[ad_1]

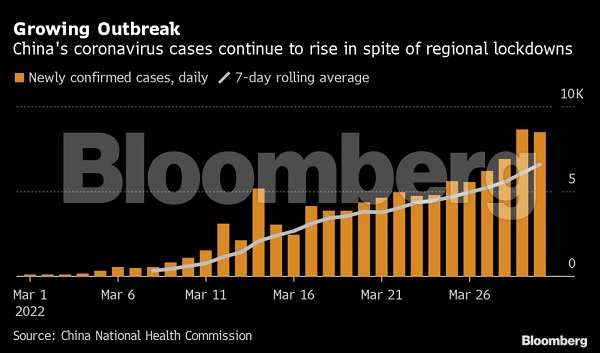

China’s Covid lockdowns are placing the economic system underneath pressure and threatening to disrupt world provide chains, prompting Beijing to name for extra contingency plans to take care of the dangers.

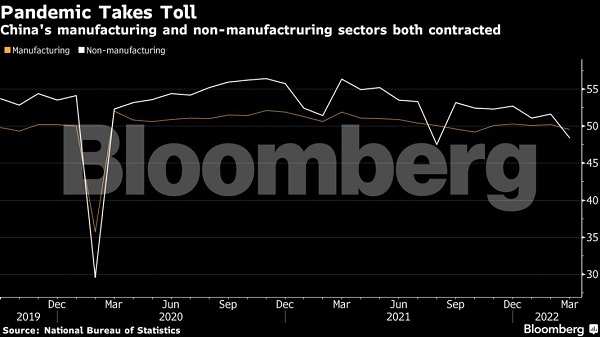

Buying managers’ indexes for March confirmed lockdowns within the expertise and commerce heart Shenzhen and automotive metropolis Changchun reduce manufacturing unit exercise within the month. Providers have additionally been hit arduous as eating places and retail outlets shut due to renewed restrictions and tightened social distancing measures.

Provide chain scares are intensifying as Shanghai — dwelling to the world’s largest container port — battles mounting infections. Covid controls within the metropolis are impacting operations and decreasing effectivity on the port, whereas transport large AP Moller-Maersk has already shut some amenities within the metropolis.

The worsening scenario places strain on coverage makers to step up fiscal and financial help. On Wednesday, China’s Premier Li Keqiang reiterated China will persist with its full-year development goal of about 5.5% regardless of new challenges and elevated dangers. At an everyday State Council assembly, he stated steady development must be a precedence and contingency plans must be drafted to take care of attainable larger uncertainties.

What Bloomberg Economics Says…

The economic system took a success in March. However the declines nearly actually understate the diploma of the deterioration in enterprise circumstances. The April PMIs will more than likely reveal a way more pronounced lurch downward. The info give a inexperienced mild to extra coverage stimulus.

– Chang Shu, chief Asia economist, and David Qu, China economist

Economists warn the scenario might worsen in April, denting development for the second quarter as uncertainty grows in regards to the scope, severity and size of China’s lockdowns. Areas protecting roughly 30% of China’s GDP are affected by the outbreaks, based on Goldman Sachs Group Inc. Natixis SA estimates a 1.8 proportion level reduce to the first-quarter development fee due to the Covid controls.

“Because the Shanghai lockdown solely occurred in late March, financial actions will seemingly sluggish additional in April,” stated Zhang Zhiwei, chief economist at Pinpoint Asset Administration Ltd. “The federal government has made it clear that the precedence is to include omicron outbreaks, which signifies the willingness to sacrifice development within the quick time period if obligatory.”

The central financial institution equally vowed to supply extra help to the economic system in a separate assertion on Wednesday. The Folks’s Financial institution of China reaffirmed that it’ll step up the magnitude of financial coverage and make it extra forward-looking, focused and autonomous.

“With intensified headwinds to development from native Covid outbreaks and coverage makers sticking to full-year targets, we expect the urgency for extra coverage help has elevated,” Goldman’s economists together with Maggie Wei stated in a report. The economists count on extra central financial institution easing steps, together with cuts to coverage rates of interest and the reserve requirement ratio.

The most recent blow to financial exercise got here Thursday morning, as authorities knowledge confirmed manufacturing exercise contracting in March for the primary time in 5 months. It was an unprecedented fall, because the indicator had prior to now risen from February yearly as individuals return to work and companies begin up once more after the Lunar New 12 months holidays.

In Shenzhen, firms like Apple Inc. provider Hon Hai Precision Trade, higher often known as Foxconn, quickly shuttered throughout a week-long lockdown in March. And in Changchun, an industrial hub that accounted for about 11% of China’s whole annual automotive output in 2020, automakers like Toyota Motor Corp. have been compelled to shut.

Some companies have been in a position to resume work by adopting a so-called closed loop system by which workers have been stored at manufacturing unit places and examined usually. Nonetheless, small and medium sized firms took a giant knock, and continued to contract in March, the PMI surveys confirmed.

The injury to consumption might be deeper and extra long-lasting than to manufacturing. Customers have gotten “extra cautious amid the renewed virus flare-up,” Julian Evans-Pritchard, senior China Economist at Capital Economics Ltd., wrote in a word.

[ad_2]

Source link