[ad_1]

It’s at all times beneficial to stagger your funding in equities over a time frame. Doing so helps common the acquisition price and reduces the danger of investing on the fallacious degree. Park the cash in a liquid fund and arrange a scientific switch plan (STP) from there to the fund of your alternative. Alternatively, you possibly can proceed holding the cash in your checking account and arrange a scientific funding plan (SIP).

As a normal precept, a lump sum needs to be unfold over half the interval it took you to earn that cash. But it surely mustn’t exceed three years. A market cycle normally completes inside that point and one is ready to common the price of buy.

So you probably have obtained your annual bonus and need to spend money on equities, unfold it over the subsequent six months. Likewise, in case you are investing an enormous quantity – lifetime financial savings or say your retirement cash, unfold it over the subsequent three years.

Fairness financial savings funds make investments about one-third in equities, one-third in arbitrage alternatives and the remaining in fixed-income. These funds are appropriate for many who can not stand up to an excessive amount of volatility within the worth of their investments and are content material with reasonable returns that are barely greater than mounted revenue choices.

Arbitrage is all about capturing the profit from the mispricing alternatives between the money and futures market within the fairness phase. That’s how they earn returns. For instance, for instance, there’s a inventory that trades at Rs 100 within the money market and at Rs 101 sooner or later market. So, by recognizing this worth differential, the fund supervisor buys the inventory within the money market at Rs 100 and sells it within the futures market at Rs 101, thereby locking this Re 1 differential by way of these trades.

Investing in arbitrage alternatives is much less dangerous than pure equities and so are the returns. However they’re riskier than investing in fixed-income. So whereas an fairness financial savings fund can be extra risky than a fixed-income fund, it might be much less risky than a pure fairness fund.

Watch the video to know if fairness financial savings funds are higher than arbitrage funds for an SWP.

Although the class has returned over 10 per cent within the final one 12 months, do do not forget that equities are risky, particularly within the brief run, and don’t provide capital safety like a set deposit. And fairness financial savings funds are not any totally different although they fall lower than a pure fairness fund when the market falls. They’ve a smaller allocation to equities.

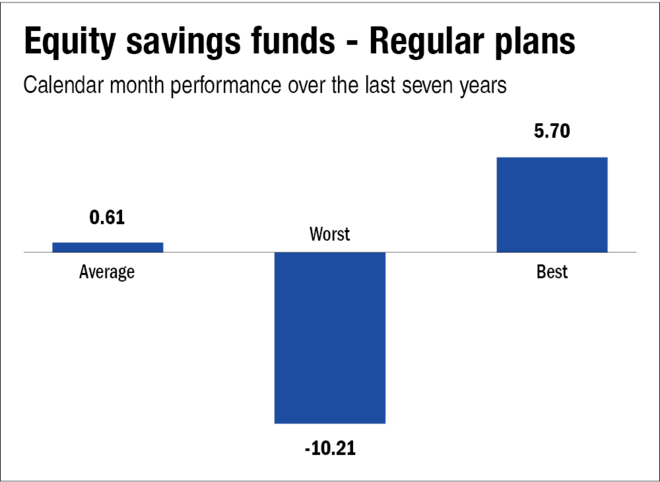

The class’s worst fall in a calendar month during the last seven years was in March 2020 when the markets crashed as a consequence of COVID. The returns had been destructive. They’d fallen by greater than 10 per cent. See the chart under.

Recommended learn: Select the ‘greatest’ mutual fund for YOU

[ad_2]

Source link