[ad_1]

In a earlier article – Why all of the fuss Fuss about ESG? – we explored the altering world of environmental, societal and governance (ESG) components.

Our firm has now turn into a part of a world-wide research of ESG metrics carried out by the GECN (Governance and Govt Compensation Specialists) Group of corporations, representing Africa for the primary time.

The research covers 5 continents: Africa, Asia, Australia, Continental Europe and North America.

We now have simply accomplished the research throughout eight listed exchanges during which South Africa is the one rising market alternate. South African listed corporations can stand tall among the many developed nations of their adoption and utility of ESG metrics.

Why is ESG vital? ESG metrics might be described as non-financial metrics and are concerning the sustainability of the world, the continents, international locations, companies and society.

Everybody is aware of concerning the dire results that world warming could have on the earth as we all know it if the rise in world temperatures exceeds 1.5 levels.

Society is changing into extra vocal about authorities and enterprise apply because the world strikes from ‘shareholderism’ to ‘stakeholderism’.

This pattern has been catapulted ahead because of the Covid-19 pandemic, which has highlighted the unsustainable enterprise practices worldwide which are resulting in the destruction of the setting and of society – highlighted by the rising wage and wealth hole around the globe.

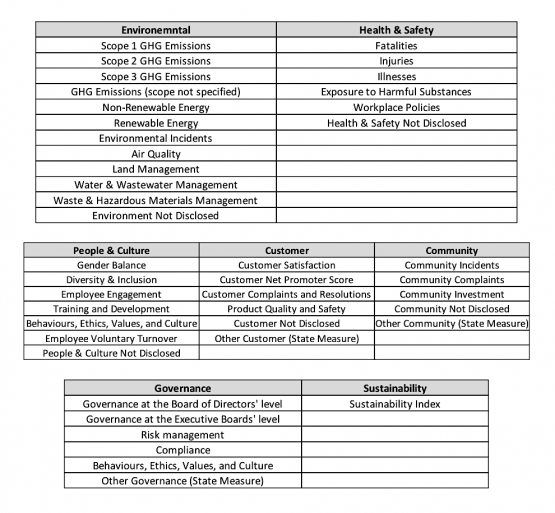

Mostly used metrics

The ESG metrics mostly used and reported on in annual monetary reviews and built-in reviews by listed corporations, and measured within the GECN research, are as follows:

Supply: GECN Group

This yr’s GECN analysis geared toward analyzing any year-on-year developments in corporations utilizing ESG metrics in govt incentive plans (each the prevalence and weighting), significantly modifications in reference to the Covid-19 pandemic and the growing market strain for corporations to extend their deal with ESG of their enterprise methods.

Our research additionally recognized {that a} rising variety of corporations are beginning to incorporate ESG metrics in govt long-term incentive plans and that the weighting is increased than in prior years – tying sustainable metrics to govt pay in the long run.

The primary developments rising from the research:

- A rising variety of corporations the world over are tying govt pay to ESG efficiency, significantly within the environmental space.

- There is a rise within the variety of corporations utilizing social metrics of their incentives in all areas, besides Singapore.

- The pandemic resulted in a major shift in social metrics – away from worker engagement metrics and in the direction of a rise in office coverage metrics (worker wellness).

- Firms allocate the next weighting to ESG metrics in short-term incentives (25%) than in long-term incentives (20%).

- Essentially the most important enhance in inclusion in long-term incentive plans is the inclusion of setting and local weather change metrics.

- The worldwide common mixture weighting of ESG metrics in incentive plans accounts for 9% of the utmost complete remuneration bundle (fastened pay plus variable pay) obtained by the corporate’s high govt every year. The query is, is the weighting of those ESG metrics materials sufficient to really incentivise administration to behave?

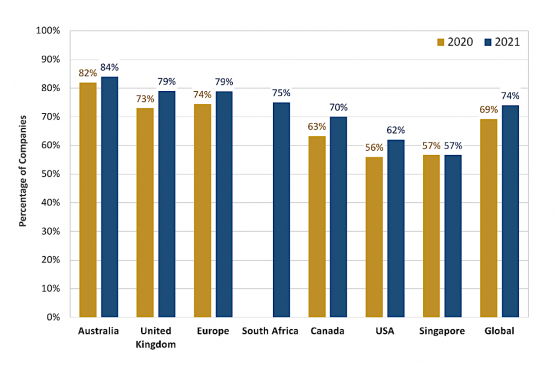

Greater than 74% of corporations in all sectors reviewed use ESG metrics.

Nevertheless, how does South Africa carry out relative to its friends globally? South Africa ranks fourth on the planet with 75% of corporations utilizing ESG metrics, whereas Australia leads (84%), adopted by the UK and Europe (79%).

South Africa is simply forward of the world common – and on condition that we’re an rising market (in comparison with developed markets), we ought to be proud to face tall.

Proportion of corporations utilizing ESG metrics in incentives

Supply: GECN Group

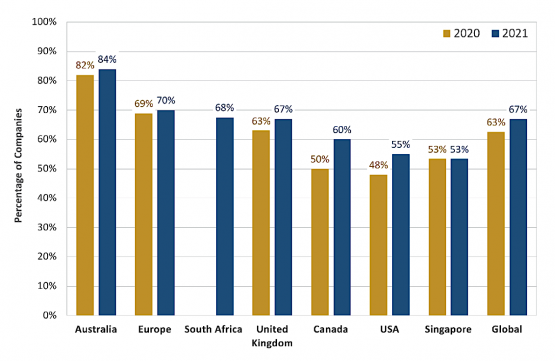

There was an enormous swing in the direction of social metrics, catalysed by the pandemic which highlighted the inequity of pay and wealth around the globe.

