[ad_1]

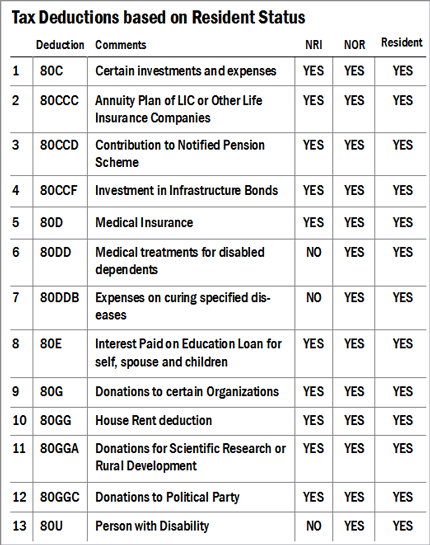

A tax deduction is the discount you’ll be able to declare underneath completely different heads to chop your tax legal responsibility, thereby decreasing your revenue tax. The revenue tax act in India has made allowances for deductions in varied sections, and these are listed beneath.

Part 80C

Part 80C gives a window of funding alternatives of as much as Rs 1.5 lakh in every monetary 12 months. This profit is accessible to everybody, no matter their revenue ranges. As an illustration, in case you are within the highest tax bracket of 30 per cent, the funding of Rs 1.5 lakh underneath this part will prevent Rs 46,800 (together with training and Secondary and Greater Training cess) annually. The varied monetary merchandise that qualify for Part 80C advantages are as follows:

- Life Insurance coverage premium cost

- Dwelling mortgage principal repaid, whereby the principal portion of the house mortgage EMI qualifies for deduction underneath Part 80C

- Staff Provident Fund (EPF) the place 12 per cent of your wage is deducted each month, and an equal quantity is contributed by your employer and put right into a fund maintained by the federal government or your organization’s provident fund belief. Solely your contribution in the direction of the fund is eligible for deduction from taxable revenue of the essential wage.

- Tuition charges for as much as two kids may be claimed. Nonetheless, any cost in the direction of any growth charges or donation to establishments is excluded

- Contributions to the general public provident fund

- Investments within the senior residents’ financial savings scheme

- Financial savings in notified time period deposits in scheduled banks with a minimal interval of 5 years underneath the financial institution time period deposit scheme, 2006.

- Financial savings in submit workplace time deposits with a 5-year lock-in

- Nationwide Financial savings Certificates, five-year government-backed safety out there at submit places of work

- Investments in tax planning mutual funds, popularly often called Fairness-Linked Financial savings Scheme (ELSS)

- Investments in pension plans

- Funding in Sukanya Samriddhi Yojana

- Other than the Rs 1.5 lakh deduction allowed underneath Part 80C, an extra Rs 50,000 deduction is accessible on funding in Nationwide Pension System (NPS)

Different Deductions

Part 80D: Premium funds in the direction of medical insurance coverage for self, partner, kids and oldsters qualify for a deduction. You possibly can declare as much as Rs 25,000 or Rs 50,000 (in case you or your partner is a senior citizen) for self, partner and dependent kids. Extra deduction of as much as Rs 25,000 or Rs 50,000 is accessible for premium paid mother and father’ coverage. Preventive well being check-ups as much as Rs 5,000 inside limits additionally qualify for tax deductions underneath part 80D.

Part 24: Curiosity on a house mortgage with a most deduction of Rs 2 lakh as curiosity cost on the house mortgage.

Part 80E: Curiosity on an academic mortgage qualifies for a deduction on full-time research for any graduate or postgraduate course. Nonetheless, there is no such thing as a profit on principal repayments.

Part 80G: Donations to funds and charities – 50 or 100 per cent of the donated quantity, relying on the charity – is deductible from revenue. However this should not exceed 10 per cent of your whole gross revenue.

Part 80DD: Deduction of as much as Rs 75,000 or Rs 1.25 lakh (in case of extreme incapacity) on the medical remedy of a dependent with a incapacity, licensed by a medical authority.

Part 80DDB: Deduction of as much as Rs 40,000 for a person underneath 60 years of age and Rs 100,000 for senior residents on prices incurred for remedy of specified sicknesses corresponding to most cancers, persistent renal failure, Parkinson’s illness and different listed ailments.

[ad_2]

Source link