[ad_1]

There are two large challenges African nations face with regards to managing public funds.

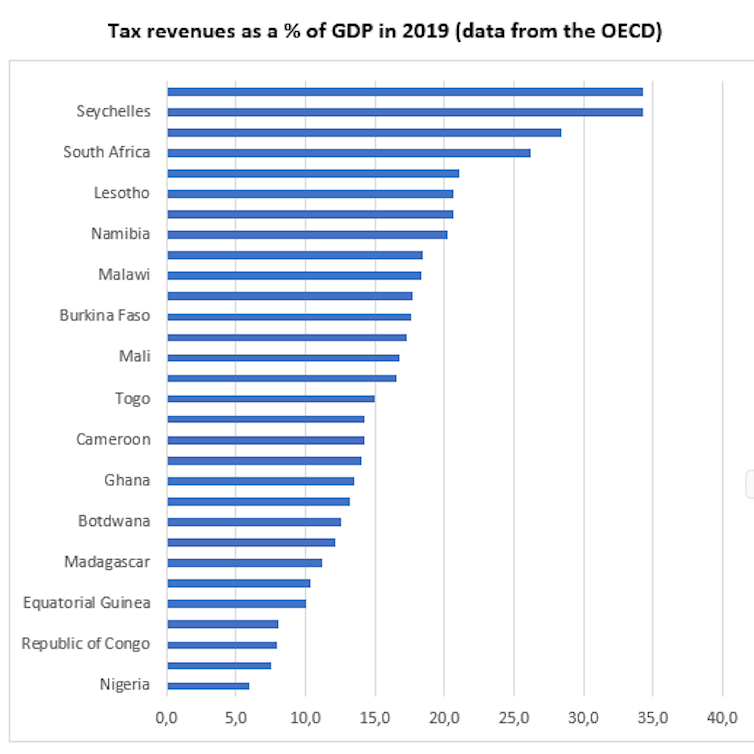

First, many lack fiscal capability on account of structural weaknesses of their economies and gaps in tax administration. Predominant informality of wage employment and reliance on subsistence agriculture in most nations make it tough to lift income past consumption and border taxes. Consequently, on common, African nations acquire a mere 16.6 per cent of gross home product (GDP) in taxes.

For comparability, nations within the Asia Pacific acquire about 21 per cent of GDP in taxes. Nations in Latin American and Caribbean nations common about 23 per cent.

On the high finish, the typical tax haul in high-income nations inside the Group for Financial Cooperation and Growth (OECD) is about 34 per cent.

Second, African nations’ fiscal capability gaps are sometimes compounded by the dearth of prudent and accountable deployment of public assets. The existence of white elephants and deserted unfinished initiatives in lots of nations betray systemic failures of venture planning and implementation.

Equally, a variety of nations routinely spend much less cash than appropriated within the funds (web of corruption). The rationale? Restricted absorption capability in authorities ministries, departments, and businesses.

For instance, a 2018 World Well being Group research discovered that, regardless of urgent want for investments in public well being, roughly 10 per cent to 30 per cent of cash allotted to well being ministries within the area go unspent.

Lastly, whereas corruption isn’t the first drawback bedevilling public finance administration in most African states, related waste and distortions of funds processes serve to restrict the affect of public spending.

The joint results of the 2 challenges retains many African nations caught in a sub-optimal equilibrium. Tax morale is dampened by inefficient expenditure patterns that fail to fulfill taxpayers’ wants. In flip, this reduces the general tax haul and reinforces authorities’s lack of fiscal capability.

The shortage of a robust income base signifies that African governments can’t undertake essential investments in public items and companies which might be wanted to realize structural financial change within the area.

