[ad_1]

Like a financial institution mounted deposit, an organization mounted deposit is a deposit with an organization, usually a non-banking finance firm (NBFC) at a hard and fast charge of return over a hard and fast tenure. The speed of curiosity is determined by the maturity of the tenure. Firm mounted deposits are ruled by Part 58A of the Corporations Act.

Options of firm deposits

- Eligibility: You should be a resident Indian. NRIs may put money into them in sure circumstances.

- Entry age: 18 years or older. Minors can open this layer, with the pure guardian working it.

- Investments: Minimal-Rs 1,000. Most-No restrict.

- Curiosity: Is determined by the tenure of the deposit and the issuer.

- Account-holding classes: (i) Particular person (ii) Joint (iii) As specified by the issuer.

- Nomination: Facility is on the market.

Capital safety

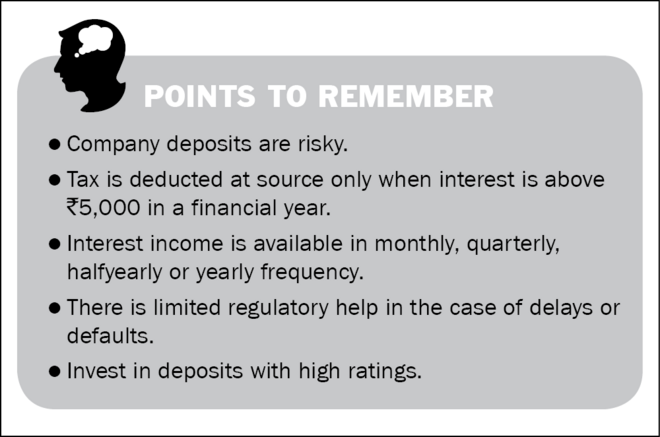

The capital in an organization mounted deposit shouldn’t be protected if the corporate is unable to satisfy its monetary obligations.

Inflation safety

The corporate mounted deposit shouldn’t be inflation-protected. Because of this at any time when inflation is above the assured rate of interest provided by the deposit, the deposit earns no actual returns. Nevertheless, when the rate of interest is larger than the inflation charge, the corporate mounted deposit does handle a constructive actual charge of return.

Funding goal and dangers

The prime goal of investing in an organization mounted deposit is to earn the next rate of interest in comparison with a financial institution mounted deposit. Firm mounted deposits are supply of normal earnings, the frequency of which could possibly be month-to-month, quarterly, half-yearly or yearly.

Suitability and alternate options

- Appropriate for conservative traders searching for assured returns from a lump sum funding for targets as much as 5 years away.

- Not appropriate for long-term wealth creation, given their incapacity to supply any significant returns above the speed of inflation. Additionally, not appropriate for traders seeking to make investments small quantities usually.

- Alternate options may be (i) Nationwide Financial savings Certificates, (ii) Put up Workplace Time Deposits, (iii) Financial institution mounted deposits, (iv) Debt mutual funds could supply higher, although not assured returns.

Ensures

The rate of interest on the corporate mounted deposit is assured so long as the corporate can handle to pay the depositors. Nevertheless, firm mounted deposits are recognized to be delayed and at occasions, firms default on funds.

Liquidity

Firm deposits are liquid to the extent that firms could allow depositors to prematurely terminate their deposits by paying a penalty.

Credit standing

An organization mounted deposit has to have a credit standing from a credit-rating company, resembling CRISIL, CARE or ICRA.

Exit possibility

Untimely encashment of the deposit is permissible however the penalties imposed for such encashment are typically larger than these imposed for financial institution mounted deposits.

Tax implications

The sum invested in an organization mounted deposit or the curiosity that it earns shouldn’t be eligible for any tax concessions. The curiosity earned on a deposit on a yearly foundation is added to the whole earnings and taxed accordingly.

Logging on

Most firm mounted deposits are provided offline. At occasions, they’re bought on-line by a broking account.

The place to make deposits

Deposits may be made instantly with the businesses providing them or by the distributors promoting them.

The best way to purchase

- You might want to fill out the deposit software kind.

- It’s possible you’ll have to submit the unique id proof for verification on the time of shopping for.

- You’ll be able to put money into deposits with money, a cheque, on-line switch or a requirement draft drawn in favour of the corporate or the required entity.

Suggestions and techniques

- The assured return on an organization mounted deposit, like another deposit, can be utilized to create an earnings ladder. Certificates may be purchased each month or quarter for acceptable denominations, which on maturity will act as a gentle earnings stream.

- To unfold the danger of holding firm mounted deposits, make deposits with completely different firms for various durations.

[ad_2]

Source link