[ad_1]

European equities offered off and merchants rushed into haven property on Monday as German chancellor Olaf Scholz ready to journey to Moscow in a recent effort to discourage Russia from launching an invasion of Ukraine.

The regional Stoxx Europe 600 index fell 2.8 per cent in afternoon dealings, in a broad decline. Germany’s Xetra Dax fell about 3.3 per cent, with sharper drops for bourses in Austria, Sweden, Denmark and Greece.

Monday’s drop got here after Jake Sullivan, US nationwide safety adviser, stated on Sunday that an assault by Russia in opposition to Ukraine might start “any day now”, together with “this coming week earlier than the top of the Olympics “.

Futures markets implied Wall Road’s S&P 500 share index, which closed virtually 2 per cent decrease on Friday after the White Home issued its first warning of an “rapid risk” of invasion, would drop an extra 0.9 per cent on Monday.

Western nations are persevering with to withdraw diplomatic and army personnel from Ukraine, and airways have cancelled flights to the nation, in strikes that jolted traders who had been targeted on US financial coverage whereas viewing geopolitical tensions as much less of a threat.

“The market has been wrongfooted,” stated Altaf Kassam, head of funding technique for Europe, the Center East and Africa at State Road World Advisors. “Individuals anticipated a de-escalation and it appears like issues are rolling within the different route.”

The potential impact of sanctions, he added, would “add to inflationary pressures in addition to individuals’s perceptions of inflation”. Client value will increase within the eurozone hit a report excessive final month, largely pushed by vitality prices. Inflation is working at a 40-year excessive within the US because the Federal Reserve prepares to boost rates of interest from pandemic-era lows.

With international provide chains snarled up from Covid-19, all main commodity markets are in a “state of extreme depletion”, stated Jeff Currie, head of commodities analysis at Goldman Sachs. “Such depleted methods are extremely susceptible to even the smallest shocks, even [with just] a number of days of disruption.”

Scholz travelled to Kyiv on Monday earlier than heading for Moscow on Tuesday. The German chief was anticipated to induce Putin to de-escalate the state of affairs on the Ukraine border and convey “how grave the results of an assault could be” when it comes to sanctions on Russia, a senior official stated.

Joe Biden spoke to his Ukrainian counterpart Volodymyr Zelensky on Sunday. The White Home stated the US president had made clear Washington would reply to Russian army motion “swiftly and aggressively”.

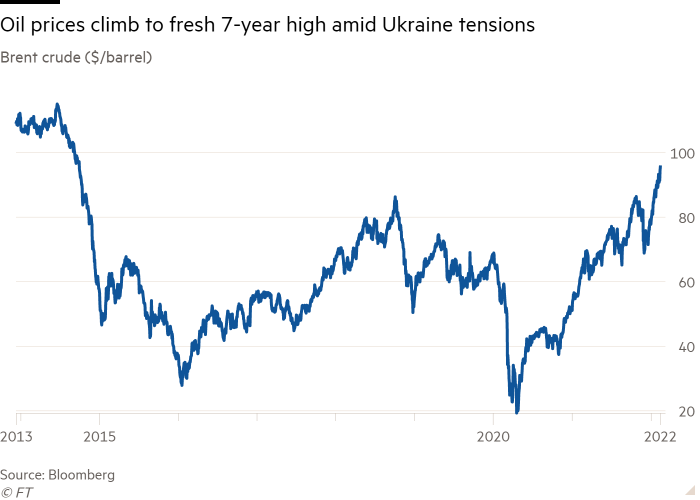

European pure fuel contracts for next-month supply jumped 12 per cent on Monday to €83.41 per megawatt hour. Worldwide oil benchmark Brent crude rose as excessive as $96.16 a barrel, the best degree in additional than seven years, earlier than trimming its beneficial properties.

“If western claims of [a] Russian invasion of Ukraine turned out to be unsubstantiated [or] Russia withdrew its troops from its western borders, oil costs will come crashing,” stated Tamas Varga at PVM Oil Associates, a dealer. “In the interim all eyes are on Ukraine and on the $100-a-barrel degree.”

High-rated authorities bonds rallied on Monday as merchants sought shelter within the lower-risk property, pushing yields decrease. America’s 10-year Treasury yield fell 0.03 share factors to 1.92 per cent. In Europe, Germany’s benchmark 10-year Bund yield declined 0.07 share factors to simply underneath 0.21 per cent. The equal UK gilt yield fell 0.05 share factors to 1.47 per cent.

In distinction, Russian and Ukrainian authorities bonds tumbled to their lowest ranges of 2022.

Ukraine’s greenback bond maturing in 2032 dropped greater than 10 per cent in value to 77 cents on the greenback. Russian dollar-denominated bonds have been down roughly 2 per cent, with the yield on a bond maturing in 2047 rising 0.15 share factors to 4.93 per cent.

In Asia, Hong Kong’s benchmark Grasp Seng fell 1.4 per cent, whereas Japan’s Topix and South Korea’s Kospi each closed 1.6 per cent decrease.

Extra reporting by Tommy Stubbington in London

Unhedged — Markets, finance and robust opinion

Robert Armstrong dissects a very powerful market developments and discusses how Wall Road’s finest minds reply to them. Enroll right here to get the e-newsletter despatched straight to your inbox each weekday

[ad_2]

Source link