[ad_1]

RBI left the rate of interest unchanged and maintained an accommodative stance. This means that the central financial institution could go for extra fee cuts in future if wanted to assist the financial system.

The central financial institution has stored the repo fee unchanged at 4% and retained reverse repo fee at 3.35%. One foundation level is one-hundredth of a share level. The repo fee is the speed at which banks park extra funds with RBI and reverse repo is the speed at which it borrows from them.

RBI has not modified key coverage charges for over one-and-a-half years. The most recent RBI coverage fee change was in Could 2020 when it had slashed the important thing rates of interest to a historic low to assist the financial system ravaged by the COVID-19 pandemic.

At this time’s announcement comes when inflation stays at an elevated degree and international central banks are in a tightening mode. Nonetheless, Das famous that capability utilisation is rising, aiding funding demand.

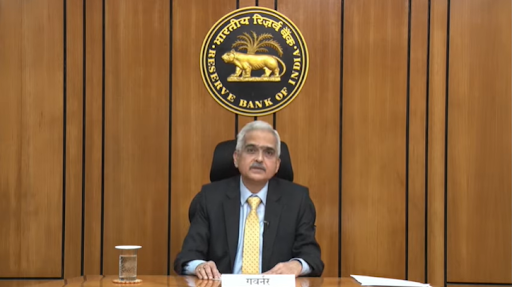

“We now have tried to restrict disruption to financial exercise. Whereas CPI edged greater, it’s alongside anticipated strains. Core inflation stays elevated and headline inflation is anticipated to peak in Q4FY22, and switch reasonable in H2FY23. Continued coverage assist is warranted for sturdy, broad-based restoration,” the RBI governor mentioned after the MPC assembly.

The central financial institution has projected GDP development in monetary 12 months 2022-2023 at 7.8%. In response to the RBI governor, GDP is projected at 7.2% for Q1, 7% for Q2, 4.3% for Q3, and 4.5% for This autumn. CPI inflation forecast for FY22 is retained at 5.3%, Das added. RBI forecasts FY23 CPI inflation at 4.5%.

“CPI is in-line with expectations and meals costs are easing so as to add to the optimism. Hardening crude oil worth is a serious upside danger. Transmission prices stays muted on slack demand. Banks ought to strengthen governance and danger administration,” Shaktikanta Das mentioned.

Additionally Learn:

[ad_2]

Source link