[ad_1]

Nattakorn Maneerat/iStock by way of Getty Photographs

Bernstein analyst Harshita Rawat distills This fall 2021 and the start of 2022 right down to 10 key insights in assessing U.S. funds shares. The highest one: “‘pandemic & stimulus’ tinted glasses are coming off, bringing some ‘winners’ right down to earth.”

General, Visa (NYSE:V) and Mastercard (NYSE:MA) are the almost certainly inside Rawat’s protection to see optimistic revisions and “enchancment in narrative”. And whereas Russia home publicity is manageable for each firms, “we’re intently watching domino results in cross-border journey.”

The 9 different key insights are:

- “Not all clients are created equal, we’re intently watching buyer acquisition prices (and probably deteriorating unit economics) in a post-pandemic world.”

- “Networks are right here to remain. Income by scaled partnership & buyer engagement beat modest financial savings on card bills.”

- Anticipate one other spherical of deal-making/M&A — “Probably patrons: service provider acquirers (each legacy & new age).” Focus areas are Purchase Now, Pay Later consolidation, business-to-business growth, invoice pay, ecommerce “energy seize, geo growth, software program, crypto.”

- Inflation will assist income of most cost shares. For instance, Visa (V), Mastercard (MA) and acquirers’ income are linked to transaction values. However it’s a unfavourable for firms counting on customers’ discretionary spending, like PayPal (NASDAQ:PYPL).

- “Ecommerce wars are starting amid deceleration, shrinking low-hanging fruit alternatives and altering market panorama.”

- Crypto is a good friend (even when sophisticated) however not a foe.” Rawat factors out that cryptocurrency is a function, not a bug, in that it drives consumer engagement and monetization.

- Rawat offers large tech credit score for persistence in funds, however sees their risk as seemingly overblown.

- Account-to-account is “nonetheless the largest risk we’re watching however we’re sleeping a tiny bit higher at night time.” A2A crucial options reminiscent of request-to-pay, variable recurring funds, and chargebacks are missing, Rawat mentioned.

- Lastly, she asks whether or not tech and fins are beginning a “nice convergence.” Rawat is intently watching the beginning of rewards on such channels as PayPal (PYPL) and BNPL and “some leveling of the taking part in subject as within the BNPL house.

Rawat additionally likes Block (NYSE:SQ) for its Money App clearing occasion, environment friendly buyer acquisition mannequin vs. its friends, and Afterpay deal integration.

In the meantime, PayPal’s (PYPL) threat reward is probably going to enhance a ecommerce deceleration is now well-understood and expectations have been reset decrease. Execution and competitors will likely be key.

Acquirers Fiserv (NASDAQ:FISV) and World Fee (NYSE:GPN) are seen as tactical restoration and valuation trades.

a bunch of cost shares, Visa (V) and Mastercard (MA) additionally price the best by SA Quant score. Affirm Holdings (NASDAQ:AFRM) and Lightspeed Commerce (NYSE:LSPD) display poorly.

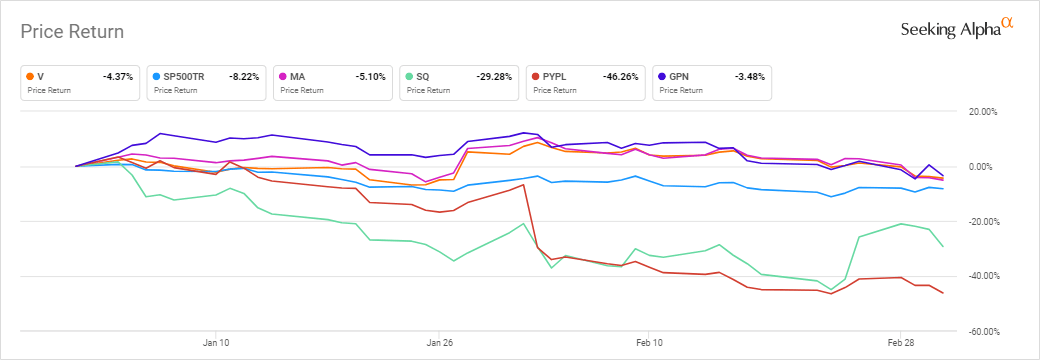

YTD, Visa (V), Mastercard (MA) and World Funds (GPN) shares fall lower than the S&P 500, whereas Block (SQ) and PayPal (PYPL) each dropped greater than the broader index as seen within the graph beneath.

Beforehand (Feb. 2), PayPal, Block, different fintech shares returned to earth after PYPL pivoted on its buyer acquisition technique

[ad_2]

Source link