[ad_1]

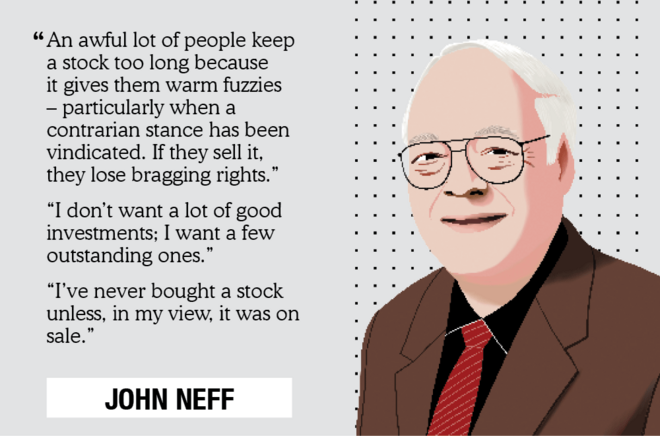

Born in 1931 throughout the Nice Melancholy, after getting poor grades in his college, John Neff joined his father’s firm concerned in supplying industrial gear. Sydney Robbins, Head of the Division of Finance on the College of Toledo, launched him to the world of finance. In 1963, John joined Wellington Administration and a yr later, he was supplied the place of Windsor Fund’s portfolio supervisor. From 1964 to 1995, he delivered returns of 14.8 per cent as in opposition to 10.6 per cent given by the S&P 500 index.

Neff adopted a easy funding strategy – purchase what is affordable. Nevertheless, he didn’t imply right here the inventory’s value however its worth. It implies that if a inventory trades beneath its truthful worth, then, based on Neff, it’s value shopping for. He at all times stayed away from the well-known shares of the market and persistently appeared for shares with low price-to- earnings (P/E) multiples. He was such a textbook worth investor that a mean Windsor inventory had a P/E of just about 60 per cent lower than the market common. This helped him obtain constant returns over a span of 31 years and beat the market returns.

Methodology:

In an effort to get John Neff sort of corporations we utilized the next quantitative filters:

- P/E lower than 15

- Constructive free money move in final three years

- Gross sales and earnings development within the final 5 years between 7 per cent and 50 per cent

- ROE greater than 15 per cent

- Complete return ratio of greater than 1 (Complete return ratio is arrived by dividing 5Y EPS development plus dividend yield by present P/E)

Utilizing the above-mentioned filters, we, at Worth Analysis, have created a listing in our inventory screener which you’ll entry anytime. You may head over to John Neff inventory screener web page.

In at present’s time, the relevance of John Neff ‘s funding philosophy hinges on how buyers interpret it. His philosophy focuses on shopping for corporations buying and selling beneath their truthful worth and P/E is a mere instrument for that as an alternative of the only consideration. The philosophy will stay related all through time so long as buyers equate ‘low cost’ with a inventory’s worth as an alternative of its value.

Additionally within the sequence:

The right way to choose inventory the Buffett and Munger means

The right way to choose shares the Benjamin Graham means

The right way to choose shares the Joel Greenblatt means

[ad_2]

Source link