[ad_1]

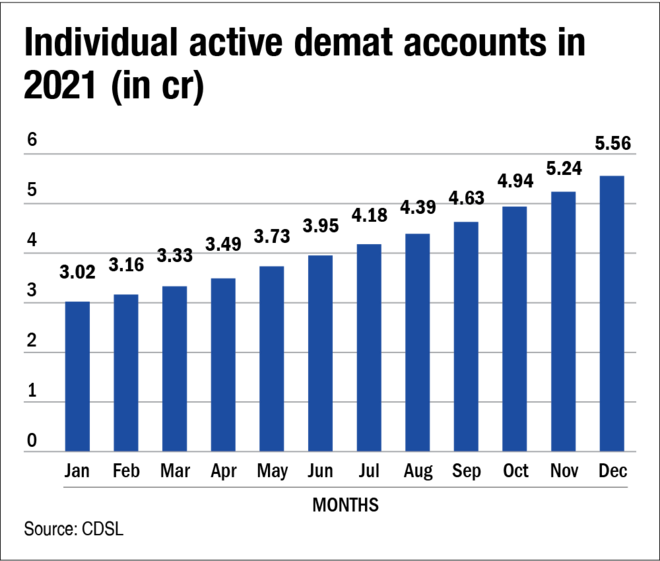

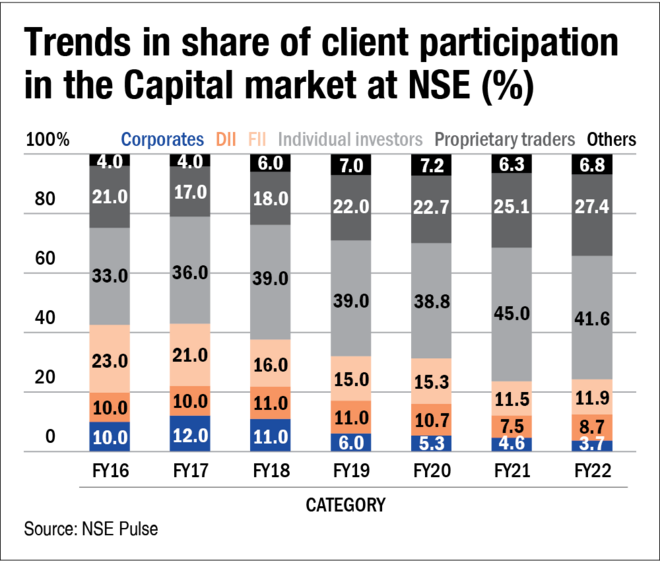

Retail participation has been traditionally low within the Indian market (about 5% of the inhabitants) in comparison with different nations like america (about 55% of the inhabitants) and the UK (about 33% of the inhabitants). However issues have been altering slowly and the continuing pandemic has accelerated the change. The expansion within the lively Demat accounts is proof for that. Furthermore, the share of particular person buyers in complete consumer participation has since the previous few years, from 33 per cent in FY16 to 45 per cent in FY21.

In line with PRIMEINFOBASE, the share of retail buyers in corporations listed on the NSE reached an all-time excessive of seven.3 per cent in Q3 FY22. The identical has been the case for prime internet value people (HNIs) whose share reached an all-time excessive of two.3 per cent. That is all regardless of a decline in each Nifty and Sensex by 1.5 per cent. This isn’t simply confined to direct participation in fairness markets however has additionally prolonged to mutual funds. In line with AMFI knowledge, the variety of SIP accounts within the mutual fund business touched the 5 crore mark in January 2021. In FY21 property of passive funds surged by 60 per cent to Rs 4.7 trillion.

On the identical time, the share of international institutional buyers (FIIs) out there has been lowering step by step. As seen within the above chart, FII participation has lowered from 23 per cent in FY16 to a mere 11.5 per cent in FY21. FPIs share in corporations listed on NSE reached a 9 yr low of 20.7 per cent.

There are a number of components which were contributing to the participation, resembling concern of lacking out available on the market rally we witnessed in 2021, easy accessibility to sources, and lack of enticing different funding alternatives on account of low-interest charges.

