[ad_1]

Loads of traders are fairly nervous that they don’t get same-day NAV after they put money into mutual funds? There are days when markets are down by 1%, 2%, and even 3-4%, and it’s an incredible alternative to put money into equities at decrease NAV!..

Nevertheless as a result of latest modifications by SEBI, Now the NAV is allotted on the conclusion of funds by the fund homes earlier than the prescribed time of three pm.

This merely implies that a lot of the traders will not be capable of get the same-day NAV (besides in a number of instances). This frustrates the traders and so they really feel they’re dropping out on this chance as a result of markets could go up the subsequent day and they won’t get a decrease NAV.

In truth I’m additionally seeing many articles and youtube movies educating traders – “Find out how to get same-day NAV in mutual funds” with out even understanding if it’s well worth the effort or not. There are some methods via which you get same-day NAV like for those who make investments via AMC portal immediately or make investments utilizing UPI within the MFU platform or make investments very early by 10 or 11 am in order that your cash reaches AMC the identical day.

However is it actually well worth the effort?

So we considered doing a small research on this matter and investigating if traders are actually dropping out quite a bit or not?

In our research, we discovered that the same-day NAV or next-day NAV doesn’t matter for traders over the long run and it has virtually no impression on their wealth creation in fairness funds.

Now let me share some stats and what we discovered

For this research, we picked 3 fairness funds which might be fairly previous, which have been

- ICICI Pru Discovery

- Franklin Prima Plus

- Birla Fairness Hybrid 95

Additionally, these are no less than 18 yrs previous funds and we downloaded the NAV of those 3 funds since inception. We’ve got the information for a complete of 4350 NAV factors.

As a subsequent step, we assume that there’s an investor who desires to speculate when markets are down. For that, we picked all these days when NAV of those funds got here down by 1%.

Then we additionally discovered what number of instances NAV of that fund was once more down the NEXT day!!. Let me present you the information

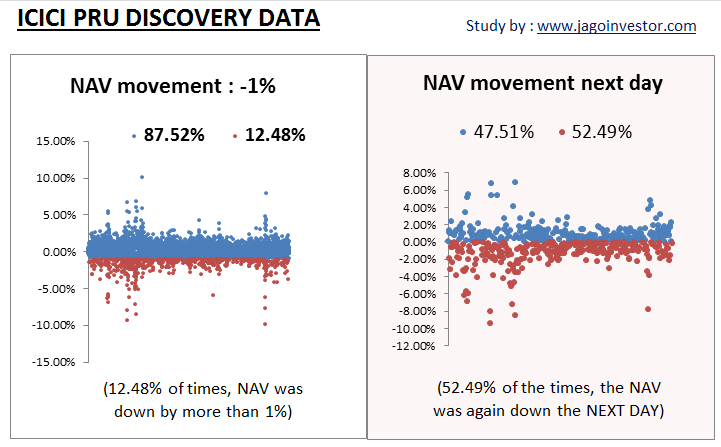

So for those who have a look at the NAV information of ICICI Pru Discovery, there was a complete of 543 out of 4350 days when NAV was down by greater than 1%.

What occurred the subsequent day?

- 258 days, the fund NAV was UP with a mean upmove of 1.02% (common of these 258 days)

- 285 days, the fund NAV was DOWN with a mean downfall of -1.37% (common of these 285 days)

This straightforward implies that on common, the subsequent day NAV was truly decrease than the day of funding and it was an excellent factor to get the subsequent day’s NAV fairly than the identical day’s NAV.

Similar-day NAV or next-day NAV? Which created extra wealth?

Let’s assume that an individual invests Rs 10,000 within the fund each time NAV of the fund is down by greater than 1%, then there are two instances..

