[ad_1]

The quickest inflation in a long time and the ensuing rush by central banks to lift rates of interest are stoking recession fears in monetary markets — worries which can be being compounded by the impression of aggressive coronavirus lockdowns in China and the warfare in Ukraine.

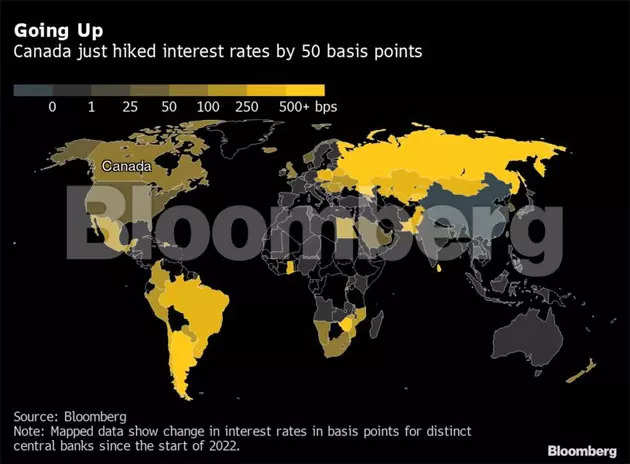

Within the final week alone, the the U.S. and U.Okay. logged inflation accelerating probably the most because the early Eighties and the central banks of Canada and New Zealand offered a mannequin for the U.S. Federal Reserve and others by mountain climbing charges 50 foundation factors for the primary time in 22 years.

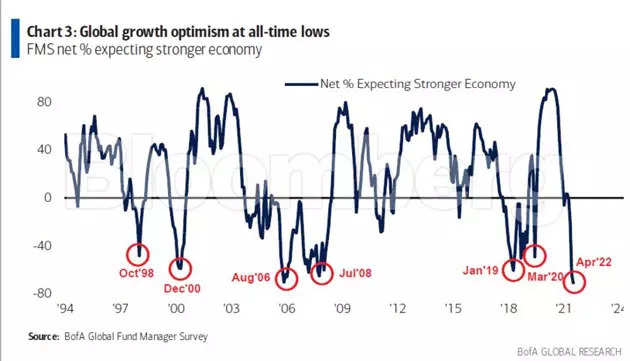

Financial institution of America Corp. reported fund managers have been probably the most bearish they’d ever been in regards to the outlook for development and JPMorgan Chase & Co. boosted its reserves to insulate itself towards an financial deterioration.

Towards such a backdrop, coverage makers head to Washington this week for conferences of the Worldwide Financial Fund and World Financial institution. The Fund is already saying the warfare means it would downgrade its forecasts for 143 economies this yr — accounting for 86% of worldwide gross home product.

“We face a disaster on high of a disaster,” mentioned IMF Managing Director Kristalina Georgieva.

What Bloomberg Economics Says…

“For the worldwide economic system, the mixed impression of warfare and coronavirus can be a yr of decrease development, larger inflation and elevated uncertainty. To get to recession, we’d have to see additional shocks. Russia chopping off Europe’s gasoline provide or China’s lockdown increasing from Shanghai to different main cities are attainable catalysts.”

— Tom Orlik, chief economist

However there are additionally causes to suppose resilience, albeit with a contact of stagflation somewhat than international recession, would be the order of the day, at the least for wealthy nations.

Because of pandemic-era stimulus, households in developed markets nonetheless have 11% to 14% of earnings in financial savings, in keeping with a JPMorgan Chase evaluation despatched to purchasers final week.

Leverage is at multi-decade lows and earnings is advancing at an annual price of about 7% amid tightening labor markets, catalysts for a possible rebound within the second half of the yr. Within the U.S., stories final week on retail gross sales and client sentiment supplied hope all customers aren’t pulling again regardless of value shocks.

“I see extra causes for the worldwide economic system to sluggish than for it to re-accelerate,” mentioned Stephen Jen, who runs Eurizon SLJ Capital, a hedge fund and advisory agency in London. “Nonetheless, whether or not it would fall right into a recession is an entire totally different story, just because the abatement of covid around the globe ought to unleash large pent-up demand, serving to to offset a part of the headwinds.”

The quickest inflation in a long time around the globe is already beginning to flip off many customers, particularly these witnessing larger meals and gasoline payments. About 84% of Individuals plan to chop again on spending due to larger costs, in keeping with a Harris Ballot for Bloomberg Information.

Central bankers are additionally pushing up rates of interest with the Fed now extra seemingly than to not enhance its benchmark by a half-point subsequent month for the primary time since Could 2000 and begin lowering its portfolio of bonds. Chairman Jerome Powell is anticipated to deal with the outlook in an look on Thursday.

One hazard is that coverage makers flip from reacting too late to rising inflation to tightening an excessive amount of as their economies weaken or if inflation seems to be pushed by provide chain woes that financial coverage can’t handle. The fund managers surveyed by BofA noticed an 83% threat of a coverage error.

“The explanation we’re taking a look at a lot slower development is that central banks want to reply by tightening coverage from its presently very straightforward state such that monetary circumstances will tighten and that may restrain demand,” mentioned Karen Dynan, Senior Fellow on the Peterson Institute for Worldwide Economics.

In a precursor of the IMF’s new financial outlook to be launched on Tuesday, Dynan estimated international development will sluggish to three.3% this yr and subsequent, in contrast with 5.8% in 2021.

The large superior economies will broaden solely reasonably this yr and weaken additional in 2023, she mentioned. Giant rising markets face a “divergent” outlook with India enhancing and China grappling with lockdowns and a property downturn.

The tempo of developments this yr has caught policymakers off guard.

The White Home’s high financial adviser Brian Deese mentioned final week that the U.S. faces loads of uncertainty. China’s Premier Li Keqiang mentioned there’s an pressing want for presidency stimulus.

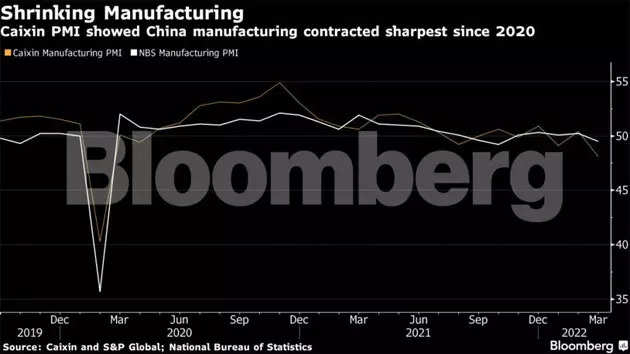

Russia’s invasion of Ukraine has overshadowed a deepening slowdown in China as the federal government continues with its “dynamic zero” strategy to controlling Covid-19, a coverage that has stalled manufacturing in manufacturing and monetary hubs Shenzhen and Shanghai and saved thousands and thousands of individuals at house.

World provide traces that have been nonetheless recovering from the pandemic might also endure an extra setback if China doesn’t management the virus quickly.

Big Manufacturing Co. is among the many producers feeling disruption. It’s ready so long as two years for bicycle components, Chairperson Bonnie Tu informed Bloomberg Tv.

“It’s a hell of job,” she mentioned.

Additionally Learn:

[ad_2]

Source link