[ad_1]

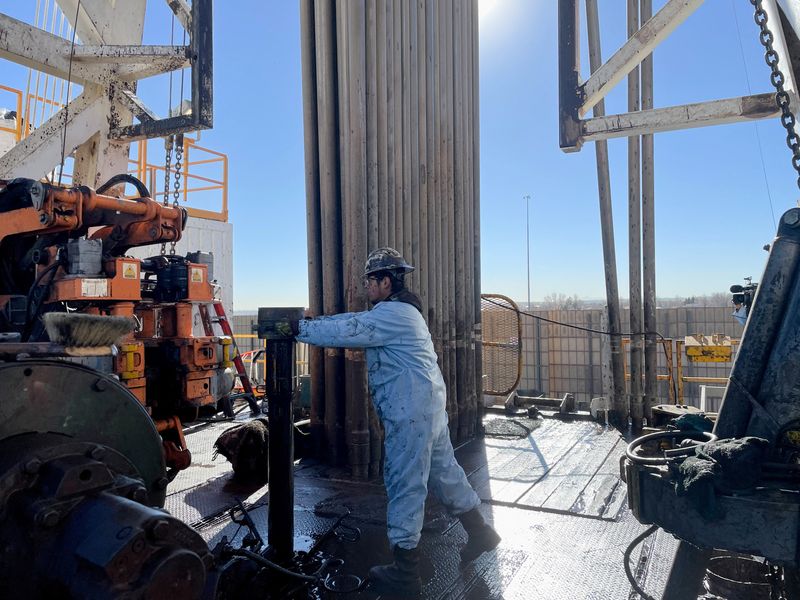

© Reuters. FILE PHOTO: A rig hand works on an electrical drilling rig for oil producer Civitas Sources, on the Denver suburbs, in Broomfield, Colorado, U.S, December 2, 2021. REUTERS/Liz Hampton/File Photograph

© Reuters. FILE PHOTO: A rig hand works on an electrical drilling rig for oil producer Civitas Sources, on the Denver suburbs, in Broomfield, Colorado, U.S, December 2, 2021. REUTERS/Liz Hampton/File PhotographBy Liz Hampton

(Reuters) – U.S. oil manufacturing forecasts are being revised upwards regardless of labor and provide chain constraints as larger costs spur extra drilling and nicely completion exercise, in response to trade specialists.

Calls for brand spanking new oil provides are being answered by extra producers as U.S. costs keep above $100 per barrel, propelled by Russia’s invasion of Ukraine. Costs are up 70% year-over-year, offsetting worries of a second pandemic worth drop and inflation.

U.S. output will finish the 12 months up 1.29 million barrels per day (bpd), at 12.86 million bpd, in response to consultancy East Daley Capital, which carefully tracks vitality equipped to U.S. pipelines. Its newest forecast improve is roughly 300,000 bpd, or 23%, larger than in its December outlook.

The majority of the projected annual rise – 1.13 million bpd – comes from the Permian Basin, the highest U.S. shale subject that has propelled america to an vitality powerhouse. There have been 332 oil rigs drilling there final week, probably the most since April 2020.

“U.S. oil costs are $30 to $40 per barrel larger” than late final 12 months and “rig counts have gotten extra responsive” to that worth motion, stated AJ O’Donnell, a director at East Daley Capital.

PROFITS AT HALF THE LEVEL

At $104 per barrel, oil is roughly twice what Permian Basin producers stated was wanted to profitably drill wells, in response to a Federal Reserve Financial institution of Dallas survey.

March filings for drilling permits there hit 904, a month-to-month excessive, which “displays a strong growth” for horizontal drilling in west Texas and jap New Mexico, stated Rystad Vitality.

Shale companies are also tapping drilled-but-uncompleted wells, standbys that may be rapidly added to manufacturing. The variety of such wells fell in February to 4,372, the bottom since 2013, U.S. information reveals.

On Tuesday, pipeline operator Enterprise Merchandise Companions (NYSE:) forecast U.S. oil manufacturing to succeed in 12.4 million bpd by December, up 800,000 bpd from a 12 months in the past, and inside 5% of the pre-pandemic document.

“There are 9 million productive acres that we’ll name Tier 1 via Tier 4,” based mostly on potential output, Tony Chovanec, a senior vp, informed analysts. “With $80 oil, we predict 2 million acres strikes from decrease tier to prime tier economics.”

LIMITS TO GROWTH

Non-public corporations have ramped up exercise as main oil corporations concentrate on reducing debt and rising shareholder payouts. Publicly traded corporations vowed to enhance returns after years of overspending.

In comparison with oil’s positive aspects, U.S. rig depend will increase to date look “anemic,” stated Tim Roberson, co-founder of Texas Customary Oil, pointing to spending restraints, investor money going to renewable vitality and trade supply-chain issues.

However, he stated, “the second half of the 12 months, it could be probably that the tempo of drilling picks up” as provide chain issues are both resolved or lowered.

Hess Corp (NYSE:) lately stated it could strongly take into account transferring up the timeline for including a fourth rig to its North Dakota operations if costs stay elevated.

Not everybody expects sturdy positive aspects. The U.S. Vitality Info Administration (EIA) this week left unchanged its outlook for an 800,000 bpd improve to 12 million bpd this 12 months. BTU Analytics, a Factset Firm, places U.S. output rising by 962,000 bpd to 12.2 million bpd by the year-end, barely down from a previous forecast.

“We have been bullish on provide because the fourth quarter of final 12 months. It has been sluggish to indicate up,” stated Al Salazar, a senior vp at Enverus, which expects U.S. output to exit the 12 months 1 million bpd larger than 2021.

After declining throughout the pandemic, oil manufacturing started rising in March. Output stayed at 11.6 million bpd for practically two months then rose to common 11.8 million bpd to date this month, in response to the EIA.

“Additional near-term upside is proscribed by tight labor markets and shortages for supplies like metal and sand,” stated Matt Hagerty, a BTU Analytics senior analyst.

(For a graphic on oil manufacturing, click on right here: https://graphics.reuters.com/USA-OIL/OIL/zjvqkdroyvx)

[ad_2]

Source link