[ad_1]

Dharmesh, 45, is a seasoned investor. He has been investing in fairness funds for the previous 20 years and has been in a position to accomplish a number of objectives with the assistance of his investments. Nevertheless, through the years, his portfolio has grow to be cluttered with funds throughout varied themes, sectors, market caps, and many others., thereby making it troublesome for him to handle it. He now needs to consolidate his portfolio and spend money on just a few good funds. However with regards to restructuring a portfolio by promoting a number of the funds in it, one has to pay tax on capital beneficial properties. So, he seeks our assist to scale back his capital-gains tax.

What number of funds are sufficient?

At current, Dharmesh is investing in 15 funds, together with two tax-saving, two small-cap, three mid-cap, three thematic, three flexi-cap, one worth and one large-cap fund(s). Ideally, an investor shouldn’t spend money on greater than four-five funds.

For many buyers, investing in two-three flexi-cap funds and one-two tax-saving funds is sufficient. Additionally, for correct asset allocation and rebalancing, one also needs to spend money on one-two short-duration debt funds.

Flexi-cap funds make investments throughout the market-cap segments and sectors and due to this fact present buyers with satisfactory diversification. Tax-saving funds, or equity-linked financial savings schemes (ELSS), are additionally managed in a flexi-cap type. One can make investments as much as Rs1.5 lakh in these in a monetary yr and get tax exemption on that quantity.

Lately many buyers additionally need worldwide diversification, so one can discover including one-two worldwide funds and investing no more than 25 per cent of your corpus in these. Do word that some flexi-cap funds have additionally began taking a measured publicity to worldwide fairness, so these could possibly be explored as nicely.

Investing in mid- and small-cap funds is totally elective and one ought to achieve this provided that one is prepared to take additional threat for additional returns. Additionally, the publicity to mid and small caps shouldn’t be greater than 20-25 per cent of the portfolio.

The subscribers of Worth Analysis Premium can check with the Analysts’ Selection part to see the most effective funds in every of those classes.

How Dharmesh can scale back the variety of funds in his portfolio

Dharmesh can do the next to chop the variety of funds in his portfolio:

- Discover out the funds in his portfolio that haven’t been performing for a number of years and exit them.

- Exit sectoral/thematic funds. These funds present restricted diversification. It is your fund supervisor’s accountability so as to add the deserving sectors/themes to the portfolio. By taking sectoral/thematic calls, you defeat the aim of investing in shares not directly by means of fairness funds.

- As instructed above, Dharmesh ought to assess his threat urge for food and take a name on his mid/smallcap holdings.

- Giant-cap funds are meant for conservative buyers. He can contemplate exiting his large-cap fund. In any case, most flexi-cap funds have a large-cap bias.

- As per the Worth Analysis classification, worth funds are additionally flexi-cap in nature, so he ought to contemplate his as a part of the flexi-cap bucket and resolve on it accordingly.

Decreasing the tax legal responsibility

Dharmesh shouldn’t exit the undesirable funds at one go. As an alternative, he ought to make the transition well and step by step. Additionally, he ought to pay attention to the exit load. It’s higher to attend till a fund turns into exit-load-free.

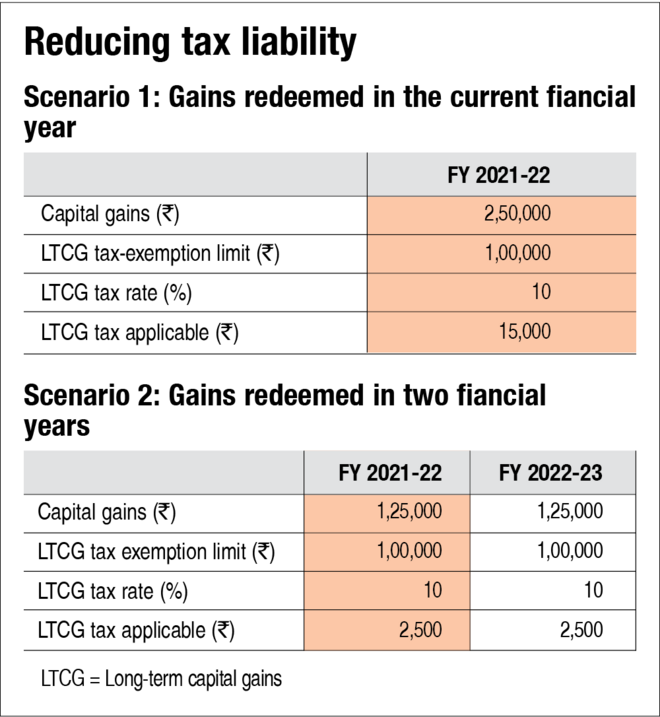

Dharmesh has long-term capital beneficial properties of Rs2.5 lakh. As we stand on the cusp of two monetary years, there may be no higher time to make modifications in his fairness portfolio. Lengthy-term capital beneficial properties on equities as much as Rs1 lakh are exempted in a monetary yr. So, if the beneficial properties on his funding are greater than Rs1 lakh, he can cut up these beneficial properties between this and the subsequent monetary yr. A number of weeks from now, the brand new monetary yr (FY2022-23) would start, which might mechanically refresh his Rs1 lakh exemption restrict. This manner, Dharmesh will be capable of take pleasure in an exemption restrict of as much as Rs2 lakh.

If he redeems the specified quantity on this monetary yr (FY 2021-22), he would want to pay a long-term capital-gain tax of Rs15,000. However, if he breaks his investments between this and the subsequent monetary yr (assuming that capital achieve in every year is Rs1.25 lakh), he could be required to pay a tax of Rs5,000 (see illustration ‘Decreasing tax legal responsibility’).

Dos and don’ts of managing a portfolio

Listed below are some pointers to handle your portfolio for the most effective consequence:

- Restrict your investments to a couple well-performing funds in an effort to assess the efficiency of every fund intently and take well timed choices, if required.

- Whereas the short-term underperformance of your fund shouldn’t set off you to exit it, a chronic historical past of underperformance as in comparison with the class, together with different components reminiscent of a change in fund supervisor, a fast enhance in expense, and many others., shouldn’t maintain you again from making the specified modifications.

- Traders are sometimes interested in sectoral funds after they’ve already rallied. This acts as a recipe for disappointment if a correction follows. As acknowledged above, simply keep away from sectoral/thematic funds and persist with vanilla flexi-cap funds.

- Bear in mind you may solely defer your tax liabilities however you can not write them off. Whilst you ought to all the time search for good methods to scale back your tax legal responsibility, do not preserve ready without end as a result of worry of taxes. This might in the end be extra dangerous to your portfolio. As an example, should you delay switching from common plans to direct, it might save your taxes in the intervening time, however you could ultimately find yourself paying extra fee on the funds, which can deplete your wealth as towards what you could possibly have collected by shifting to direct plans.

Do not ignore these

[ad_2]

Source link