[ad_1]

Even the gods, it appears, are being singed by inflation, if the expertise of devotees like Shekhar M Shetty is something to go by. Confronted with the rising costs of practically all the pieces, one of many bills the 68-year-old entrepreneur has in the reduction of on are his choices to the divine. “If I used to spend round Rs 100 a day for puja, now I’ve minimize that to Rs 50.”

Whereas he curtails the bills in his private life, in his skilled avatar because the proprietor of Sri Devi Café close to Bengaluru East Railway Station, he plans to extend the charges of a number of the gadgets on the menu by Rs 5-10. He is aware of clients at his eatery — the place a plate of idli prices Rs 30 — are price-sensitive. He has little alternative. “The value of all the pieces has gone up — from cooking gasoline to grease, to electrical energy, to elements. I’ll have to extend costs,” says Shetty, who final undertook such a hike over two years in the past. His resolution is in keeping with a current advisory by the Bruhat Bengaluru Lodge Affiliation to eating places to extend costs by 10% in view of rising prices.

With no fast repair in sight, the present cycle of inflation is prone to be lengthy and grim for Indians, and the belt-tightening that has already begun is prone to intensify.

For 2 consecutive months, February and March, India’s headline retail inflation breached the higher tolerance stage of 6% set by the Reserve Financial institution of India (RBI). In March, client value index (CPI) inflation surged to six.95%, a 17-month excessive, up from 6.1% in February. Each the numbers are alarming, as they transgressed the accepted inflation band of 2-6%, and don’t augur effectively for an financial system that has simply began rebounding after being rammed by the Covid-19 pandemic.

On the again of hovering costs of cereals, greens, meat and fish, oils and fat, client meals value inflation too jumped to a 16-month excessive of seven.7% in March, ringing alarm bells concurrently in Delhi’s North Block and Mumbai’s Mint Avenue. India’s wholesale value index-based inflation additionally jumped to 14.6% in March, from 13.1% in February.

In opposition to this backdrop and, extra importantly, virtually every week earlier than the inflation numbers for April had been anticipated — prone to be launched on Might 12 —the RBI stepped in with an unscheduled coverage announcement. There have been two t a ke aw ay s f r o m R B I G o ve r n o r Shaktikanta Das’ deal with on the afternoon of Might 4.

One, the repo charge, that means the speed at which RBI lends to industrial banks, was raised by 40 foundation factors, one thing which analysts anticipated to occur solely subsequent month. Two, the money reserve ratio (CRR) was hiked by 50 foundation factors, which can drive lenders to put aside extra money with the central financial institution and thus suck out an estimated Rs 87,000 crore liquidity from the system. “As a number of storms hit collectively, our actions right this moment are necessary steps to regular the ship,” stated Das, calling himself an “everlasting optimist”.

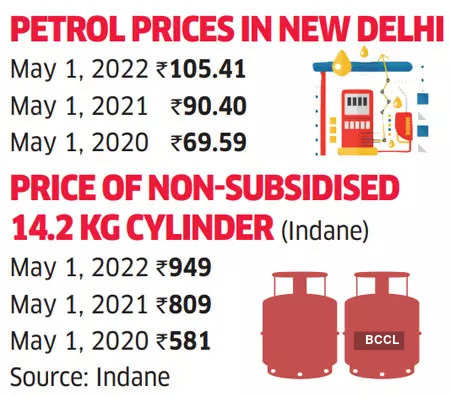

In India, a normal gasoline cylinder of 14.2 kg now prices Rs 1,000 as towards Rs 581 on Might 1, 2020, an increase of 72% in simply two years. Equally, 1 litre of petrol in Delhi prices Rs 105, a steep rise from Rs 70 two years in the past. The Russia-Ukraine warfare, which started in February and continues to be raging, is primarily liable for the spike in vitality costs.

DK Srivastava, chief coverage advisor of EY India, says the menace of inflation could keep put for nearly a yr. “Because the home inflation in India is pushed by world supply-side rigidities and excessive petroleum costs, it’s prone to persist for not less than three to 4 quarters. Provide-side components normally take for much longer earlier than the scenario improves,” he says.

