[ad_1]

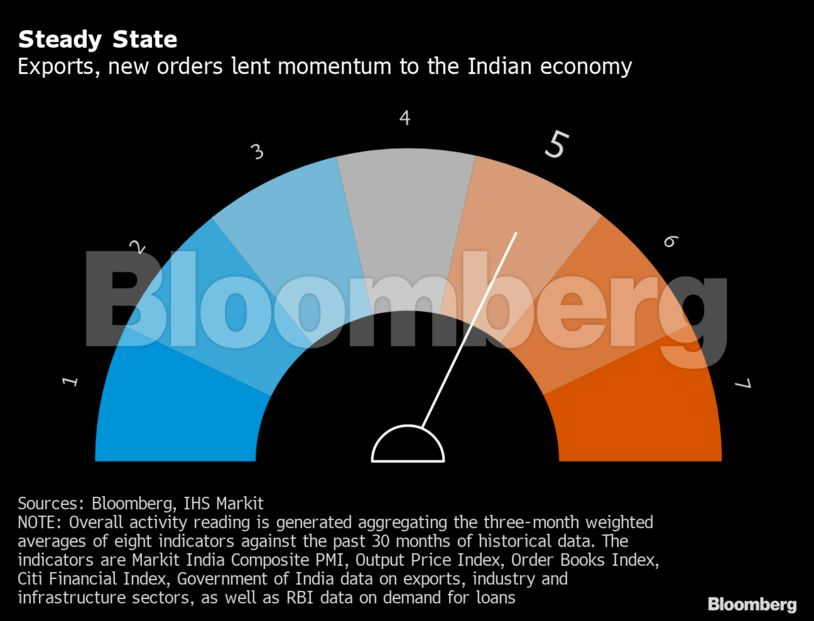

India’s financial momentum remained secure in December at the same time as the primary indicators of slowing output development appeared throughout some industries.

That’s the studying from the general exercise tracker comprising eight high-frequency indicators compiled by Bloomberg Information. Whereas the needle on a dial measuring the so-called ‘Animal Spirits’ stayed unchanged at 5 for a seventh month, high producers throughout shopper durables and vehicles signaled weak spot because the 12 months wound down.

The studying most likely worsened this month as omicron-fueled Covid-19 circumstances spiked, forcing some Indian states to resort to virus-control measures together with placing curbs on some providers and companies. That’s more likely to push India’s coverage makers to retain their accommodative bias as the federal government prepares its annual finances and rate-setters get able to evaluate borrowing prices in February.

Beneath are particulars of the dashboard:

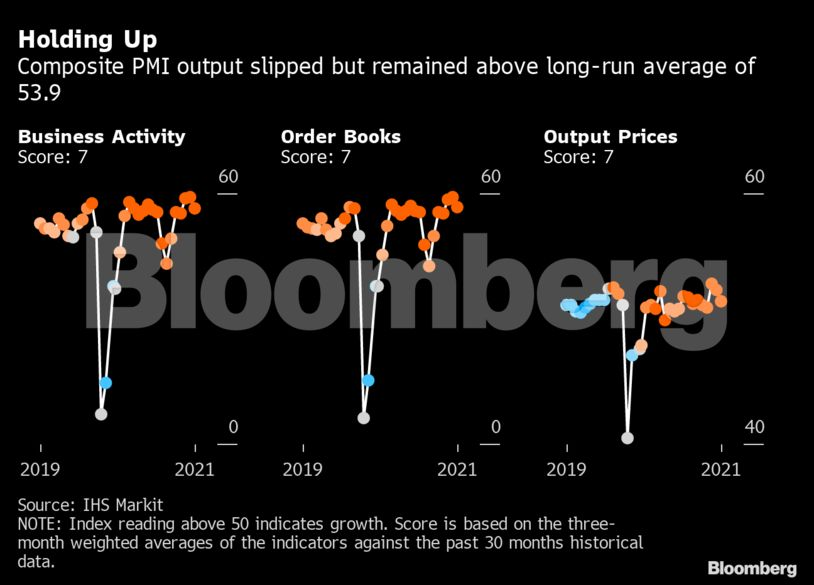

Enterprise exercise

Exercise in India’s dominant providers sector expanded for the fifth month, and manufacturing for the sixth, though development in new work and manufacturing misplaced some momentum, in response to IHS Markit. Whereas the composite index slipped to 56.4 final month from 59.2 in November, it held up above its long-run common.