The poor have borne the brunt of the fallout from the pandemic by means of lack of jobs, discount in pay, elevated gas and meals costs – therefore there was an elevated deal with this non-financial metric.

This has been significantly prevalent in South Africa, which has the best Gini coefficient (measure of revenue inequality), and one of many highest unemployment charges on the planet.

South Africa strikes to 3rd place for the usage of social metrics (68%), behind Australia (84%) and Europe (70%).

South Africa leads the cost on variety, fairness and inclusion (DEI) metrics, with this social metric being entrance of thoughts in most corporations’ methods. World-wide, 45% of corporations use DEI metrics, adopted by 37% who use worker engagement metrics.

Proportion of corporations utilizing social metrics in incentives

Supply: GECN Group

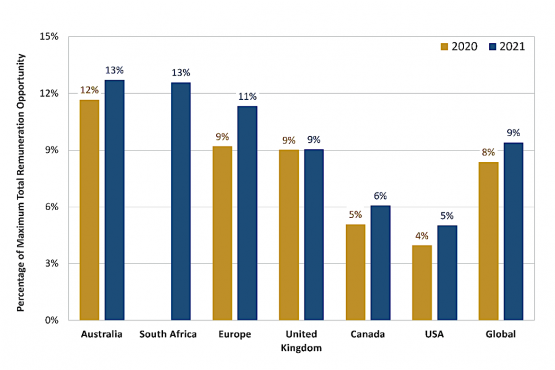

South Africa ties in first place with Australia, with 13% for an important metric of ESG – the weighting of the manager most complete remuneration linked to ESG metrics.

The hyperlink between the manager key efficiency indicator (KPI) and govt pay is essential in incentivising the manager to ‘do the fitting factor’.

Though the weighted linkage remains to be fairly low (and growing), South Africa is effectively forward of the worldwide common of 9%.

Common proportion of high executives’ most complete remuneration contingent on weighted scorecard ESG metrics

Supply: GECN Group

The cut up between weightings of efficiency metrics for short-term and long-term time horizons is essential within the incentivisation of executives, since this determines whether or not a forward-looking sustainable method is extra vital than short-term wins, which may end in long run losses.

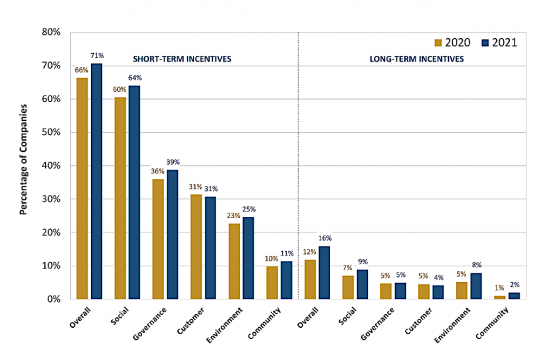

The chart beneath exhibits that utilizing ESG metrics is rather more prevalent in short-term incentives (71%) than in long-term incentives (solely 16%).

We will solely hope that the transfer from short-term in the direction of long-term incentives continues quickly, as that is how ESG metrics will turn into sustainable.

Proportion of corporations utilizing ESG metrics in incentives by short- and long-term incentives by kind of measure

Supply: GECN Group

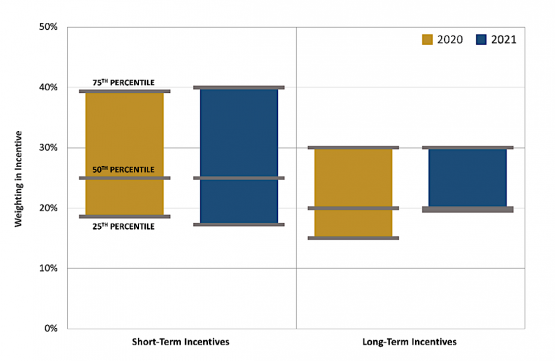

The prevalence doesn’t, nonetheless, inform the total image of the effectiveness of ESG metrics in short- and long-term incentives.

It’s relatively the weighting of the metric that’s vital, as this incentivises the manager’s behaviour.

The median weighting for ESG metrics in short-term incentives is 25% in comparison with 20% in long-term plans, and is critical for each.

Within the higher quartile, 25% of metrics or extra have a weighting in short-term incentives of 40% and 30% for long-term incentives. That is encouraging for the longer term sustainability of ESG.

Even on the decrease quartile, 25% of metrics or much less nonetheless have a weighting of 20% for long-term incentives.

Weighting of ESG metrics in incentives by short- and long-term incentives

Supply: GECN Group

Within the coming years, we count on to see progress of the developments in corporations that undertake non-financial ESG metrics of their incentive plans:

- Over the long run (5 to 10 years) these corporations have the next historic complete shareholder return (TSR) in comparison with the market.

- They are going to be bigger market capitalisation corporations or have increased institutional shareholding percentages

- They are going to have the next weighting on non-financial metrics.

The world is in pressing want of change by way of its setting, local weather change, social inequity and well-being.

ESG metrics could possibly be the silver bullet that brings this alteration about, however solely whether it is universally adopted and ruled.

South Africa units an instance in that, as an rising market, we are able to contribute and stand tall amongst our world friends.

Chris Blair is CEO of 21st Century and Bryden Morton is govt director.

[ad_2]

Source link