[ad_1]

New Delhi:

The 12 months 2021 noticed many milestones for India’s electrical automobile (EV) journey. With incentives making EVs engaging to fabricate and personal, investments are pouring in and people are beginning to take electrification critically. As we sit up for the 2022 Union Funds, the numerous progress made by EVs has made it an more and more engaging sector for development in funding and jobs.These days, it is not uncommon to see just a few EVs on the roads of main cities resembling Mumbai. Nevertheless, as EVs transfer up the adoption curve, the variety of EVs on the highway will proceed to extend. The capital alternative for India’s EV transition, together with the autos, batteries, and charging infrastructure that we count on to be deployed between 2020 and 2030, has the potential to be Rs 19.7 lakh crore ($266 billion). Central and state governments, producers, infrastructure suppliers, and startups alike are already enjoying their half in capturing this chance. Nevertheless, realising it in full will imply that capital should stream not solely to companies but in addition to customers within the type of loans.

Why Financing Is Essential for EV Adoption

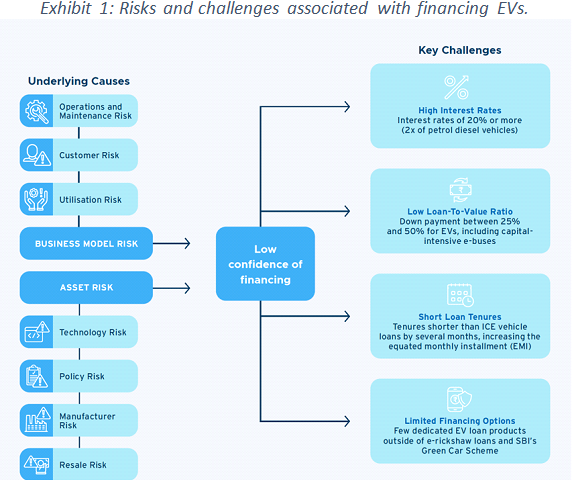

For a number of automobile segments and use circumstances, EVs with authorities incentives are already cheaper than inner combustion engine autos on a complete price of possession foundation. Nevertheless, upfront price can nonetheless current a barrier to EV adoption. Automobile loans can assist EV consumers overcome this dilemma by distributing the value differential over time. That mentioned, as EVs are a comparatively new know-how backed by a nascent ecosystem, underlying dangers make loans tough to acquire. Within the situations that loans can be found, consumers cope with larger rates of interest, shorter mortgage tenures, and better down funds in contrast with petrol and diesel autos.

With the expectation that India’s monetary establishments may faucet into an EV finance market alternative of Rs 40,000 crore ($5 billion) per 12 months by 2025 and Rs 3.7 lakh crore ($50 billion) per 12 months by 2030, there are a number of new initiatives to handle these challenges. On the nationwide degree, NITI Aayog and the World Financial institution have lately introduced a $300 million (Rs 2,230 crore) first-loss risk-sharing facility as a assure mechanism on EV loans. Below the Delhi EV Coverage, an rate of interest subvention scheme has been introduced to subsidise financing for electrical three-wheelers. Fintech-based financiers are leveraging know-how to develop EV financing to tier 2 and tier 3 cities.

Mainstreaming finance for EVs, nevertheless, would profit from a regulatory sign and push along with these market-driven measures. The Reserve Financial institution of India’s (RBI’s) precedence sector lending (PSL) has the potential to behave as such a catalyst.

How PSL Can Catalyse EV Finance

Precedence sector lending was established by the RBI in 1972 to reinforce entry to finance for “precedence” sectors of society. It requires banks to direct a specified share of their internet credit score to predetermined sectors which can be extremely employable and assist alleviate poverty however are usually not thought of economically profitable. This intervention has been notable in supporting the expansion of many of those sectors, together with exports, the place credit score elevated 20 per cent yearly following PSL inclusion.

Inclusion of EVs as a precedence sector will imply that banks have one other avenue by way of which they’ll meet their regulatory necessities beneath PSL. Non-banking finance firms will have the ability to entry larger EV finance from banks that want to leverage these establishments’ potential of reaching numerous geographies and high-risk debtors. The transfer may also encourage banks to enhance their understanding of EV know-how and coverage, institutionalising this new asset class into the monetary

business.

The Highway Forward for PSL Inclusion

Simply as this intervention can strengthen the way forward for EV finance, it will probably additionally bolster the precedence sector lending imaginative and prescient of equitably increasing credit score and supporting employment: EVs can generate and assist livelihoods throughout city and rural India, enhancing accessibility to markets. Gas financial savings ensuing from choosing EVs can be utilized in the direction of different crucial avenues resembling healthcare, training, housing, or meals. Jobs within the EV provide chain are additionally anticipated to rise with an increase in localised manufacturing and fleet electrification.

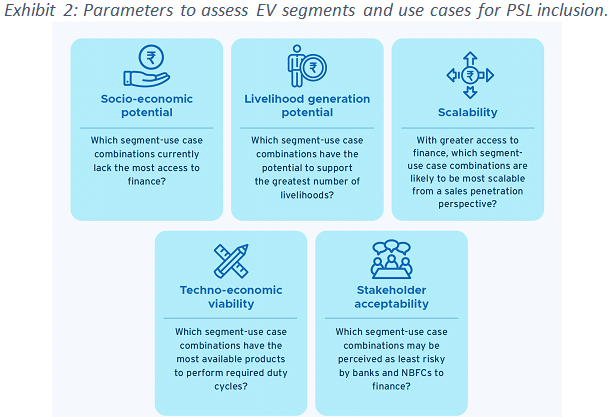

On the similar time, you will need to word that totally different segments and use circumstances face totally different financing challenges and profit livelihoods otherwise. Maximising the affect of the reform will imply that what will get financed by way of PSL can be as pertinent as how a lot financing occurs.

To grasp the type of EV finance that must be prioritised by the RBI, a survey requested a various set of stakeholders to evaluate segment-use case combos for the parameters above in Exhibit 2 . The survey revealed that market-ready segments—electrical two-wheelers, three-wheelers, and industrial autos—current probably the most impactful pathway for PSL inclusion. As a subsequent step, RBI might want to seek the advice of with central and state authorities policymakers, monetary establishments, and business to align on the design of PSL pointers for EVs. We are going to want engagement and consensus from all sides to get from suggestions to reform.

Additional supportive mechanisms additionally must be evaluated in parallel, for instance:

– Making a PSL sub-target encompassing EVs and renewable vitality would set up a transparent incentive mechanism for banks.

– Together with EVs as an infrastructure sub-sector would allow capital price discount upstream.

– Introducing EVs as a definite monetary reporting class would guarantee transparency of EV loans information.

– Implementing monetary devices resembling curiosity subventions and mortgage ensures would solidify financier confidence.

Individually, though none of those mechanisms are prone to be a silver bullet, collectively they carry the promise of making an enabling surroundings for mass financing of EVs. By creating mutual advantages for all stakeholders, prioritising financing can assist India construct on its momentum from 2021, serving to EVs transfer from the margins of Indian roads to the mainstream in 2022 and past.

[This piece was authored by Ryan Laemel, Principal, Rocky Mountain Institute (RMI) and Isha Kulkarni, Associate, RMI India]

Additionally Learn:

[ad_2]

Source link