[ad_1]

Dragoneer Funding and Tiger International are backing Bazaar, a startup that’s making an attempt to digitize Pakistan’s retail with e-commerce, fintech and last-mile provide chain options, they stated right this moment, becoming a member of a rising checklist of high-profile traders making massive bets within the South Asian market.

The 2 traders are main Bazaar’s $70 million Sequence B funding. Current backers together with Indus Valley Capital, Defy Companions, Acrew Capital, Wavemaker Companions, B&Y Enterprise Companions and Zayn Capital additionally participated within the new spherical, which brings one-and-a-half yr previous startup’s all-time increase to over $100 million.

Bazaar is making an attempt to construct what it calls an “working system for conventional retail” in Pakistan. It’s a $170 billion market that contains 5 million small, medium-sized and enterprises throughout the nation.

However these retailers are largely unbanked and offline right this moment. Banks and different formal monetary establishments don’t lengthen credit score to those retailers as a result of they don’t have a credit score rating. This hole has compelled many of those store operators to take loans from shark mortgage suppliers.

For these following the South Asia protection, this problem will sound very acquainted.

Enterprise-to-business e-commerce Udaan, logistics startup ElasticRun, and Dukaan, a startup that’s serving to outlets go browsing, in addition to scores of startups and giants together with Reliance and Amazon are fixing an analogous drawback in India.

Bazaar is combining many of those choices.

The startup’s B2B e-commerce market, due to its community of a dozen achievement amenities, helps retailers in 21 cities and cities throughout Pakistan procure objects to promote.

These retailers additionally use the startup’s Simple Khata app, which helps them preserve bookkeeping. Bazaar’s monetary arm, referred to as Bazaar Credit score, is providing these retailers, a lot of whom function neighborhood shops, with short-term working capital financing.