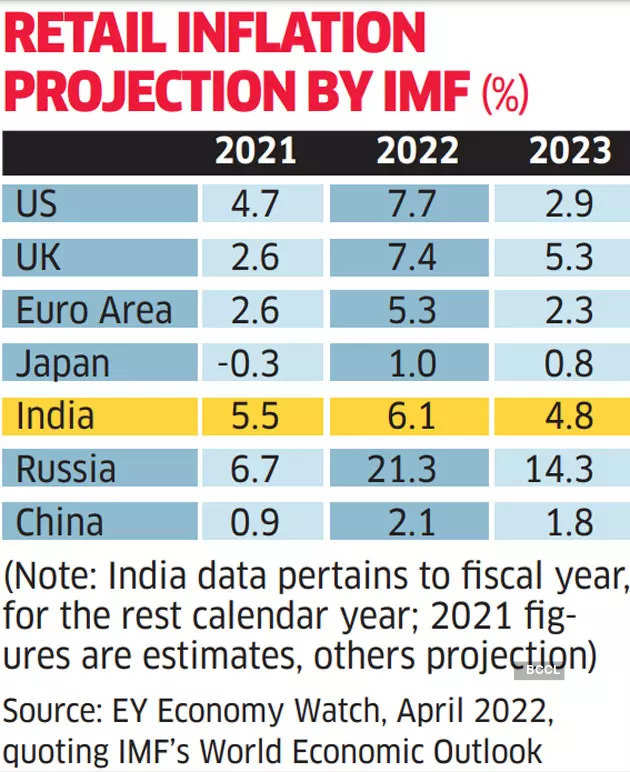

The query is, how lengthy will this excessive inflationary pattern persist? Worldwide Financial Fund’s World Financial Outlook, April 2022, has projected India’s retail inflation at 6.1% for 2022-23, larger than what’s anticipated for Europe (5.3%) and decrease than the estimates for UK (7.4%) and the US (7.7%) — geographies that historically witnessed low inflation however are actually reeling from extraordinary value pressures. Specialists say a spike in commodity costs in addition to tightening of the labour market are the first causes behind such a reversal. The identical report says India’s retail inflation could ease to 4.8% solely in 2023-24. (Information for nations barring India pertain to calendar years.)

PRICEY TAG

Individuals are making an attempt other ways to offset their hovering prices, caused by an ideal storm of things, from the Russia-Ukraine battle to provide chain bottlenecks to a ban on palm oil exports from Indonesia. Puja Jaggi and her daughter Shivani, who run home-baking enterprise Baker Aunty in Delhi’s New Mates Colony, are in a quandary.

“Our distributors have elevated the costs of all the pieces — from cashew nuts and almonds to even castor sugar. A cake would price us `800 to make earlier, and we might promote it for Rs 1,100. However that very same cake right this moment prices us Rs 1,100 to make,” says Shivani. “It’s a troublesome resolution to extend costs as a result of shoppers won’t perceive, they someway count on house bakers to be low-cost.” On a private stage, says Shivani, no costly purchases are on the playing cards.

A h m e d a b a d – b a s e d B i n u Francis, a 27-year-old tech and advertising and marketing guide, says, “I used to be planning to purchase a brand new telephone, however telephones are additionally getting costlier as a result of commerce wars and provide chain points. I changed the battery of my telephone as an alternative and can get a brand new one after two years.”

From particular person households to giant conglomerates, a raft of such choices is being taken. On Tuesday, Coca-Cola India’s president advised ET that extra value hikes are on the playing cards, whereas the heads of corporations like HUL and Britannia have additionally expressed related sentiments. Nestle, in the meantime, has elevated the worth of a 70 g pack of Maggi Masala from Rs 12 to Rs 14.

Among the many most tangible whammies has been the regular upward march of gas costs. Francis, as an illustration, has deferred his resolution to purchase a automobile, within the face of the excessive costs of automobiles and gas, as a result of it “simply doesn’t make sense anymore”.

In Bengaluru, a software program engineer in his 30s, who has requested anonymity, too, has postponed his plan to purchase a brand new automobile this monetary quarter as a result of larger prices and a few current medical bills. He says that when he does purchase, he’ll in all probability purchase a used automobile. “That makes extra sense economically,” he says.

S&P World Scores’ chief economist for Asia-Pacific, Louis Kuijs, says they count on India’s inflation to stay elevated in 2022-23, as larger worldwide commodity costs are including to present price pressures in each business and agriculture. “As home demand recovers, we predict these price pressures might be handed on to retail costs to a higher extent,” says Kuijs.

Together with Shetty of Sri Devi Café, many Indians should bear that burden.

[ad_2]

Source link