- Case 1: Investor same-day NAV

- Case 2: Investor will get next-day NAV

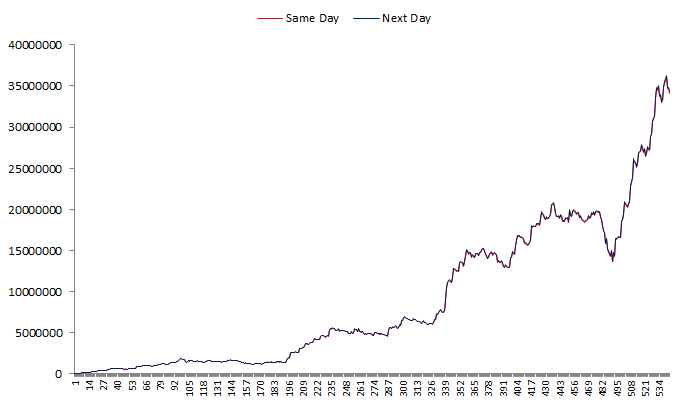

We discovered that the wealth created was MORE in case 2 truly, nonetheless, the distinction was not vital sufficient to brag about. Let me present you the numbers

- Case 1: Investor same-day NAV : Rs 3,47,08,084

- Case 2: Investor will get next-day NAV : Rs 3,48,48,780

The distinction between same-day and next-day NAV is roughly 0.41%, so by getting next-day NAV the traders create 0.41% extra wealth, On this explicit case, it was truly an excellent factor for investor to NOT GET the same-day NAV

Let me additionally present you ways the wealth will enhance over time in each the instances

For those who have a look at the graph above, there are literally TWO charts. The purple line is the expansion of wealth (with Rs 10,000 funding each time markets fall by greater than 1%) in case the investor will get same-day NAV. And there’s a black line that reveals the next-day NAV case. You’ll be able to see that each the traces are so shut that you may actually simply see one single line.

Information with the opposite two mutual funds?

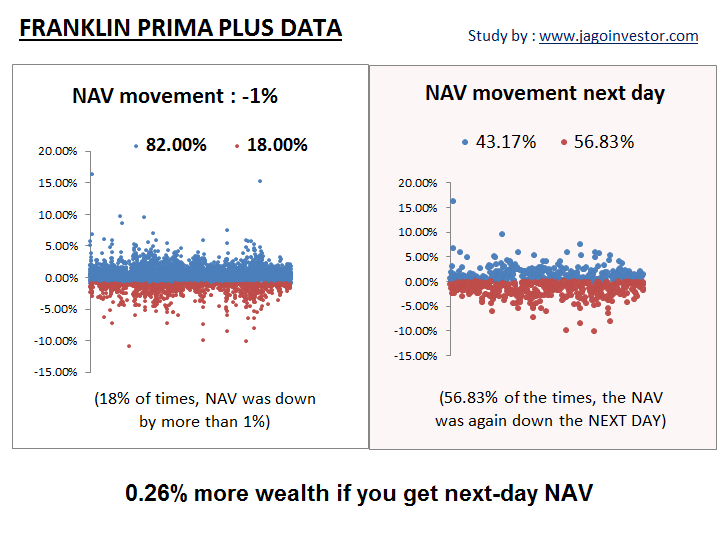

Let me additionally present you an identical research outcomes with Franklin Prima Plus and Birla Fairness Hybrid 95 fund.

Incase of Franklin Prima Plus, each time NAV was down by greater than 1%, the subsequent day NAV fell once more 56.83% of the time and it was extra possible to get a greater NAV if one obtained the subsequent day NAV.

Buyers created roughly 0.26% extra complete wealth by getting the subsequent day’s NAV