Retailers’ curiosity

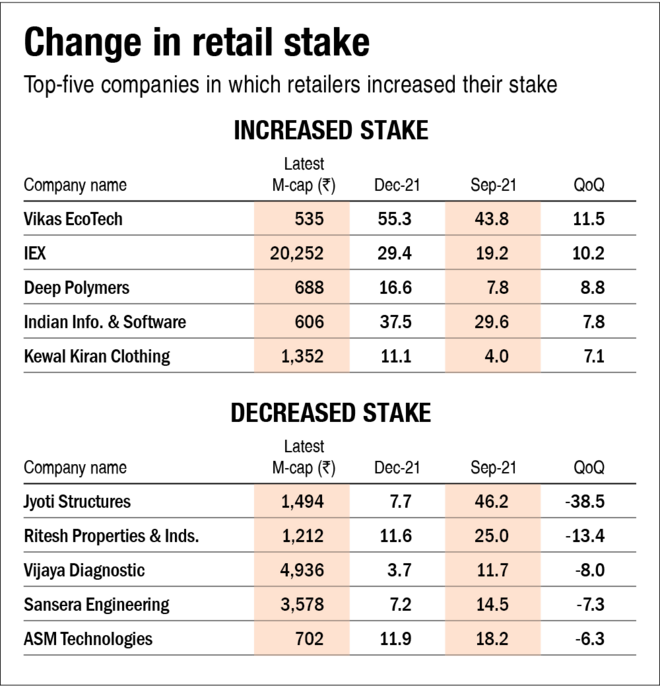

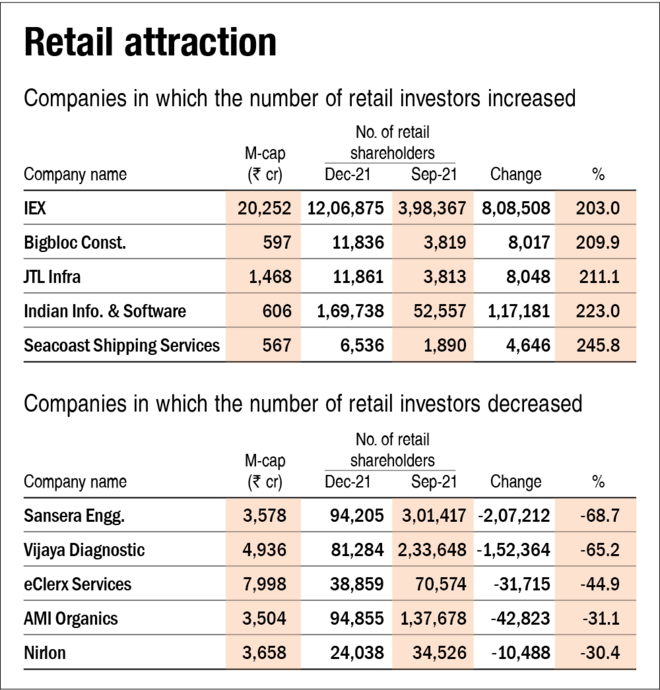

To offer a transparent perspective, listed below are some corporations (minimal market cap of Rs 500 crore) during which retail buyers have elevated their stake over the last quarter.

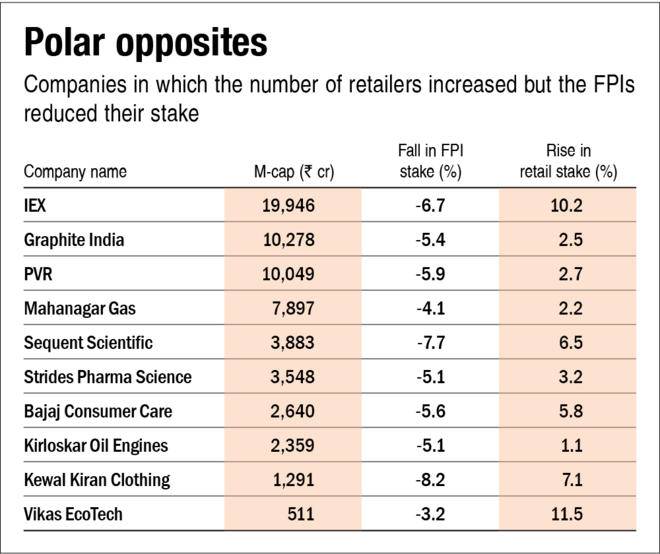

FIIs and retail buyers have additionally been polar opposites – the place the FIIs decreased their stake whereas the retailers elevated theirs.

Whereas we’re glad in regards to the elevated participation of retail buyers out there, they tend to go in the direction of extra dangerous shares as we noticed in certainly one of our earlier tales. As a lot as we love lively retail participation, it could be so much higher for the buyers to be sensible with their investments and never get carried away with random ideas.

[ad_2]

Source link