[ad_1]

Getty Photos

It is a story about how a easy software program bug allowed the fourth-biggest cryptocurrency theft ever.

Hackers stole greater than $323 million in cryptocurrency by exploiting a vulnerability in Wormhole, a Internet-based service that enables inter-blockchain transactions. Wormhole lets individuals transfer digital cash tied to 1 blockchain over to a special blockchain; such blockchain bridges are significantly helpful for decentralized finance (DeFi) companies that function on two or extra chains, typically with vastly totally different protocols, guidelines, and processes.

A guardian with no tooth

Bridges use wrapped tokens, which lock tokens in a single blockchain into a wise contract. After a decentralized cross-chain oracle referred to as a “guardian” certifies that the cash have been correctly locked on one chain, the bridge mints or releases tokens of the identical worth on the opposite chain. Wormhole bridges the Solana blockchain with different blockchains, together with these for Avalanche, Oasis, Binance Sensible Chain, Ethereum, Polygon, and Terra.

However what if you cannot belief the guardian? A lengthy analysis posted on Twitter just a few hours after the heist stated that Wormhole’s backend platform did not correctly validate its guardian accounts. By making a faux guardian account, the hacker or hackers behind the heist minted 120,000 ETH cash—price about $323 million on the time of the transactions—on the Solana chain. The hackers then made a collection of transfers that dropped about 93,750 tokens into a personal pockets saved on the Ethereum chain, blockchain evaluation agency Elliptic stated.

The hackers pulled off the theft by utilizing an earlier transaction to create a signatureset, which is a kind of credential. With this, they created a VAA, or validator motion approval, which is basically a certificates wanted for approving transactions.

“As soon as they’d the faux ‘signatureset,’ it was trivial to make use of it to generate a legitimate VAA and set off an unauthorized mint to their very own account,” somebody utilizing the Twitter deal with @samczsun wrote. “The remaining is historical past. tl;dr—Wormhole did not correctly validate all enter accounts, which allowed the attacker to spoof guardian signatures and mint 120,000 ETH on Solana, of which they bridged 93,750 again to Ethereum.”

tl;dr – Wormhole did not correctly validate all enter accounts, which allowed the attacker to spoof guardian signatures and mint 120,000 ETH on Solana, of which they bridged 93,750 again to Ethereum.

— samczsun (@samczsun) February 3, 2022

Different helpful deepdives on the hack are here and right here.

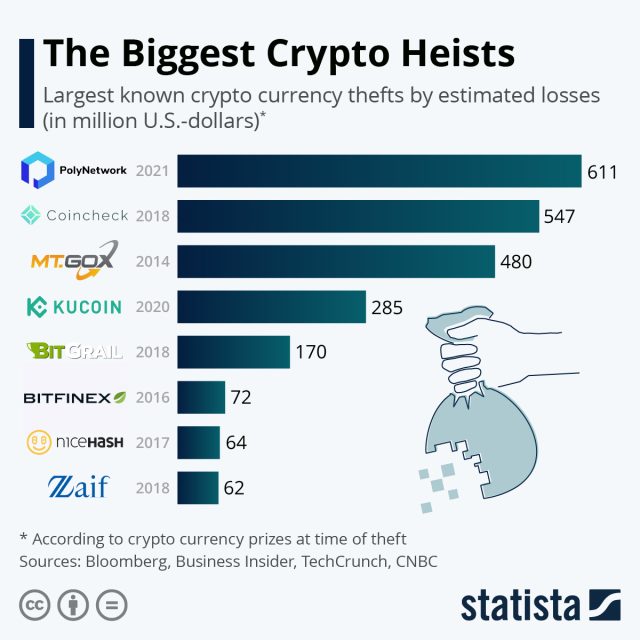

The haul is the fourth-biggest cryptocurrency theft of all time, based on this roundup from Statista, simply behind the $480 million stolen from Mt. Gox in 2014, the $547 million taken from Coincheck in 2018, and the $611 million snatched from Polynetwork final 12 months (this record-setting quantity was later returned by the thief).

Statista

In 2021, losses from cryptocurrency thefts totaled $10.5 billion, based on Elliptic, up from $1.5 billion the 12 months earlier than.

A nontrivial problem

The Wormhole hack took few blockchain safety specialists without warning. The problem of writing software program that interacts with a number of chains in a secure method is nontrivial, and solely a restricted variety of instruments and strategies can check the soundness of the code.

“Constructing bridges inherits all of the complexity of every blockchain,” Dan Guido, CEO of safety agency Path of Bits, stated in a message. “They seem deceptively easy, however they’re among the many most tough code to write down in actuality.”

Compounding the issue, the brand new hack got here shortly after a latest change was made in among the software program concerned.

“The bridge didn’t count on that customers might submit a signatureset, because the change to facilitate that was a latest one within the Solana runtime,” Guido defined. “By submitting their very own signature knowledge, an attacker short-circuited a signature examine that allowed them to take possession of a considerable amount of tokens.”

In an e-mail, Dane Sherret, a options architect at bug-reporting service HackerOne, defined it this fashion:

There’s a

verify_signaturesperform that’s alleged to take cryptographic signatures from the guardians and bundle them collectively. Regardless of its title,verify_signaturesdoesn’t really confirm itself—it makes use of thesecp256k1native program on Solana. The model of the solana-program Wormhole was utilizing didn’t appropriately confirm the handle, which allowed the hacker to create an account that would bypass all the checks.By way of the above steps, the hacker was in a position to bypass the signature checks and pull the ETH over to Ethereum which meant that for a time period among the wETH [the wrapped ETH on Solana] was not really backed by something.

This hack is tough for me to wrap my head round as a result of it was initiated on the Solana blockchain—which makes use of the Rust programming language for its good contracts. As Ethereum makes use of the Solidity programming language for its good contracts, it’s an instance of how new networks, with totally different idiosyncrasies and totally different languages, at the moment are speaking to one another—which makes safety all of the harder.

Cross-chain purposes pose different dangers as nicely. In a publish penned final month, Ethereum co-founder Vitalik Buterin warned that “elementary safety limits of bridges” made them weak to a special class of blockchain exploit generally known as a 51% assault.

Also called a majority assault, a 51% assault permits a malicious social gathering that good points greater than 50 p.c of hashing energy on a blockchain to reverse beforehand made transactions, block new transactions from being confirmed, and alter the ordering of latest transactions. That opens the door to one thing generally known as double spending, a hack that enables the attacker to make two or extra funds with the identical foreign money tokens. Buterin wrote:

I do not count on these issues to indicate up instantly. 51% attacking even one chain is tough and costly. Nonetheless, the extra utilization of cross-chain bridges and apps there may be, the more severe the issue turns into. Nobody will 51% assault Ethereum simply to steal 100 Solana-WETH (or, for that matter, 51% assault Solana simply to steal 100 Ethereum-WSOL). But when there’s 10 million ETH or SOL within the bridge, then the motivation to make an assault turns into a lot larger, and enormous swimming pools could nicely coordinate to make the assault occur. So cross-chain exercise has an anti-network impact: whereas there’s not a lot of it occurring, it is fairly secure, however the extra of it’s occurring, the extra the dangers go up.

In the meantime, demand for blockchain interoperability continues to develop, probably making the safety challenges extra vexing. Each Guido and Sherret suggested bridge operators to take proactive steps to stop related hacks sooner or later. Such steps embody finishing a number of safety audits and placing solely restricted performance on community allowlists till builders are assured in a perform’s maturity and security.

[ad_2]

Source link