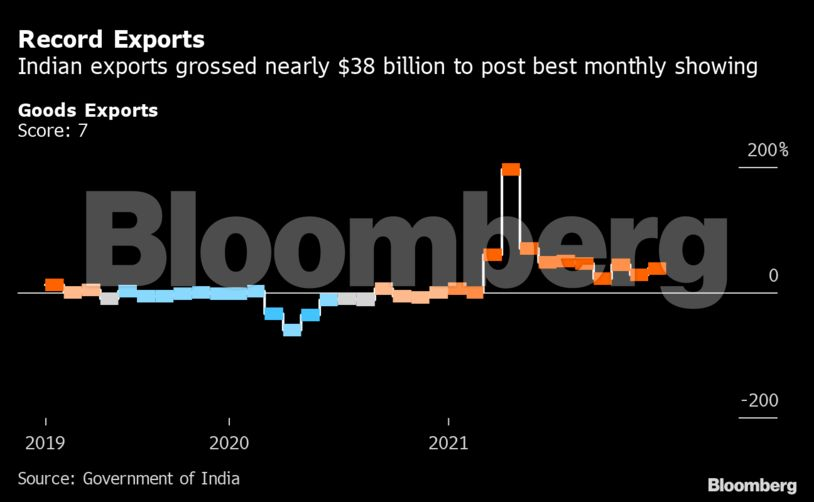

Exports

Exports grew a strong 39% year-on-year in December to $37.8 billion, the best month-to-month tally on report led by commodities, chemical substances and electronics. Nevertheless, the commerce deficit remained elevated at near $22 billion on the again of robust imports.

Client exercise

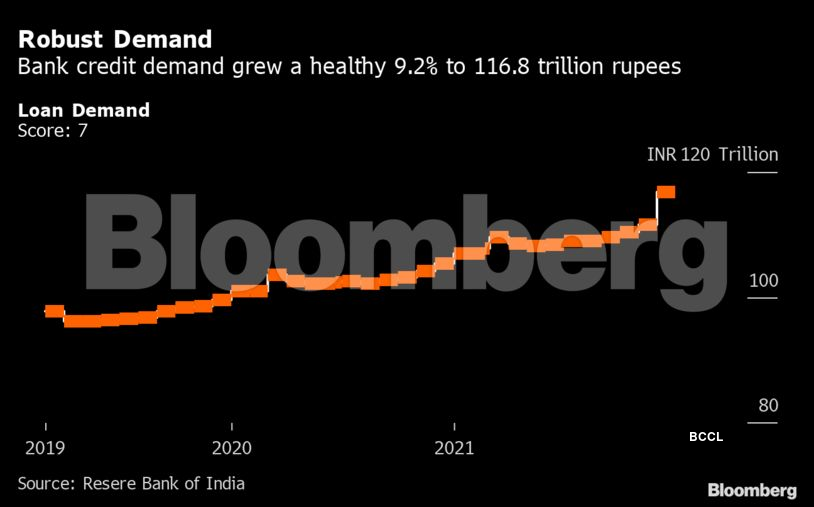

Passenger automobile gross sales fell for a fourth straight month, as manufacturing was hit by a worldwide chip scarcity. That apart, demand for financial institution credit score grew a wholesome 9.2% on the finish of December from a 12 months earlier, whereas liquidity situations remained in surplus final month.

Industrial exercise

Industrial manufacturing development cooled to a nine-month low of 1.4% in November from a 12 months earlier, which QuantEco Analysis economist Yuvika Singhal attributed to elements together with a post-festive drop in manufacturing and supply-side disruptions.

Output at infrastructure industries, which makes up 40% of the commercial manufacturing index, eased to three.1% in November. Each knowledge are printed with a one-month lag.

[ad_2]

Source link