[ad_1]

The Reserve Financial institution of India is more likely to stick with the tightening of financial circumstances so long as the Russia-Ukraine battle fuels inflation, however would look to melt the blow of the magnitude of tightening by spreading them out, even when it means extra off-cycle financial coverage conferences.

The Reserve Financial institution of India is more likely to stick with the tightening of financial circumstances so long as the Russia-Ukraine battle fuels inflation, however would look to melt the blow of the magnitude of tightening by spreading them out, even when it means extra off-cycle financial coverage conferences.

The off-cycle MPC choice on Might 4 to boost repo fee by 40 foundation factors was one in every of such steps to cut back the ache on the economic system from one large improve to counter the value pressures that may have dealt a giant blow to markets, mentioned central financial institution observers.

Inflation after breaching the higher tolerance band of 6%, might be accelerating as a result of a sustained surge in meals costs, largely as a result of disruptions attributable to the battle, necessitating a fast response from the central financial institution. Moreover, the ban of export of palm oil by Indonesia got here as a bolt from the blue. The recent weather conditions the world over is more likely to cut back farm output which will additional intensify value pressures.

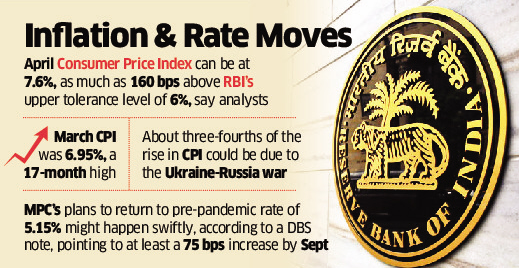

HDFC Financial institution’s chief economist Abheek Barua projected April CPI (client value index) at 7.6%, a superb 160 foundation factors above RBI’s higher tolerance degree of 6%. The March CPI rose to six.95% which is a 17-month excessive. The April CPI print could be launched on Might 12.

Whereas the off cycle could have shocked markets, the central financial institution had ready the marketplace for tightening in its April coverage when its precedence modified from `selling development’ to `curb inflation’. RBI was consciously behind the curve as a result of the economic system wanted extra assist however needed to act when value rise is getting entrenched.

Inflation is prone to changing into extra generalised because the cross by way of of upper enter prices to customers happens with a lag, other than transportation and logistics,” noticed DBS Group Analysis led by chief economist Taimur Baig. “This coupled with the chance that as reopening from the pandemic is full, the character of inflation will shift from being purely items pushed to services-led, making value will increase extra enduring.”

About three-fourth of the rise in CPI was because of the battle, an economist mentioned. If battle involves an finish and inflation stress softens, RBI would possible return to its straightforward financial coverage because the central financial institution feels that the economic system which was recovering from the pandemic-led stress wants extra handholding.

The sharp acceleration in headline CPI inflation in March was propelled by meals inflation because of the impression of opposed spillovers from unprecedented excessive world meals costs. 9 out of the 12 meals sub-groups registered a rise in inflation in March. Excessive frequency value indicators for April point out the persistence of meals value pressures.

The MPC’s plans to return to the pre-pandemic degree of 5.15% may occur swiftly, which factors to a minimum of 75 bps improve by September, the DBS observe mentioned.

The coverage fee should still stay beneath the impartial fee, a degree when the true fee turns into zero.

The rise in coverage charges will surely hamper financial restoration by curbing demand. The RBI is prepared for brief time period sacrifices in an effort to make long run development a sustainable one.

“Inflation have to be tamed in an effort to hold the Indian economic system resolute on its course to sustained and inclusive development. The most important contribution to general macroeconomic and monetary stability in addition to sustainable development would come from our effort to keep up value stability,” Governor Shaktikanta Das mentioned Wednesday after saying the out-of-turn coverage choice.

[ad_2]

Source link