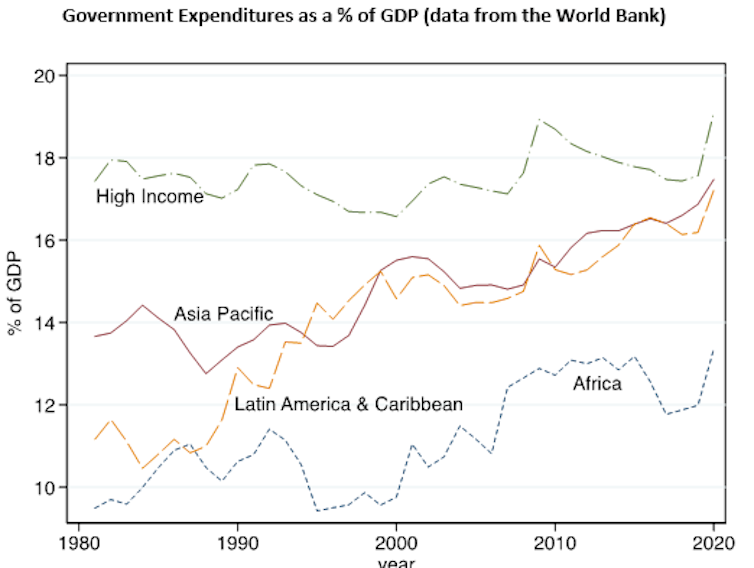

As proven under, African states proceed to lag their counterparts in different areas on the metric of presidency spending as a share of GDP. Counter to fashionable opinion about allegedly bloated public sectors within the area, the issue in lots of African nations is that they’re under-governed by states that may scarcely meet the large demand for public items and companies.

Which is why, in my opinion, African governments ought to align each income technology and public spending with public opinion.

The problem is: how can nations go about democratising the administration of public funds?

Potential solutions

One chance of getting out of the fiscal ditch that many African governments discover themselves in is thru higher public participation within the funds course of. This may be finished immediately, or via elected legislative representatives. Entrenching a political tradition of public participation and legislative enter within the funds course of would definitely not be a silver bullet. However it might improve the alignment between funds appropriations and taxpayers’ priorities.

On the particular person stage, analysis reveals that spending cash on taxpayers’ precedence areas is prone to enhance tax morale, thereby enhancing general fiscal capability.

The incentives for involving legislatures within the funds course of are equally robust. Legislatures are integral to accountable democratic authorities. Subsequently, as an alternative of at all times deferring to Ministries of Finance, African legislatures ought to be a core a part of the appropriation course of.

The present monopoly of funds processes by Ministries of Finance produces two issues. First, with out legislative enter (ideally representing particular person legislators’ constituency pursuits), lots of the area’s budgets mirror the priorities of presidents and allied curiosity teams. As a result of appropriation is just not at all times tied to precise wants on the bottom, it’s no marvel that governments waste cash on white elephants or unfinished initiatives.

Second, since most legislatures’ involvement within the funds course of tends to be restricted to up or down votes on govt proposals, particular person legislators have little incentive to accumulate experience in legislative appropriation and funds oversight. Changing into good at these legislative roles takes effort and time. Merely acknowledged, not involving legislatures within the funds course of weakens the essential oversight operate of legislatures.

A task for multilateral organisations

These home public finance administration challenges are sometimes compounded by donors and multilateral organisations. Almost all make rhetorical commitments to robust establishments and democracy. But with regards to funds issues many desire to solely interact with presidents, finance ministries, and central banks to the neglect of legislatures and civil society organisations.

Usually that is finished underneath the guise of the allegedly “apolitical” and technical nature of public finance administration.

However what could be extra political than the method of (re)distributing public assets?

To engender the event of coherent public finance administration processes in African states, multilateral organisations and donors ought to try to incorporate legislatures and civil society organisations in all issues relating to fiscal coverage. Doing so could be the precise and democratic factor to do. It could additionally improve the probability of prudent use of assets by governments.

The implications of the historic opacity round these engagements are clear for all to see. Analysis reveals that elites in low-income nations are wont to misappropriate assist, with disbursements related to elevated deposits in offshore monetary centres.

Not a silver bullet. Only a good begin

Lastly, it’s price reiterating that the democratisation of funds processes won’t be a silver bullet in fixing African states’ public finance administration challenges. Certainly, it will likely be messy. Injecting legislators and their constituencies into the method is prone to complicate the distributive politics of budgets in most nations.

This may increasingly decelerate the appropriation course of or end in institutional paralysis. However this ought to be handled as a function and never a bug. Given what’s at stake, it is sensible that there could be distributive conflicts round budgets. That is what we see in high-income democracies. We must always anticipate no much less of democratising African states.

A model of this text initially appeared within the Finance and Growth Journal of the Worldwide Financial Fund: It’s time to democratize public finance administration techniques in African states..![]()

Ken Opalo, Assistant Professor, Georgetown College

This text is republished from The Dialog underneath a Artistic Commons license. Learn the unique article.

We’re a voice to you; you’ve been a help to us. Collectively we construct journalism that’s impartial, credible and fearless. You’ll be able to additional assist us by making a donation. It will imply rather a lot for our means to deliver you information, views and evaluation from the bottom in order that we will make change collectively.

[ad_2]

Source link