[ad_1]

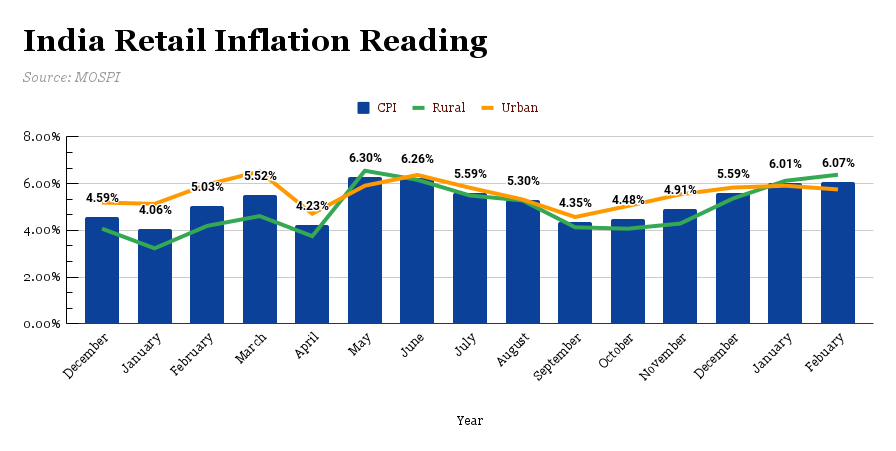

The retail inflation charge in India – measured by the Shopper Value Index (CPI)- got here in at 6.07% in February 2022, as per information launched by the Nationwide Statistical Workplace (NSO) on Friday.

A Reuters ballot of 36 economists had forecast that the studying had seemingly slipped to five.93% in February on an annual foundation.

The retail inflation studying has as soon as once more breached the higher restrict of the Reserve Financial institution of India’s (RBI) Financial Coverage Committee (MPC), the second time since June 2021. In January 2022, the studying had risen to six.01%.

City inflation in February moderated to five.75%, down from 5.91% in January whereas rural inflation got here in 6.38%, as in opposition to 6.12% seen in January. Month-on-month, the mixed retail inflation rose 0.24%, rural & city inflation grew 0.18% & 0.30% every.

Internals:

- Inflation in eggs at 4.15% in February Vs 2.23% in January

- Inflation in oils & fat at 16.44% in February Vs 18.70% in January

- Inflation in greens at 6.13% in February Vs 5.19% in January

- Clothes & footwear inflation in February at 8.86% Vs 8.84% the earlier month

- Gasoline & mild inflation in February at 8.73% Vs 9.32% in January

Earlier right now, information revealed that wholesale inflation measured the Wholesale Value Index (WPI), spiked to 13.11% year-on-year in February, eleventh straight double-digit studying.

On this, rankings & advisory agency CareEdge opined “With geopolitical tensions removed from offering any respite, the resultant disruptions in world provide chains, rising freight prices and a rise in worldwide commodity costs are anticipated to maintain wholesale value pressures elevated at double-digit ranges for the remaining fiscal. Nonetheless, a beneficial base might pull down the general WPI inflation to some extent within the coming months.”

It might be famous that whereas the RBI’s coverage goal is extra CPI-centric, the next WPI inflation studying could also be seen as a precursor to larger shopper costs. It’s because producers might ultimately cross on the uptick in prices to customers.

Analysts are cautious of how the continuing geopolitical strife in Europe would affect the accelerating retail inflation, particularly contemplating the truth that India fulfills its crude wants over 80% by way of imports and the way the risky market might have an overarching affect on costs of shopper items.

RBI now finds itself in a difficult scenario the place it will need to improve the charges to curb the spiking inflation however on the similar time a war-like scenario globally is prone to decelerate actual financial development.

Additionally Learn:

[ad_2]

Source link