[ad_1]

It is extremely troublesome for somebody to vary his/her funding philosophy. However that is exactly what Warren Buffett and different masters of the sport have carried out beneath the affect of Philip Fisher. Referred to as one of many earliest proponents of progress investing, he shot to fame in 1958 following the publication of his guide ‘Frequent Shares and Unusual Earnings’. After dropping out of Stanford Graduate Faculty of Enterprise in 1928, he labored as a securities analyst for just a few years earlier than beginning his personal cash administration agency Fisher & Firm in 1931. He retired in 1999 on the age of 91.

Fisher’s philosophy hinges on progress with a really long-term funding horizon. His well-known 15-point method (defined in his guide) helps traders decide whether or not an organization has succesful and trustworthy administration, possesses robust revolutionary capabilities and might proceed to develop gross sales for a number of years. On the core of this method lies the scuttlebutt technique. Leveraging this technique, retail traders can receive details about an organization from numerous sources, together with distributors, clients and former staff, and so forth. Actually, Philip Fisher used to go to firms in an trade and discuss to every one in every of them about its opponents’ strengths and weaknesses as a way to get an in-depth image of their capabilities.

So, what are you able to be taught from this nice investor? His books may also help you be taught the artwork of long-term progress investing. And because of the character of the scuttlebutt technique, you’ll start to consider shares as companies reasonably than simply tradable devices and inculcate a way of possession reasonably than being a mere speculator. That is an evergreen funding philosophy, particularly in case you are fairly enterprising and assume long-term. So, be taught from the grasp and discover the checklist of firms that we have now ready based mostly on the strategy.

Filters

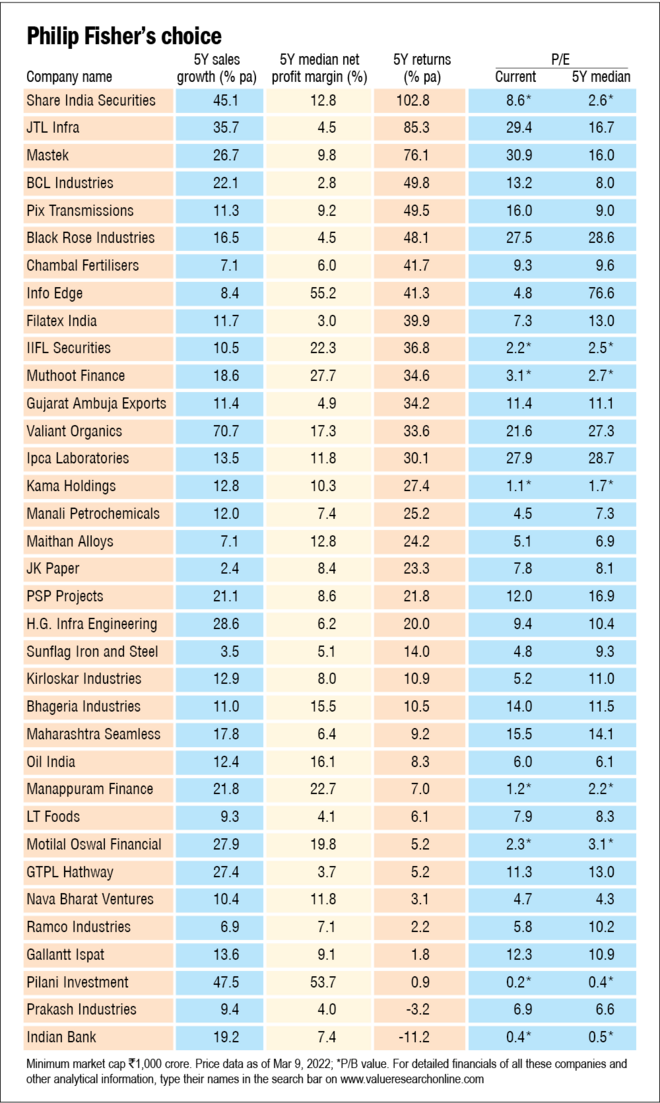

With a purpose to get a listing of Philip Fisher-type firms, we have now utilized the next quantitative filters:

- Optimistic TTM gross sales progress

- 5Y annualised gross sales progress better than 5Y trade median

- TTM internet revenue margin better than trade median

- 5Y median internet revenue margin better than 5Y trade median

- Web revenue margin better than trade median in all 5 years

- Worth to earnings progress (PEG) between 0.1 and 0.5

- Dividend payout ratio lower than 30 per cent

Right here is the checklist of firms that cleared these filters.

Additionally within the collection:

Learn how to choose shares the Buffett & Munger approach

Learn how to choose shares the Benjamin Graham approach

Learn how to choose shares the Joel Greenblatt approach

Learn how to choose shares the John Neff approach

Learn how to choose shares the John Templeton approach

Learn how to choose shares the Peter Lynch approach

[ad_2]

Source link