[ad_1]

Final month, I began what I referred to as was a walkthrough of Worth Analysis Premium. Our Premium service has many elements and my aim is to familiarise you with all of them, main in addition to minor.

So, for this month, let me ask you probably the most primary query potential: why do you come to Worth Analysis On-line?

In fact, the solutions are as different because the mutual funds and fairness data and analyses on the web site. I will slender it all the way down to a extra focussed query: why did you come to Worth Analysis On-line for the primary time?

Lots of you first got here to Worth Analysis so way back that you could be not bear in mind. Nevertheless, I’ve a good suggestion. Based mostly on the search data on our web site and thru Google, we all know that most individuals first come to Worth Analysis to search for a particular mutual fund. Sometimes, both they’re looking for one thing like ‘finest fairness fund’, ‘finest tax-saving fund’, or ‘good fund for revenue’, or they sort within the identify of a particular mutual fund and they’re in search of data and evaluation about that fund.

Nothing shocking right here, thus far. Ours is probably the most trusted supply in India for mutual fund knowledge and evaluation and clearly, individuals will first come right here in search of data on mutual funds. As soon as they’re right here, they get hooked on different options just like the Portfolio Supervisor, the academic content material and movies, and so on., however the preliminary driver is at all times an pressing must get to know extra a few sort of mutual fund or some particular mutual funds. Up to now, so good. That is what we’re right here for.

Nevertheless, it’s an unlucky undeniable fact that the official ‘varieties’ of funds that exist in India don’t map on to the precise investing wants that you’ve got. To start with, we have to begin fixing the issue of the large variety of mutual funds which can be there for the Indian investor.

Categorisation is at all times a solution to resolve such issues of lots. Nevertheless, as I stated, whereas there may be an official, detailed classification system for funds primarily based on the place the funds make investments, we want a separate one to serve your wants. For Worth Analysis Premium, now we have created one thing totally different primarily based in your investing objectives and wishes. This can be a appreciable evolution of the tried-and-tested framework that Worth Analysis has traditionally had. For instance, now we have at all times had the Worth Analysis star-rating system that divides virtually all funds into 5 high quality tiers, however these 5 tiers are contained inside the regular (SEBI-influenced) system of categorising funds. These classes are a tremendously highly effective analysis software and symbolize the perfect method of dividing funds in accordance with the place they make investments.

Even so, these classes are, by necessity, not structured in accordance with your funding wants. If you would like the best potential returns out of your funds, the research-oriented categorisation system can’t present a set referred to as ‘aggressive development funds’. Nevertheless, that is the form of utility that may be supplied by Worth Analysis Premium.

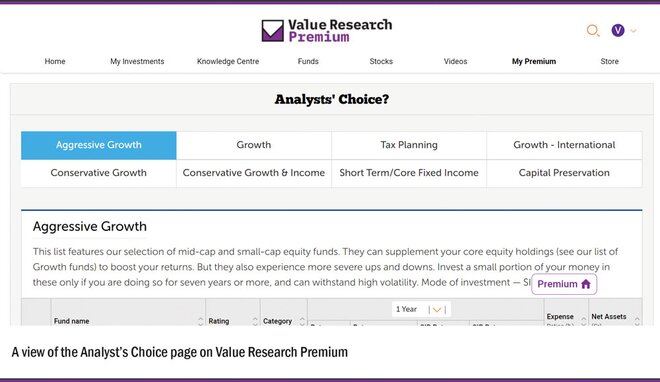

Analysts’ Choic

In Worth Analysis Premium, within the Analysts’ Selection part, now we have eight goal-oriented courses:

- Aggressive development

- Development

- Tax planning

- Development – worldwide

- Conservative development

- Conservative development & revenue

- Brief-term/core mounted revenue

- Capital preservation

The names are self-explanatory. What’s most necessary is that there isn’t a particular person whose funding wants can’t be met by some mixture of those. In Analysts’ Selection, now we have chosen a complete of 44 funds distributed underneath these heads. These are all it is advisable create a portfolio of mutual funds that’s suited to any investing objective.

Not simply that, every part comes with clearly acknowledged pointers as to what these funds are meant for and the way buyers ought to put money into them. All in all, that is the last word end result of the objectives you had while you first got here to Worth Analysis On-line.

Much more

In fact, this is only one a part of the detailed walkthrough I am doing by means of the main options of Worth Analysis Premium. There are different helpful options as nicely, corresponding to:

Portfolio Planner: These are customized portfolios which can be recommended to you as a part of your Premium membership. The algorithm that now we have developed takes under consideration your objectives, your revenue, your saving capability and numerous different components.

Portfolio Evaluation: Whereas some members could also be ranging from scratch, an enormous query for others is whether or not your present investments match into your objectives? That is usually a tough query to reply as a result of there are a whole lot of implications of switching outdated investments, not the least of which is taxation. Within the Premium system, you may get an analysis and a recommended fix-list primarily based on our skilled groups’ inputs.

And these are simply headline options. There are much more that may assist you maintain monitor of your investments, returns, taxation and virtually every part else that may assist you obtain your monetary objectives. Check out Worth Analysis Premium for the complete particulars.

[ad_2]

Source link