[ad_1]

Worldwide investing is the brand new smash hit within the mutual fund ecosystem. A class that had 35 schemes until 2019 is now flourishing with 64 funds, an increase of a whopping 83% in simply two years! Effectively, a whole lot of this may be attributed to blockbuster post-COVID returns in world markets, notably the US which has enthused Indian traders probably the most. Then, after all, there are rupee depreciation and geographical diversification advantages as properly.

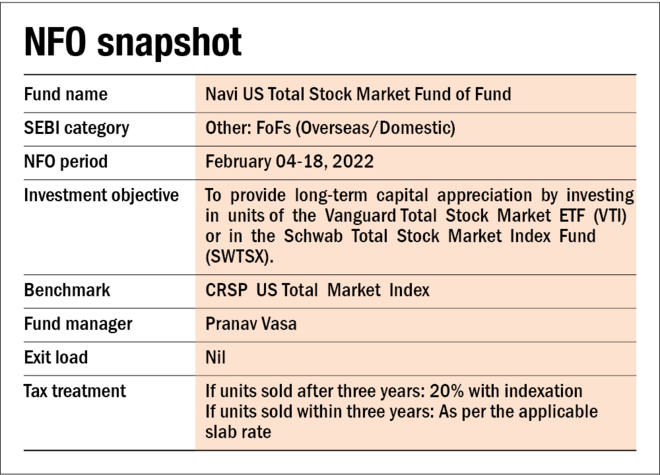

Becoming a member of this sizzling area now, Navi Mutual Fund has rolled out a brand new fund provide (NFO) on February 04, 2022, the Navi US Whole Inventory Market FoF. The subscription interval for the fund will shut on February 18, 2022. What makes this fund even hotter is the truth that at present, it’s the solely gateway for Indians to spend money on Vanguard, the pioneer of providing low-cost passive fund administration schemes. It is actually like an Aha! second for passive junkies.

This NFO comes at a time when the mutual fund trade is on the point of exhausting permissible international publicity as per SEBI guidelines and has due to this fact put gates on recent investments in lots of the worldwide mutual funds. Nonetheless, there is no such thing as a influence on the schemes that spend money on international ETFs (as additionally within the case of this NFO launched by Navi) as a result of they’ve a separate restrict, and there may be sufficient runway there for now. You possibly can learn extra about it right here.

Concerning the technique

The Navi US Whole Inventory Market FoF is a fund of funds that goals to spend money on the Vanguard Whole Inventory Market ETF (VTI). VTI is the third-largest ETF on the planet and tracks the efficiency of the CRSP US Whole Market Index. The latter has greater than 4,000 constituents, throughout small-, mid- and large-cap corporations, representing almost 100 per cent of the US investable fairness market.

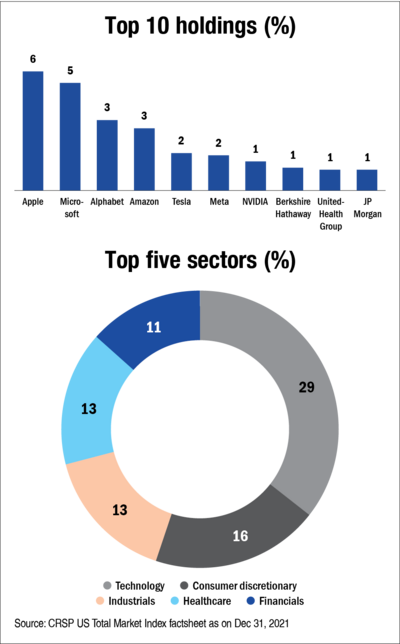

The highest 10 holdings embrace behemoths corresponding to Apple, Microsoft, Google, Amazon, Tesla and the like and make up round 25 per cent of the portfolio. With 29 per cent weight, expertise is the highest sector within the index which VTI tracks, adopted by shopper discretionary and industrials with 16 per cent and 13 per cent proportion in property respectively (as on December 2021).

The expense ratio of this scheme as proposed by the AMC is 0.06 per cent. That is on prime of the bills of the underlying ETF which is 0.03 per cent. Therefore with the mixed expense ratio of 0.09 per cent, this scheme could be the most affordable fund within the worldwide class as of now.

Although the funding goal of the fund says it will probably spend money on VTI or Schwab Whole Inventory Market Index Fund (SWTSX) however as per our dialog with the fund home, the latter has solely been added as a backup fund on SEBI’s recommendation and VTI is the first fund during which the scheme could be investing.

Concerning the efficiency

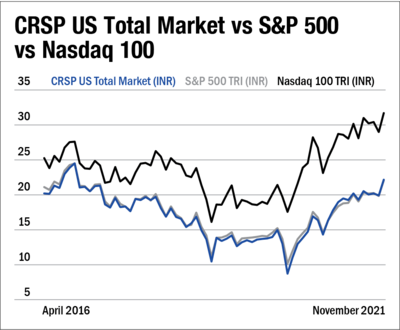

As talked about above, the underlying ETF of this new fund tracks CRSP US Whole Market Index which broadly represents your complete US fairness market. S&P 500 is one other fashionable index that’s broad-based nevertheless it consists of solely the highest 500 corporations and therefore represents roughly 80 per cent of the whole worth of the US inventory market. Then there may be the Nasdaq 100 index which includes the 100 largest non-financial corporations listed on the Nasdaq inventory change.

Pushed by the stupendous rally within the US tech shares recently, Nasdaq 100 has outstandingly overwhelmed the opposite two broader indices. It’s due to this cause, many fund homes have lately launched their Nasdaq 100 choices. Nonetheless, these shares additionally are typically extra unstable. So, if one desires to guess on US fairness however in a much wider method, then CRSP US Whole Market index or S&P 500 index match the invoice. We in contrast their five-year rolling returns and located that these two have virtually proven the identical efficiency within the final 5 and a half years.

Concerning the AMC

After buying the Essel Mutual Fund in April final 12 months, Navi Mutual Fund launched its first product, the Navi Nifty 50 Index Fund in July 2021. Navi Mutual Fund manages Rs 943 crore of AUM throughout debt, fairness and hybrid funds as of December 2021. Of this, Rs 167 crore belongs to Navi Nifty 50 Index Fund, and the remaining is primarily the legacy of Essel Mutual Fund.

The AMC has launched two extra passive funds final month – Navi Nifty Subsequent 50 Index Fund and Navi Nifty Financial institution Index Fund and has many extra schemes lined up as per the provide paperwork filed with SEBI. Low expense ratio and passive focus are the 2 USPs of this fund home.

Additionally learn: Three questions it is best to ask earlier than investing in an NFO

[ad_2]

Source link