a P/E of round 57.6, which is greater than its friends’ median P/E of 16.6.

28) Is the inventory’s price-to-book worth lower than its friends’ common degree?

No. Submit-IPO, the corporate’s inventory will commerce at a P/B of round 12.1, which is greater than its friends’ common P/B of 5.2.

Additionally, learn our earlier story on Prudent Company IPO to study key IPO particulars and vital firm info.

Disclaimer: The creator could also be an applicant on this Preliminary Public Providing.

[ad_2]

Source link