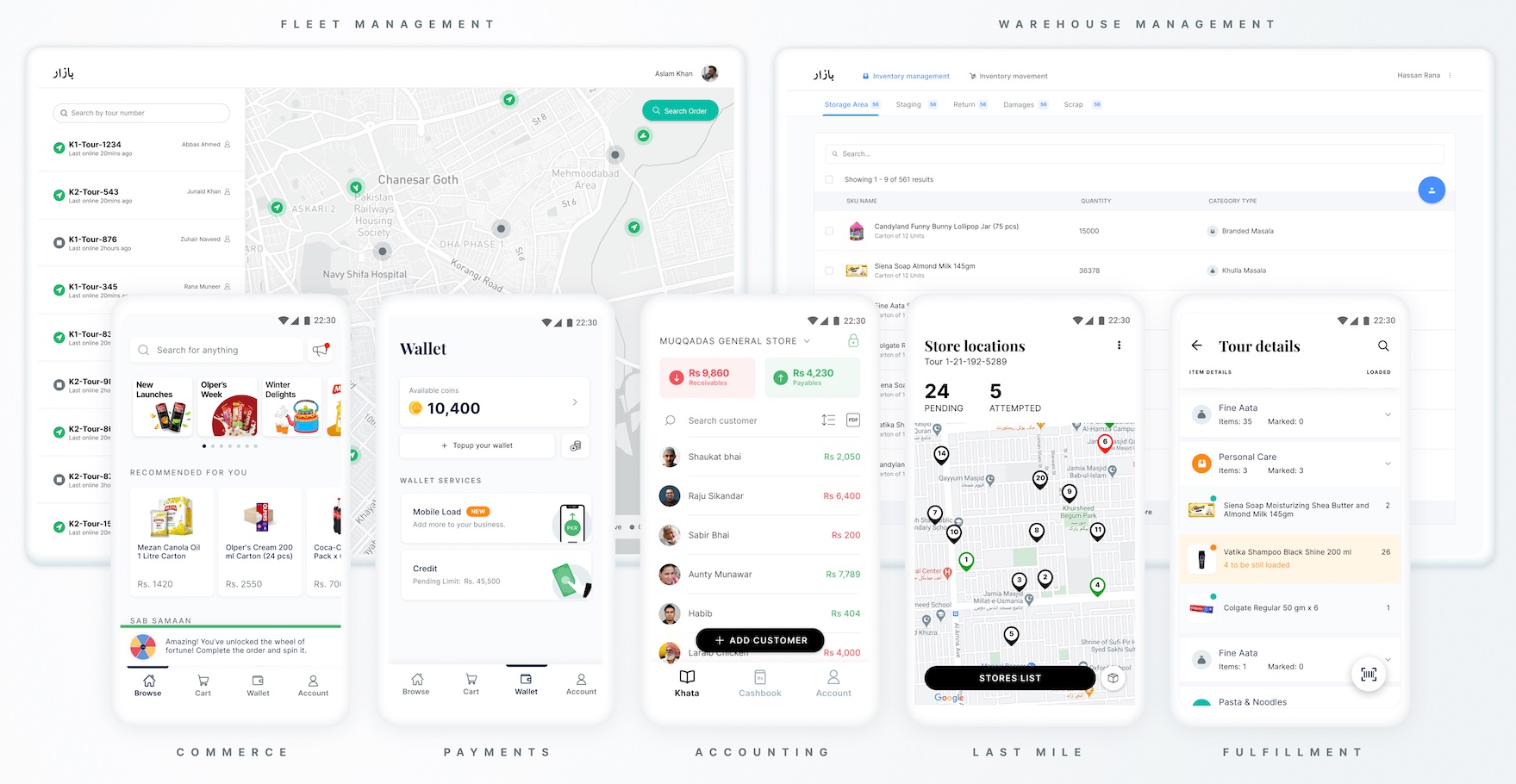

Bazaar’s suite of commerce, fintech and provide chain merchandise

Piecing collectively a lot of its providers is smart for a startup like Bazaar in Pakistan because it allows the startup to supply a extra complete set of values to a service provider and Simple Khata helps the agency win prospects, stated Saad Jangda, co-founder of Bazaar, in an interview with TechCrunch.

In August, “we had simply began piloting our credit score product and on the time we had partnered with a third-party,” he stated. “Now, our credit score product is developed fully in-house and is digitally-enabled that connects to our final mile community. All the things from order era to credit score disbursement to money assortment is finished fully by Bazaar,” he stated.

“We purchase prospects by way of Simple Khata, funnel them by way of commerce, and as soon as we’ve got sufficient information on the retailers, we begin constructing a credit score product atop of it,” he stated, including that the startup has issued 1000’s of loans in current months.

Simple Khata has amassed over 2.4 million registered companies throughout 500 cities in Pakistan. “However extra importantly, Simple Khata is serving as each a core system of data and likewise serving to us launch in new cities,” he stated.

Retailers have recorded over $10 billion in annualized bookkeeping transaction worth on Simple Khata, the startup stated. “Our enlargement inside Pakistan in the previous couple of months is a testomony to how essential Simple Khata is for us,” he stated.

The startup’s final mile community, which was operational in simply two cities in August of final yr, is now including three to 4 cities every month.

“The aim is to maintain constructing for Pakistan. We need to cowl greater than 100 city and rural centres throughout the nation and construct the biggest community within the nation in order that we are able to transfer any class of products from level A to B each time and wherever is required.”

The startup plans to deploy the contemporary capital to develop to extra cities throughout Pakistan and launch new market classes. It’s also working to scale its lending choices and discover new product traces.

Childhood pals Saad and Hamza reconnected in Dubai a number of years in the past. On the time, Jawaid was at McKinsey & Firm whereas Jangda was working with Careem as a product supervisor for ride-hailing and meals supply merchandise. The alternatives they noticed of their house nation drove them again to the nation to construct Bazaar.

“We’re thrilled to help Bazaar’s imaginative and prescient of constructing an end-to-end commerce and fintech platform for tens of millions of unbanked and offline retailers in Pakistan,” stated Christian Jensen, Accomplice at Dragoneer Funding Group. “Bazaar’s tempo of geographic enlargement and new product growth is a testomony to the uncommon expertise and tradition Hamza and Saad have cultivated at Bazaar.”

[ad_2]

Source link