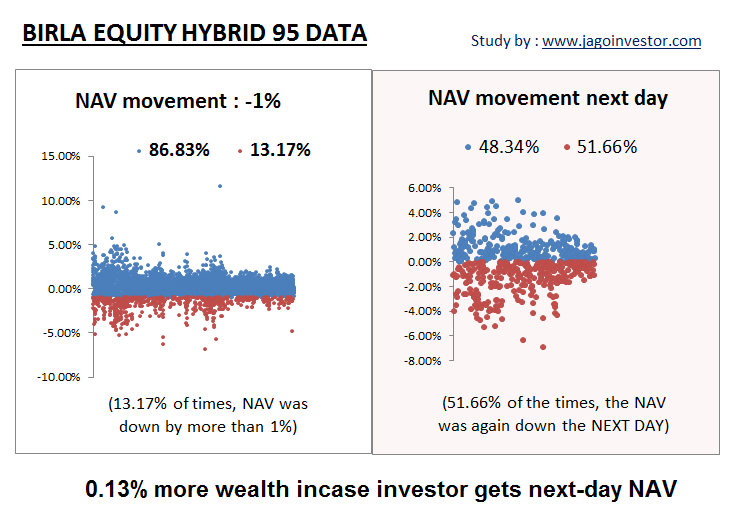

Within the case of the Birla Fairness Hybrid 95 fund each time NAV was down by greater than 1%, the subsequent day NAV fell once more 51.66% of the time and it was extra possible to get a greater NAV if one obtained the subsequent day NAV.

Buyers created roughly 0.13% extra complete wealth by getting the subsequent day NAV.

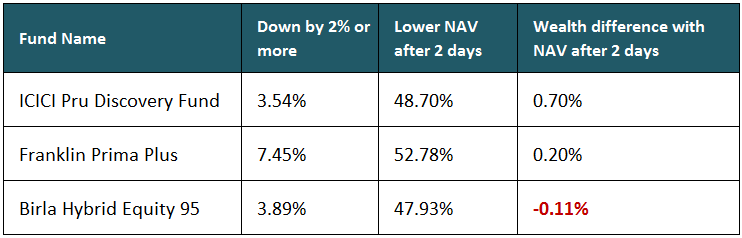

Markets down by greater than 2% and one obtained NAV after 2 days?

Allow us to additionally see what if we modified the information slightly bit. What if one invested when markets have been down by greater than 2% and one obtained NAV after 2 days (not simply the subsequent day)?

If this occurs then how will information change?

You’ll be able to see above that even when one will get NAV after 2 days, nonetheless, two funds created extra wealth. For those who have a look at ICICI pru discovery fund, 3.54% of the instances the NAV of the fund fell by greater than 2%, and each time that occurred, 48.70% of the instances, the subsequent day NAV was additional decrease, it was helpful to get the long run NAV and never same-day NAV.

Ultimately, by getting after-2-days NAV, the particular person was capable of generate 0.70% extra wealth in comparison with same-day NAV.

Conclusion and What we will Be taught

By the point you might have discovered that whereas traders visualize that the day NAV can once more go up, they overlook that the subsequent NAV can go down additionally and so they can get a fair cheaper NAV.

Over time, if you’re a daily investor who’s there for the long run, typically you might get slightly larger NAV the subsequent day and typically you might get a decrease NAV, which finally cancels out the impression. So listed here are the learnings

- For those who get subsequent day NAV, there may be virtually a 50% likelihood that you’re going to get a fair decrease NAV

- Over a very long time, the quantity of wealth you’ll make won’t be very totally different within the case of same-day or next-day NAV

- The fear and frustration will not be price it in any respect, and also you shall simply not fear about what NAV you’re getting.

- If markets leap by 2-3% on a given day and also you need to e book income, then it’s higher to promote the subsequent day as the prospect of getting a greater NAV is larger on the subsequent day as a result of similar logic.

- Whilst you could lose out a bit on a single transaction, there will likely be different transactions when you’ll profit and in totality, you received’t lose out in any respect. In truth, the research reveals that you’re higher off getting the subsequent day NAV to enhance your returns, however then it’s a small margin.

- Subsequent time when markets are down by an excellent quantity, investing on that day is extra necessary than which day NAV you’re getting. So give attention to systematic funding greater than anything

Notice that we’re not discussing on this article if it’s morally proper or fallacious for AMC to provide the subsequent day NAV. These are absolutely technological challenges that should be solved. On this article, we simply needed to do quantity crunching to seek out out which path is best and I hope we did the job

We’d like to hearken to your feedback on this matter and for those who suppose in any other case?

[ad_2]

Source link