[ad_1]

Inventory splits normally work, and the 20-for-1 break up by Google’s father or mother firm Alphabet could spark a wave.

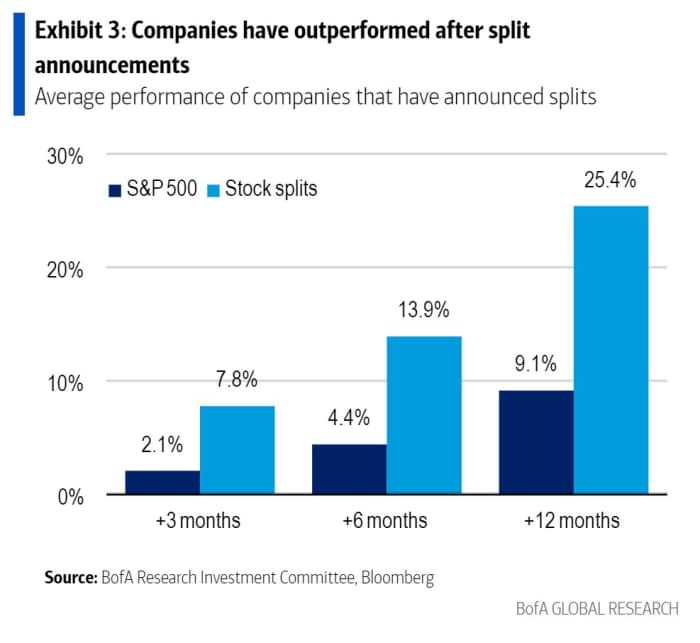

That’s in keeping with evaluation from Financial institution of America, which discovered that corporations which have introduced inventory splits have outperformed the market.

S&P 500

SPX,

shares which have break up, on common, have gained 25% over the subsequent 12 months, in comparison with the 9% acquire for the broad index.

“Among the outperformance is probably going as a consequence of momentum. Firms that announce splits have seemingly seen sustained market outperformance and anticipate that outperformance to proceed,” say the Financial institution of America analysts. “Underlying power within the firm is a major driver of elevated costs. As soon as the break up is executed, buyers who’ve needed to realize or improve publicity could begin to rush for the possibility to purchase.”

They’re turning into rarer, nevertheless, at simply 28 over the previous 5 years, in comparison with the height of 346 between 1996 and 2000.

On Alphabet

GOOGL,

GOOG,

particularly, BofA analyst Justin Publish says the break up, and extra aggressive inventory buybacks, are suggestive of a administration workforce turning into extra shareholder pleasant. “If extra company managers undertake shareholder-friendly postures, it might spark a wave of splits and convey extra buyers flows into the market, proving assist for embattled progress corporations,” he provides. Learn associated commentary on the Alphabet break up.

Some $6.6 trillion in market cap, or 17% of the S&P 500, trades above $500 per share.

The evaluation nevertheless doesn’t point out the rising proportion of brokers providing fractional possession, which makes the excessive price of a single share of inventory much less of a difficulty for retail buyers.

[ad_2]

Source link