[ad_1]

South Africa entered onerous lockdown two years in the past on March 28. On the time, many thought it will final a couple of weeks or perhaps a couple of months at most. As an alternative, the Covid-19 pandemic continues to be with us.

Learn:

Whereas we’re nonetheless making an attempt to determine the short- and long-term implications of the continuing pandemic, we should now additionally contemplate how the brutal Russian invasion of Ukraine will change the worldwide financial and political order.

In different phrases, the world has confronted two profound crises within the area of two years. They are going to trigger far-reaching change, however what precisely? Understanding the current is tough sufficient. Predicting the longer term is effectively neigh inconceivable.

A number of commentary now talks in regards to the world splitting into two blocs, one led by America and one by China (joined by Russia and different intolerant states).

The place South Africa would slot in is unclear.

Native enterprise elites and the center class are inclined to look West, however many political leaders look East.

Professionals research logistics

Nonetheless, one possible consequence is an elevated deal with resilience and safety of provide over velocity, effectivity and price. Anyone working a enterprise will think twice about the place essential inputs come from, the dangers of disruptions and steps wanted to forestall disruption (governments are hopefully doing the identical).

Shortages of pc chips have hobbled auto manufacturing over the previous 18 months, as an example, however extra lately German producers discovered themselves in need of a a lot much less refined half that’s imported from Ukraine, the common-or-garden however essential wire harness.

Common Omar Bradly, the American World Warfare II hero, is claimed to have famous that “amateurs discuss ways whereas professionals research logistics”.

Russia’s generals appear to have forgotten that in planning their invasion of Ukraine, with troopers working out of meals and ammunition and tanks getting caught with out gasoline, however enterprise leaders won’t wish to be caught brief once more.

That stated, a giant a part of the pressure on world provide chains stays the extraordinary demand for items in comparison with the previous. That is one consequence of the pandemic that’s nonetheless with us. Demand for items, significantly by American shoppers, continues to be effectively above pre-pandemic tendencies. Spending on companies has recovered however not again to the place it will have been within the absence of the pandemic. Seen on this mild, provide chains really carried out remarkably effectively to supply and ship record-breaking quantities of products. However not effectively sufficient to keep away from shortages, enormous worth will increase and prolonged lead instances.

US client spending on items and companies, rebased

Supply: Refinitiv Datastream

Neither of those two world crises is over.

China has once more resorted to onerous lockdowns to restrict the unfold of the virus. However in most different international locations it has fortunately change into background noise because of widespread vaccination, immunity from prior an infection, higher therapy choices, much less extreme strains and, frankly, folks merely desirous to get on with their lives. Whether or not we’re actually on the finish of the pandemic stays to be seen, however there’s purpose to be optimistic.

China’s onerous lockdowns of main cities together with Shanghai and Shenzhen will add additional strain to produce chains.

China is the world’s manufacturing facility and can stay so for a very long time even when firms begin diversifying away from a rustic the place coverage has change into much less predictable and geopolitics extra unsure.

The conflict in Ukraine additionally rages on with no speedy finish in sight, even when Russia appears to have given up a few of its unique conflict goals. The market response – with equities up because the first days of the invasion – appears to counsel that traders imagine the worst-case eventualities are much less possible.

The Fed shifts

Nevertheless, within the background one other vital shift is underway.

Central banks, led by the US Federal Reserve, have turned hawkish, that means they wish to act to tame excessive inflation.

The Fed’s most well-liked inflation gauge hit a four-decade excessive of 6.4% in February. Whereas gasoline costs are a part of the story, core inflation excluding meals and gasoline was at 5.4%. Within the Eurozone, inflation hit 7.5% in March, the best because the creation of the one foreign money in 1999. The power worth spike has performed an even bigger position in Eurozone inflation than within the US, however core inflation nonetheless hit a report 2.9%.

Confronted with traditionally excessive inflation and traditionally low unemployment charges, central banks are set to proceed tightening coverage regardless of the more and more unsure development outlook. For a lot of the previous 14 years, central banks, significantly the Fed, had been seen as traders’ buddies. This was significantly true two years in the past once they unleashed unimagined stimulus in response to the Covid shock.

No extra. What lies forward will more and more be a trade-off between sustaining development and decreasing inflation. All indications are that the Fed and firm will now deal with the latter.

No quarter given

Regardless of rate of interest danger, most main world fairness benchmarks had been constructive in March, with China being a notable exception. Nevertheless, the primary quarter return from world equities was decidedly destructive. Other than the shock of conflict, fairness markets have needed to low cost rising rates of interest.

The primary quarter was even worse for bonds. Rising rate of interest expectations noticed yields leap. The benchmark US 10-year Treasury yield rose to 2.32% on the finish of March having began the 12 months at 1.4%. Shorter-term yields elevated quicker, resulting in a flattening yield curve. The US two-year Treasury yield nonetheless ended the quarter at 2.28% having began at 0.7%. Yields rose in different developed international locations too, and the share of bonds with destructive yields has shrunk quickly from a peak of $18 trillion {dollars} to low single digits.

