[ad_1]

Bengaluru:

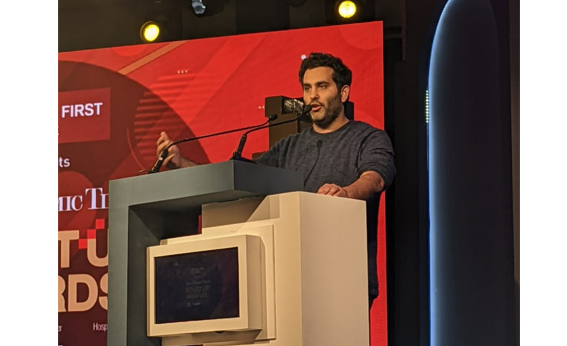

Indian digital financial system and India as a complete is an extremely formidable place and the nation’s startups are on the forefront of the restoration from the pandemic, Instances Web vice-chairman Satyan Gajwani mentioned kicking off a star-studded ET Startup Awards on Saturday.He mentioned that the final two years have been crammed with upheaval and uncertainty and because the world goes by huge upheaval and uncertainty, and excessive oil costs, India is blessed to have the cushion of over $630 billion of foreign exchange reserves.

Gajwani recounted how two years in the past, after the pandemic hit India, March 12, 2020, was the day that a lot of the startups in Bangalore shut their workplaces. The final two years since then have seen ‘real upheaval’ owing to lockdowns and uncertainty.

“But by two years of uncertainty, have a look at the place we’re immediately. The Indian digital financial system and India as a complete is in an extremely formidable place,” Gajwani mentioned.

“We’re now the world’s fastest-growing financial system. And even because the world goes by huge upheaval and uncertainty, India is blessed to have over $630 billion of foreign exchange reserves insulating us from the geopolitical uncertainty that we see immediately.”

He mentioned startups have been on the forefront of the restoration from the pandemic. Final 12 months, he mentioned we had 44 unicorns, pushing the full variety of these billion-dollar startups to 83 that had been value almost $300 billion.

He added that there was lots of pleasure on the grassroots degree, too, as evident from the federal government knowledge. 5 years in the past there have been 733 startups, this knowledge exhibits, however now this has gone as much as 14,000 immediately.

And lots of of those are popping out from the smaller cities and cities, indicating how the accessibility of connectivity is essentially altering the financial system of entrepreneurship.

Not simply the variety of startups, he additionally pointed to the brand new range within the startups. “As a substitute of simply shopper corporations we’re seeing corporations and thrilling areas like synthetic intelligence, drone know-how, house, know-how, clear know-how, and rather more,” he mentioned including how the present geopolitical occasions of the world have additionally taught us the significance of home enterprise.

Gajwani added that greater than large valuations, it was the general public issuance that grabbed consideration. “We hit a brand new milestone this 12 months, with an unprecedented quantity of public issuances, particularly of our startups, they’ve captured all of our consideration.”

He mentioned this may carry transparency and enhance governance. “With it comes transparency, comes daylight on our companies, and the next normal that our companies have to really meet to develop into not simply high-value corporations, however sturdy, sustainable, wholesome corporations for our ecosystem,” he mentioned.

Additionally Learn:

[ad_2]

Source link