[ad_1]

2021 was an amazing 12 months for the funding trade. Sensex returned greater than 23 per cent, and dozens of firms made merry with their blockbuster IPOs. The mutual fund trade had its share of rub off with AMCs netting near Rs 1.9 lakh crores in internet inflows, fuelled by a flurry of latest fund presents (greater than 130!) accumulating unprecedented quantities of cash.

We appeared on the knowledge for probably the most profitable NFOs of final 12 months and located one frequent thread operating throughout – in every of them, an amazing quantity of AUM (over 95 per cent!) was contributed by the Common plans.

That is in stark distinction to their older, current class friends, the place the scales between common and direct plans are usually not so skewed for the online flows. Clearly, the success of NFOs closely relies on the large push from the distributors.

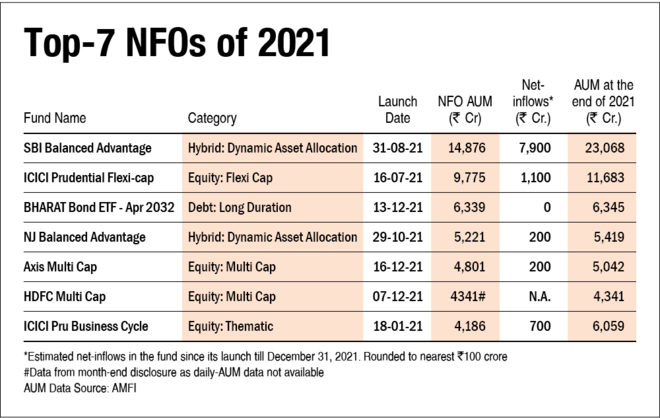

Right here we have a look at among the top-AUM grossing NFOs of 2021 and the way their tales have unfolded after a dream debut.

SBI Balanced Benefit

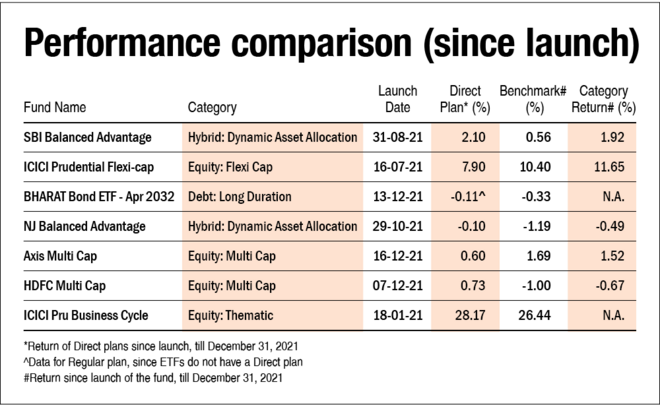

This fund etched its identify within the chronicles of the Indian fund trade by accumulating the best ever AUM in its NFO in August final 12 months. And its dream run hasn’t ended because it has continued to draw inflows like a magnet even after the NFO interval. After beginning with an asset dimension of near Rs 15,000 crore, it has obtained one other Rs 7,900 crore in internet inflows within the final 5 months as per our estimates. Nonetheless, with internet (unhedged) fairness weightage remaining in a decent vary of round 40 per cent, the fund hasn’t proven a lot dynamism in its asset allocation on this quick whereas. The deployed fairness allocation can be tilted closely in the direction of giant caps, suggesting a conservative bias. Efficiency in these preliminary few months has been positive because it has managed to remain forward of the benchmark and a mean peer.

ICICI Prudential Flexi-cap

With fairness markets and, in flip, traders’ curiosity operating excessive, this fund was an instantaneous hit with an NFO assortment of near Rs 10,000 crore in July final 12 months. Nevertheless it’s by no means simple to deploy that sort of cash rapidly when valuations are already trending excessive. Extra so, for a value-conscious fund home like ICICI Prudential. In consequence, it took a few months to speculate even 50 per cent of the AUM in equities, and as per the final disclosed portfolio, the fairness allocation remains to be solely 81 per cent. This warning has come at a possibility value because the fund trails its benchmark and friends by about 2.5-3 per cent in returns since launch. However to be honest, it is higher to tread cautiously than pay the worth of investing recklessly at no matter valuations. However, with 19 per cent nonetheless mendacity in money and equivalents, the fund supervisor would hope that the markets open some good shopping for alternatives quickly, or the traders may begin asking questions.

BHARAT Bond ETF – April 2032

Edelweiss has pioneered passive debt funds in India, and their Bharat Bond sequence of alternate traded funds has caught traders’ fancy. Its fifth tranche, launched in December 2021, isn’t any completely different. The fund comes with a maturity of round 10 years and invests in a portfolio of high-quality bonds issued by PSUs. It raised over Rs 6,000 crore on the time of its launch in December 2021. However in contrast to many fairness ETFs, virtually all its belongings are contributed by the ETF variant, whereas the fund-of-fund (FoF) has raised solely 5 per cent of the full AUM.

In keeping with fortnightly disclosures, the fund hadn’t deployed all of its money by December 15, 2021. Nonetheless, by the top of that month, it had deployed all of it with a mean portfolio yield of 6.99 per cent, which is greater than the indicative yield of 6.87 per cent offered by the AMC throughout the NFO interval.

NJ Balanced Benefit

Regardless of the AMC being the latest on the block, its debut fund made a powerful begin netting round Rs 5,000 crore. It was a exceptional feat, because of the well-entrenched distribution community of its dad or mum NJ Group. The post-launch inflows, nevertheless, have been fairly muted. The fund has allotted about 52 per cent in fairness, out of which allocation in mid and small-caps is greater than 34 per cent, making it one of many extra aggressively managed ones within the context of market cap exposures.

Axis Multi Cap and HDFC Multi Cap

The class of multi-cap funds resulted from a regulatory mishap in late 2019. However, fund firms have grabbed the chance to launch one other fund with each palms. Two AMCs, Axis and HDFC, have been the prime beneficiaries. Each launched their multi-cap funds in December 2021 and rank among the many largest 5 multi-cap funds, because of their uber-successful NFOs. However that is the place their similarities finish.

Axis is build up positions steadily, with solely 57 per cent of AUM invested throughout 43 inventory markets by the top of January. HDFC, alternatively, is sort of absolutely deployed in a seemingly over-diversified portfolio of 106 shares. Notably, Gopal Agarwal can be operating his Massive and Mid-Cap Fund in a similar way with a portfolio unfold throughout 135 shares.

Their alternative of shares just about displays the funding philosophies of the 2 AMCs, with Axis’ growth-oriented portfolio valued rather more richly at a P/E of 35 (the best amongst its friends) whereas that of HDFC at simply 21.

ICICI Prudential Enterprise Cycle

‘Enterprise cycles’ theme has caught the flamboyant of asset managers, with 4 of them launched final 12 months. However the one from ICICI Prudential was most profitable in attracting AUM. Notably, the investor curiosity hasn’t died down publish the NFO as there have been inflows to the tune of Rs 700 crore within the subsequent months per our estimates. It has been over a 12 months since its launch, however the money part within the portfolio has remained above 15 per cent. Regardless of this, the direct plan has managed to beat the benchmark in a rising market, which is spectacular. Going by its theme, the fund is at present betting massive on monetary providers, vitality and development sectors.

[ad_2]

Source link