[ad_1]

Earlier than Thursday’s market motion kicks off, Palantir (PLTR) will ship fourth-quarter financials. Deutsche Financial institution’s Brad Zelnick expects the outcomes will are available in line with the information, which requires income of $418 million.

Nonetheless, the 5-star analyst believes many of the investor focus will flip to the “sustainability and high quality of progress and any preliminary view for C1Q22 and CY22.”

Zelnick notes that the slowdown in Authorities and Industrial income, coupled with “contribution margin compression,” is a worrying signal relating to the long-term alternative and profitability for Palantir.

That stated, after an uncharacteristic 6% drop in C3Q, based mostly on current deal exercise and “wholesome reported backlog metrics,” Zelnick is in search of a major quarter-over-quarter uptick in C4Q Authorities income. Whereas conceding the federal government enterprise is “considerably lumpy in nature,” the analyst continues to consider Palantir’s Authorities alternative is “substantial.” Whereas progress charges are prone to “reasonable,” Zelnick believes the “magnitude of the long-term alternative stays intact.”

However as has usually been famous about Palantir, the large knowledge specialist generates the majority of its income from authorities contracts, which, whereas massive in nature, means many of the gross sales come from just some shoppers. Due to this fact, it’s seen as important for the corporate to make headway within the business section for the enterprise to finally succeed. Right here, Zelnick isn’t positive the corporate has what it takes to make the grade.

“Regardless of some optimistic indicators on new pilots, buyer rely and deal quantity, the move by to Industrial income has been underwhelming to date,” famous Zelnick, who stays “cautious” on the Industrial aspect, believing the chance for Palantir right here is “smaller than many respect.” The analyst sees “proprietary platforms” akin to Palantir offering extra of a “area of interest” service.

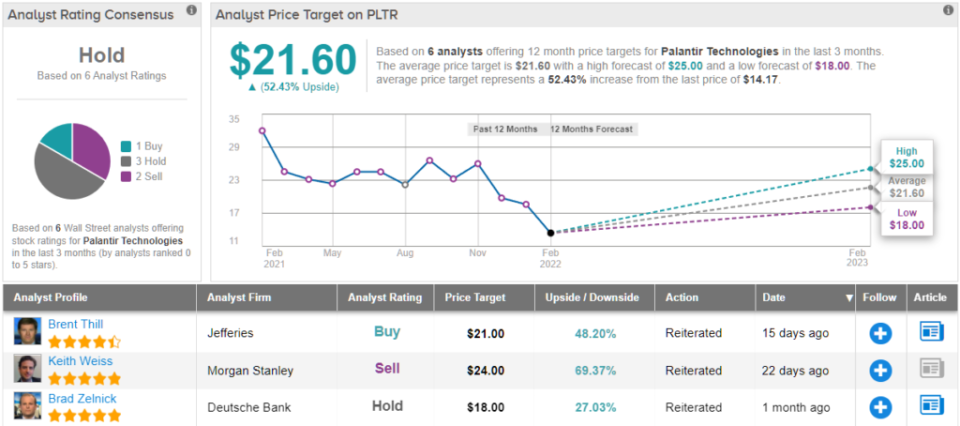

As such, with an “eye towards stabilizing progress and profitability as keys to start rebuilding confidence,” forward of the print, Zelnick charges PLTR a Maintain together with an $18 value goal. However, following the shares’ 60% pullback over the previous yr, there’s upside of 27% from present ranges. (To observe Zelnick’s observe document, click on right here)

The remainder of the Avenue is on the identical web page. Palantir’s Maintain consensus ranking relies on 1 Purchase, 3 Holds and a pair of Sells. Identical to Zelnick’s take, nevertheless, there are many features projected nonetheless; at $21.60, the typical value goal suggests shares will rise ~52% within the yr forward.

It is going to be fascinating to see whether or not the analysts improve their rankings or scale back value targets over the approaching months. (See Palantir inventory forecast on TipRanks)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is vitally necessary to do your individual evaluation earlier than making any funding.

[ad_2]

Source link