The 8% appreciation of the rand in opposition to the greenback because the begin of the 12 months has compounded the losses from world property for South African traders.

Happily, South African bonds and equities had been constructive, so a diversified portfolio would’ve held up fairly effectively.

The FTSE/JSE Capped SWIX returned 1.5% in March, 6.7% year-to-date and 20% over one 12 months. South African bonds returned 1.8% within the first quarter regardless of volatility in native yields and the massive world bond sell-off. The 12-month return of 12% is effectively forward of money.

Since bonds, equities and the foreign money have been buoyed by elevated commodity costs, they’re all in danger ought to these costs fall sharply.

A 12 months or three

If we have a look at three-year returns, overlaying the final of the pre-pandemic days, the Covid-crash and restoration, and the Ukraine conflict, an attention-grabbing image emerges.

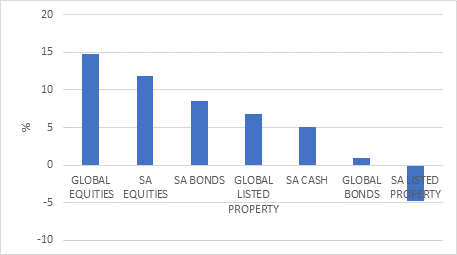

Three-year annualised asset class returns in rand, %

Supply: MSCI, FTSE, JSE, Bloomberg, Refinitiv

International equities returned 14% per 12 months over the previous three years in US {dollars} as measured by the MSCI All Nation World Index. This can be a remarkably good consequence given the turmoil the worldwide economic system confronted.

By way of world bonds, it’s notable that the ballyhooed improve within the benchmark US 10-year yield just about takes it again to the place it was three years in the past. The UK equal is about 60 foundation factors greater than it was three years in the past. Germany’s now trades at 0.5%, whereas it was round 0% in April 2019. It spent a lot of the subsequent three years submerged beneath 0%.

Whereas world bond returns had been implausible whereas yields had been falling, the current rise in yields just about worn out the return of the previous three years.

10-year native foreign money authorities bond yields, %

Supply: Refinitiv Datastream

South African equities (FTSE/JSE Capped SWIX) delivered a 12% annualised return over the three years to finish March. That’s about 7% forward of inflation and in keeping with the long-term (120-year) common actual return.

Nevertheless, the truth is that there are only a few years the place fairness returns line up with the historic common.

The common is made up of blockbuster years, destructive years, and years when nothing a lot occurs. However common years are uncommon.

This means that it’s essential keep invested over a number of years to profit from the nice years once they happen. This additionally implies that it’s essential sit by means of the unhealthy years, since we can’t predict which years might be good or unhealthy.

That is significantly true of native listed property returns. Regardless of gaining 26% over the previous 12 months, the three-year annual return of the FTSE/ JSE All Property Index is -4%. This compares poorly to the 30-year common actual return of round 6%.

South African bonds delivered 8.5% per 12 months, effectively forward of inflation and regardless of the federal government shedding its final funding grade credit standing in March 2020. The July 2021 unrest additionally didn’t meaningfully dent bond returns. On condition that the most effective indicator of future bond returns is solely the yield you pay immediately, the outlook for bond returns stays enticing, particularly given bettering home fundamentals.

Cash market returns are linked to prevailing short-term rates of interest. When the SA Reserve Financial institution minimize charges aggressively two years in the past, cash market returns fell in tow. They are going to now observe the repo fee greater once more, however at this stage nonetheless lag inflation. Additionally it is unlikely that we’ll return to the pre-2020 state of affairs the place short-term rates of interest had been 2% to three% above inflation, providing enticing risk-free actual returns.

In different phrases, the age-old risk-return trade-off is again.

Lastly, on the finish of March the rand was solely barely weaker in opposition to the greenback in comparison with three years in the past and never removed from the place it was six years in the past. The concept that the rand all the time falls and boosts world returns for South Africans is solely not true. The long-term development is weaker, however there might be lengthy durations of sideways motion or appreciation. This must be thought-about.

In abstract

The world confronted main shocks prior to now two years and is present process financial and political modifications that we don’t but absolutely comprehend. But funding returns had been fairly good. Buyers who ignored the noise and caught to their technique would have performed effectively.

It’s straightforward to get carried away with the unhealthy information of the second, however with change there are all the time funding alternatives.

This doesn’t imply blindly extrapolating tendencies since what labored prior to now won’t work as effectively sooner or later. However being appropriately diversified, keeping track of valuations and being affected person will go an extended strategy to attaining the specified consequence.

Izak Odendaal is an funding strategist at Outdated Mutual Wealth.

[ad_2]

Source link