[ad_1]

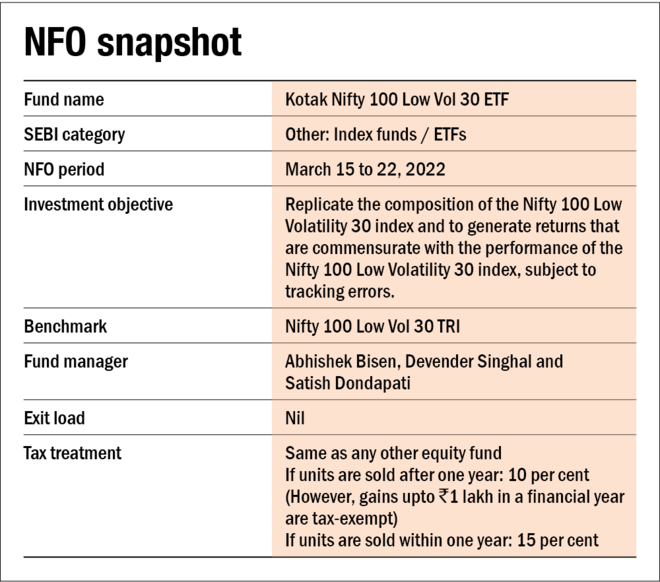

Kotak Mutual Fund has launched a brand new index fund, Kotak Nifty 100 Low Vol 30 ETF, that tracks the Nifty 100 Low Vol 30 TRI. The brand new fund provide (NFO) is open for subscription from March 15 to March 22, 2022. Kotak Nifty 100 Low Vol 30 ETF might be managed by three fund managers; Abhishek Bisen, Devender Singhal and Satish Dondapati. Listed here are the important thing particulars of the NFO:

Concerning the technique

Kotak Nifty 100 Low Vol 30 ETF can be the second to imitate ‘Nifty 100 Low Vol 30 TRI’ after ICICI Prudential Nifty Low Vol 30 ETF. The underlying index consists of top-30 least risky shares among the many top-100 firms by market cap on the Nationwide Inventory Change (NSE), the place the least risky constituent will get the very best weight (capped at 3 per cent throughout quarterly evaluation) and so forth. Volatility right here is calculated as the usual deviation of every day worth returns for the final one 12 months.

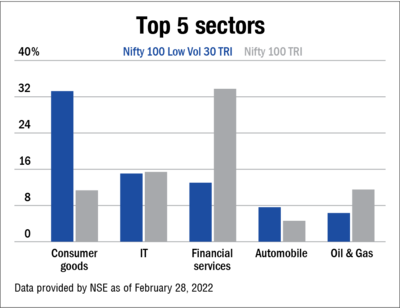

When it comes to sector diversification, the Nifty 100 Low Volatility 30 index appears to be closely tilted in the direction of Client items, however the Nifty 100 index is tilted extra in the direction of Monetary companies and IT, in practically equal proportion. Round 75 per cent of each the indices are concentrated in the direction of the top-5 sectors.

It should be famous that each these indices are market-cap based mostly and thus, each these allocations would endure a change because the market cap of their constituent firms change, at any time when they endure re-balancing, i.e., about twice a 12 months.

Concerning the efficiency

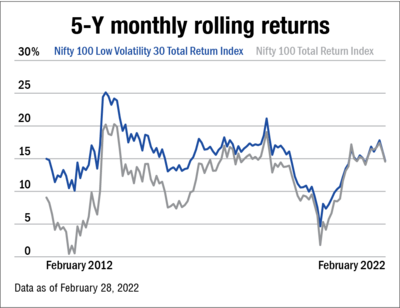

We in contrast the five-year rolling returns of the Nifty 100 Low Vol 30 index with the Nifty 100 TRI. We see that regardless that the fund has outperformed the broader Nifty 100 TRI over the past decade, its efficiency has lowered since 2017. Up to now 6 months, the index has carried out at par with the Nifty 100 TRI. Although, it’s price noting that these are historic tendencies and can’t be extrapolated into the long run.

Concerning the AMC

Kotak Mutual Fund has been within the enterprise since 1998. As of February 2022, the AMC managed property price about Rs 2.75 lakh crore, rating itself sixth within the 41-player mutual fund trade.

Within the open-end fairness funds phase, the fund home manages an asset base of round Rs 99,000 crore throughout 27 home funds. Out of this, the share of passive fairness (index funds/ETFs) is barely Rs 13,000 crore, unfold amongst 13 funds.

Additionally learn: 3 questions it is best to ask earlier than investing in an NFO

[ad_2]

Source link